YC’s Fresh Batch Has An Ivorian Fintech With Francophone Super App Ambitions

It’s not everyday an Ivorian firm gets into Y Combinator. In fact Djamo—an Abidjan-based fintech—is the first ever tech startup from the West African country to go under the YC accelerator wing.

Djamo’s mission is to become a super app, a challenger bank and a payment solutions provider in not just Ivory Coast, but the entire Francophone Africa. As far as the numbers go for that region, there are about 31 French-speaking nations in Africa, comprising at least 141 million people.

The super app bell dings again!

Getting into the Winter 2021 batch of the Silicon Valley-based startup school comes along with a typical USD 125 K seed money in the bank. This is the amount of investment Djamo has secured, alongside the other 10 African startups that pitched at YC’s online single-day demo event. A total of 319 companies from 41 countries participated, rousing the interest of over 2,400 investors.

Though most the African startups in the new class are from the fintech block, Djamo’s presence in the event is significant for few but tangible reasons. First, it’s an Ivorian fintech startup; secondly, it’s a challenger bank; and finally, the has supper app ambitions.

The most separate yet key ingredient in this development is that the company has a Francophone African focus.

However, according to the company’s official website, Djamo’s mission to become the a first super finance app seems restricted to West Africa. Well, the region is home to most of Africa’s French-speaking countries—so it mostly makes sense.

Now, when it comes to super apps and challenger banks in Africa, the hype is mostly restricted to South Africa and Nigeria. For example, Lagos-based Kuda (a digital bank) is fresh out of a USD 25 Mn Series A round led by Peter Thiel’s venture capital firm.

A month ago, Joburg-based TymeBank (also a challenger bank) landed USD 109 Mn from English and and Filipino investors.

Ivorian fintechs have definitely landed investments in the past. But from what’s evident, Djamo might be the first local tech startup in the country to have such big financial plans recognized by the American accelerator. The startup was founded just last year and its app and Visa card were rolled out in November 2020. Before Y Combinator, the startup raised USD 350 K pre-seed.

Today, Djamo has around 90,000 registered users and processes over 50,000 transactions monthly.

But don’t forget other players

In Francophone Africa, less than 25 percent of 25 do not have bank accounts. The colossal segment of non-wealthy customers, comprising about 120 million people, remain unbanked and seen as an unprofitable market—at least according to the traditional financial institutions in the region.

But the financially excluded population is what mobile money platforms, telcos and fintech startups are racing to bank.

In July 2020, French telecoms provider Orange unveiled the mobile banking arms of its Ivorian operations, after rolling out digital lending in Spain and back in France.

According to the telecoms giant, the platform will bank 10 million customers in Ivory Coast in the next 5 years—while preparing to transplant the service to Senegal, Mali and Burkina Faso.

In the same way, Standard Chartered—the largest bank in Africa—has launched a digital bank to serve unbanked Ivorians.

It was in the March 2018 that the South Africa-headquartered financial institution said it was going to use the West African country as a testing ground for a global roll out of its digital services. That means, Standard Chartered’s digital banking ambitions across the world kicked off in Ivory Coast.

Per 2018 data, there are estimate of 9.8 million mobile money accounts in Ivory Coast, all of which as registered with these telcos, including South Africa’s MTN, the Moov subsidiary of Etisalat and tech platforms like Celpaid and Quash Services.

The market is an already active one, so focused on that Didier Drogba, the Ivorian football star, to be the first ever to open a digital bank with Standard Chartered (a marketing ploy of sorts, though).

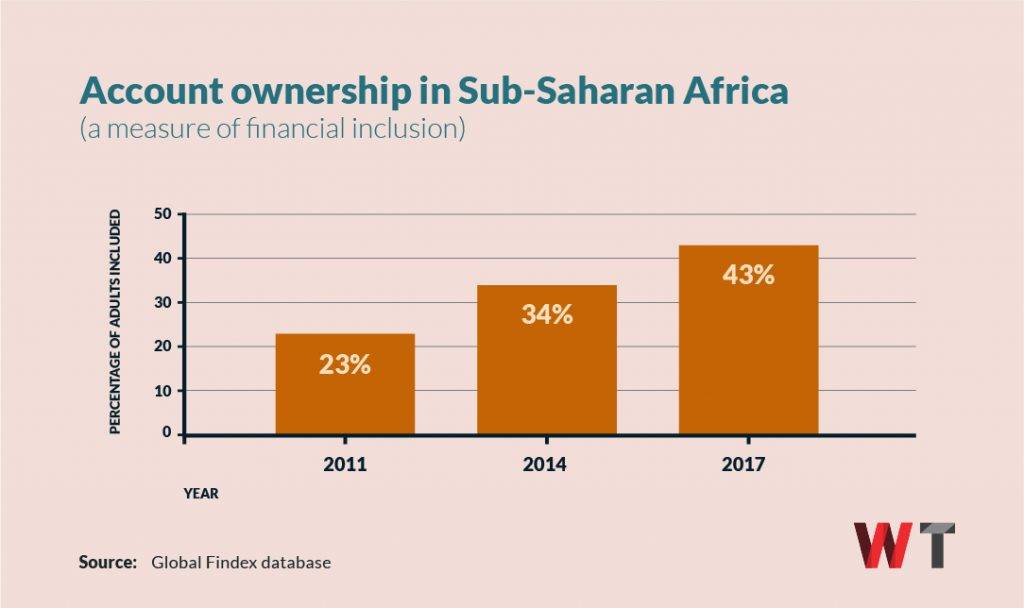

However, financial exclusion isn’t a problem peculiar to Francophone Africa, but the entire Sub-Saharan Africa banking to the last mile has only recently started brandishing hopeful numbers.

Djamo seems to have a heckload of competitors wiating, but as far as African fintechs backed by YC are considered, there might be a way to innovate around existing barriers to finally bank unbanked ivorians. After all, Y Combinator’s African fintechs have shown promise in the last few months.

Late last year, Stripe—a Lagos-based fintech—was acquired by American payments giant Stripe for a reported USD 200 Mn. This month (Mar), Flutterwave—also a Lagos-based based fintech—attainted unicorn status after raising USD 170 Mn in Series C.

Also, the fintech sector continuously claims the lion share of the annual ventur capital considerations coming into Africa.

Another feather in the Francophone hat

It cannot be overemphasized that Francophone Africa has been undermined by investors, chiefly because it contributed just 19 percent to Sub-Saharan Africa’s GDP. Meanwhile, Anglophone countries outside South Africa—the region’s second largest economy—contribute 14 percent to the economy.

Thankfully, though, the World Bank has forecast that Africa’s French-speaking countries will have 62.5 percent of the continent’s fastest-growing economies by 2021. From there on out, it’s been nothing but an influx of business interesting, from France’s Molotov TV to Netflix, among others.

Featured Image: Trust.io