The year 2019 saw a Japanese fund with around USD 20 M in its coffers take the African venture space by storm. Kepple Africa Ventures was the most active VC during the pandemic period, where many VC funds opted to wait and watch.

The rate at which the fund infused money in early-stage startups was quite remarkable as there had been a lot of talk about inaction in early-stage venture space in African tech, but not enough action to match the words apparently.

Kepple Africa Ventures, however, spotted the venture capital opportunity in Africa, like the other Japanese funds: Samurai Africa Fund and Uncovered Funds. The renowned Toyota Group trading arm, Toyota Tsusho, also began investing in African companies through its CVC arm Mobility54 in 2019. But what set Kepple Ventures apart was its speed.

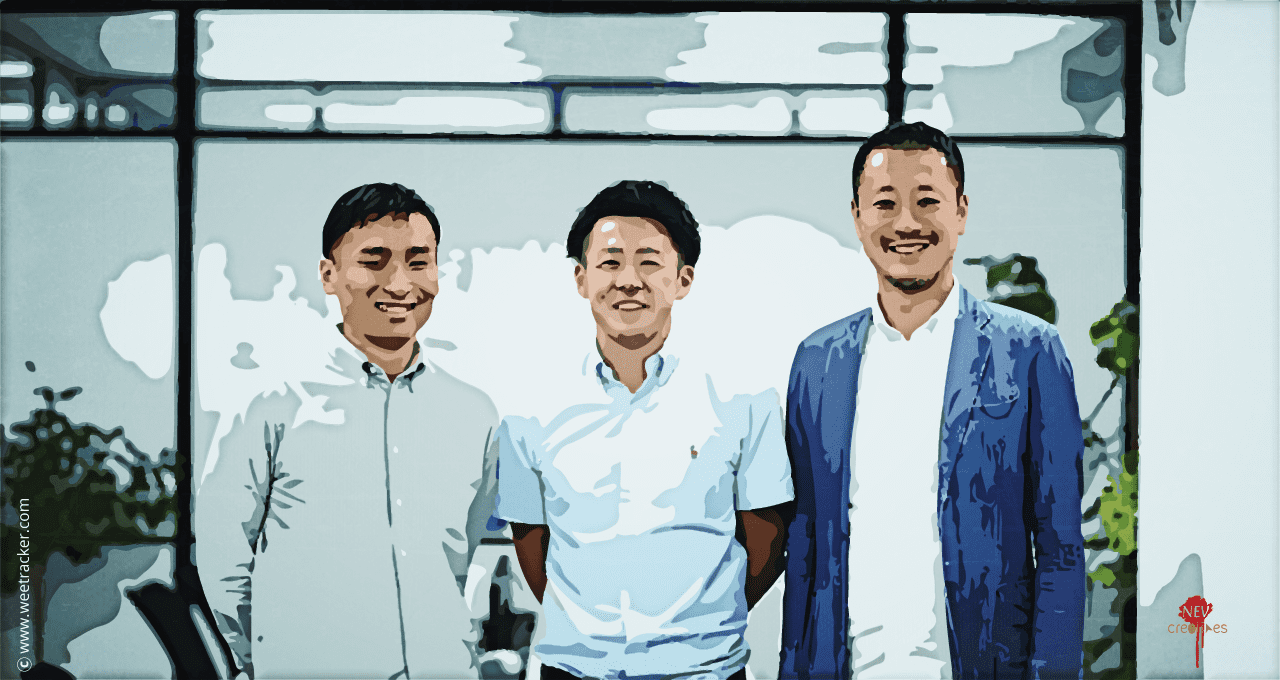

Kepple Africa Ventures was launched by Satoshi Shinada and Ryosuke Yamawaki. In a podcast interview with The Flip, the duo explained how the idea of the fund was conceived. It was difficult for Japanese companies to launch their business models into African markets. So, it was necessary for them to innovate their products as per local demography. This birthed the idea of funding companies that could bridge the gap between the markets.

Satoshi and Ryosuke, who had known each other for some time and given their stint in Africa, were perfect to act as catalysts for bridging the gap between Japanese companies and African markets. This led to the launch of the Africa-focused VC fund Kepple Africa Ventures, which focused on creating new industries.