In recent years, there has been a significant increase in the adoption of wealthtech apps across the globe, as more people seek to invest their money in a way that is convenient, affordable, and secure. This rise in the popularity of wealthtech apps can be attributed to several factors, including the growing demand for digital financial services, the need for greater access to global financial markets, and the desire for a more user-friendly and personalized investing experience.

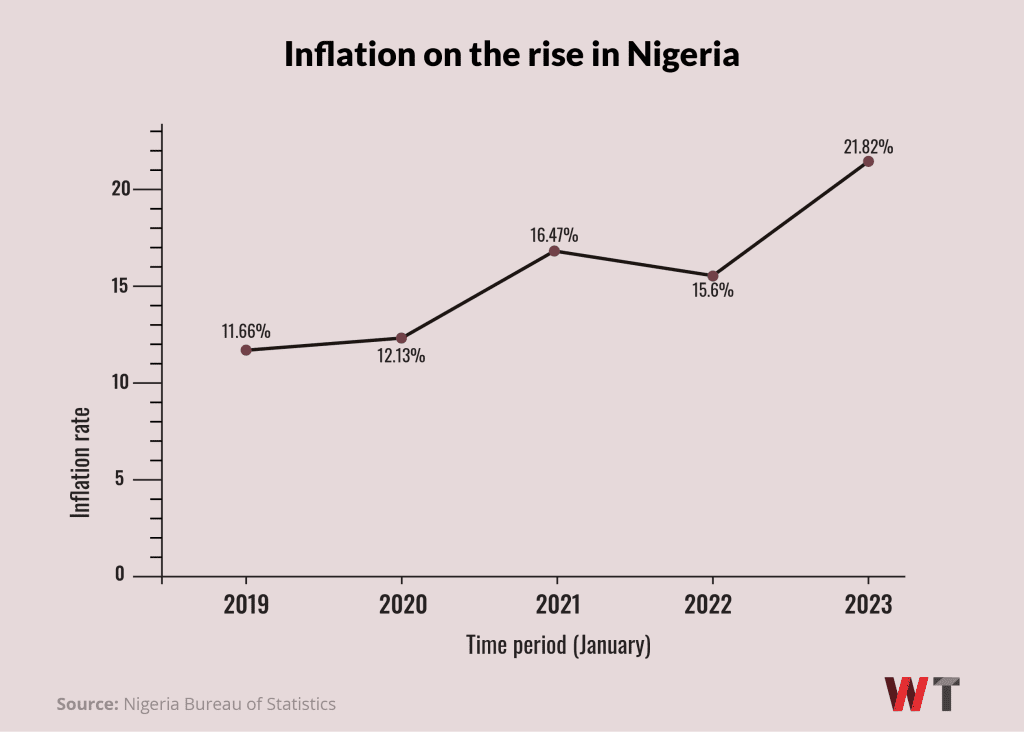

It could be argued that the unsavoury realities sweeping through global economies of late - characterised by galloping inflation and fears of a recession - have made an even bigger case for wealthtech products, and perhaps more so in African markets troubled by economic instability, inflation, and currency devaluation.

Nigeria and South Africa, Africa's largest economies, witnessed record levels of inflation in 2022, and this poses a threat to the continent’s rising but often-embattled middle class.

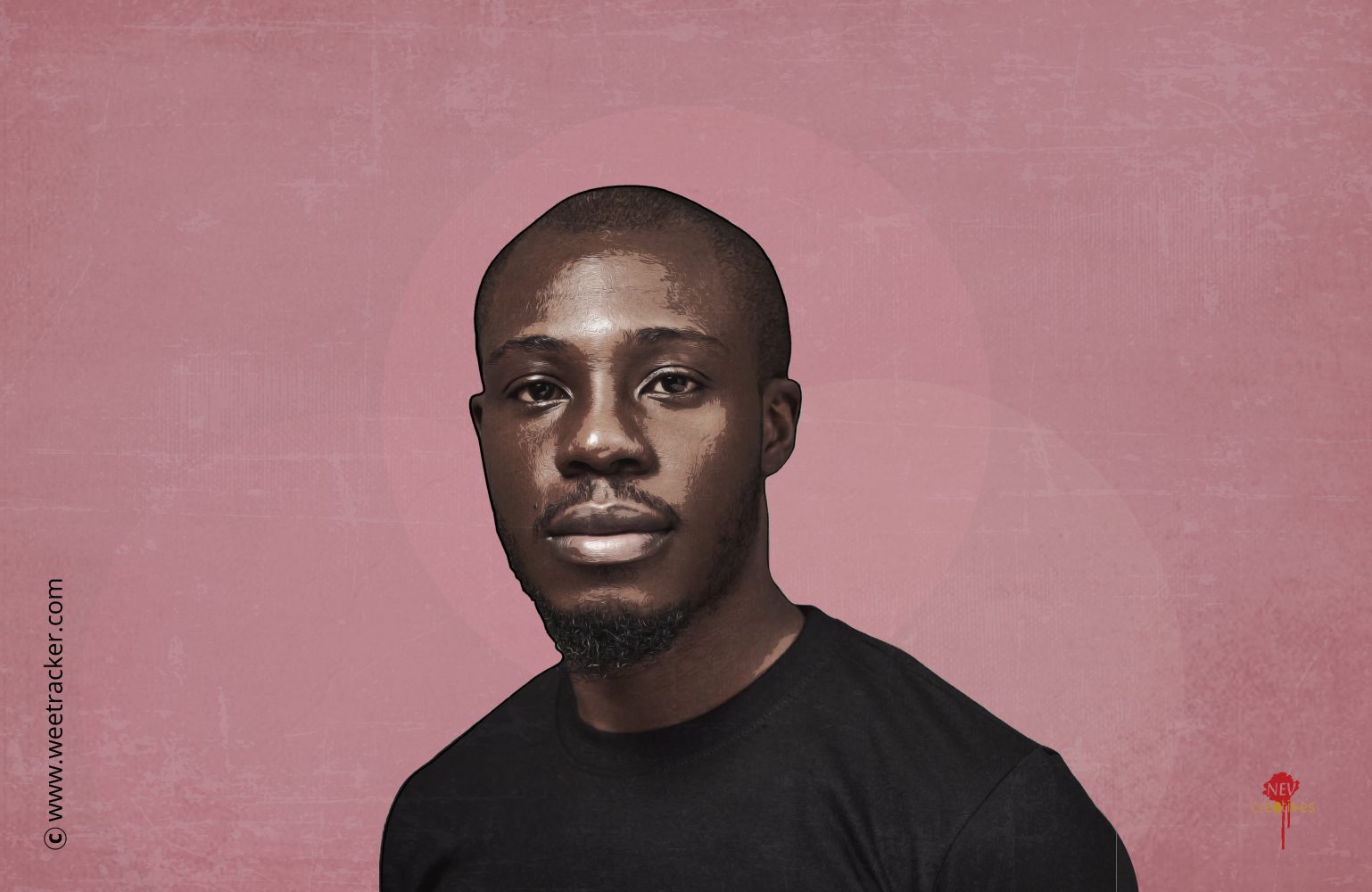

Thus, locals are increasingly taking to apps provided by startups such as Risevest; a Nigerian wealthtech enabling locals – who typically wouldn’t have access to foreign stock markets – to invest in local and global dollar assets, holding their investments in a more stable currency to protect them from turbulent local markets. Other wealthtech startup investment apps such as Piggyvest, Cowrywise, Bamboo, Chaka, and Trove are also seeing significant adoption.