As far as many often-told African founding and funding narratives go, things have been pretty much chronological; launch the startup then—if need be—approach some willing VCs. In some cases obviously scarcer than the hen’s teeth, a firm can bring in the bag less than a year after hitting the market.

However, there’s one unputdownable story that went beyond just defying the found-launch-and-raise chronology to become the reason for an unusual behavior on the part of one of Africa’s most-watched investment vehicles. And it quite interestingly happens that this narrative emerges from one of the continent’s most advanced tech startup ecosystems.

In October 2017, a certain South African startup was issued a corporate cheque of USD 1.4 Mn for a business idea that was, at the time, unknown to the market it now serves. It was until 2018 that the company officially kicked off ops, initially facing the car-owning populace of the country.

Thus began the spiel which saw a trio of experts attempt to strip ‘compensations’ off their needlessly many clothes.

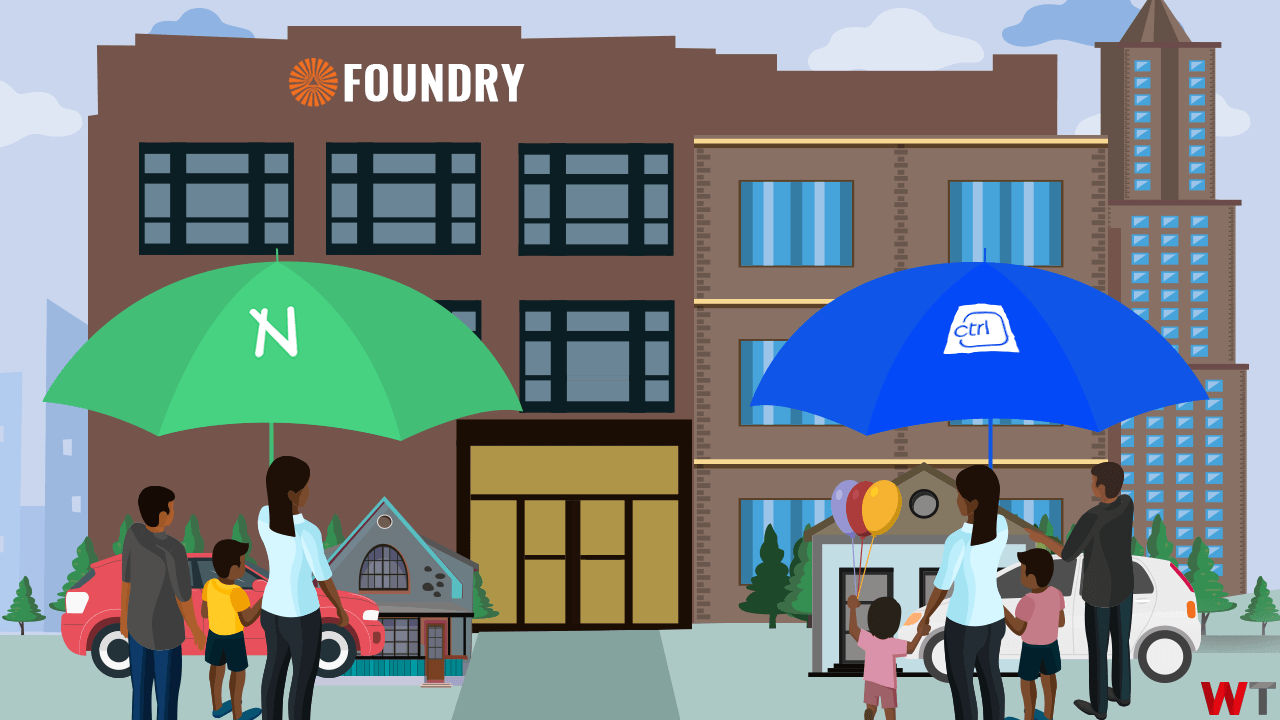

Alex Thomson—after 20 years of consulting with big insurance firms—consorted with insurance industry old-timers Sumarie Greybe and Ernest North to build Naked, which, fast-forward to 2021, is a Series A-stage insurtech.

Naked Insurance—now a digital insurance platform for homes, cars, content, and isolated belongings—uses Artificial Intelligence (AI) to offer unique insurance to its customers.