Nigeria’s Fintech Challenger OPay Sees Valuation Soar Despite Tech Downturn

The recent financials of prominent consumer internet brand Opera Limited suggest an significant uptick in the valuation of its Nigerian portfolio company, OPay; one of the leading mobile-based platforms for payments, transfers, loans, savings and other services in the country.

In the face of tightening liquidity and heightened investor scrutiny, OPay, which has ties to predominantly Chinese backers, appears to be defying market trends and charting an upward trajectory.

With Opera’s disclosed 9.44% stake in the fintech valued at USD 269 M in Q4 2023 and adjusted to USD 253.3 M in its latest Q1 2024 financials, representing a substantial gain of over USD 100 M, OPay’s valuation has climbed to between USD 2.7 B to USD 2.9 B, deducing from the numbers Opera shared.

This follows OPay’s previous valuation of USD 2 B, achieved after a USD 400 M Series C funding round in 2021 led by SoftBank. Opera has over the years divested its stake in OPay; from as much as 31% in 2021 (when it sold 29% of its OPay stake for USD 31.1 M – OPay was valued at ~USD 800 M at the time) to the current 9.44% (after quietly upping its OPay stake from 6.4% in 2023).

OPay’s valuation upswing is particularly noteworthy against the backdrop of broader struggles faced by African startups in securing funding gaining market traction, and justifying valuations. The once-burgeoning optimism surrounding the continent’s tech ecosystem has given way to a more cautious and discerning approach among investors, necessitating startups to recalibrate their strategies for sustainable growth.

In the wake of tightening liquidity and increased scrutiny on business fundamentals, startups are being compelled to pivot, downsize, or, in some cases, shutter operations altogether, while cases of valuation markdowns have been reported at notable players such as fintech darling Chipper Cash, e-commerce player Wasoko, and the now-defunct biotech startup 54gene. High-profile closures, including Kenyan logistics startup Sendy and South African transit data provider WhereIsMyTransport, serve as reminders of the challenges confronting African startups in navigating turbulent market conditions.

Despite the downturn witnessed across the ecosystem, OPay appears to be holding its own. Its journey to prominence has been characterised by adapting and evolving with a focus on addressing the needs of Africa’s burgeoning digital economy. Since 2018, OPay has rapidly expanded its footprint, quadrupling its user base and achieving over 60% revenue growth on a constant currency basis throughout 2023, Opera’s financials suggest.

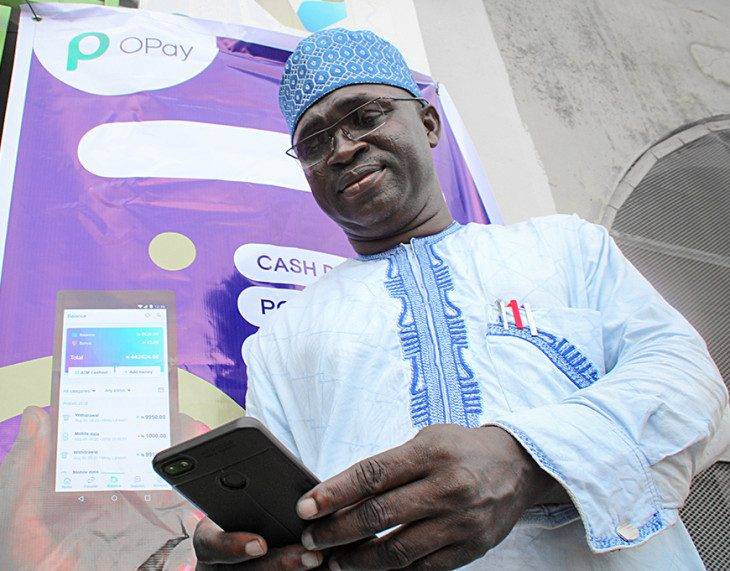

At the heart of OPay’s success lies its suite of mobile money and payment services, catering to the needs of Nigeria’s unbanked and underbanked population.

A debilitating cash scarcity that struck Nigeria last year following a botched banknotes reform effort, coupled with the struggles of traditional banks in the midst of the crisis, pushed users to fintech platforms with OPay among the biggest winners. By providing a functional platform for sending and receiving money, paying bills, and facilitating transactions through a vast network of agents, OPay has emerged as a trusted financial partner for millions across the country.

OPay’s growth trajectory extends beyond Nigeria, with strategic expansions into new markets such as Egypt, signalling its ambition to become a dominant player in Africa’s fintech landscape. With monthly transaction volumes exceeding USD 3 B and a strategic partnership with WorldRemit for international money transfers, OPay is poised for further growth and expansion.