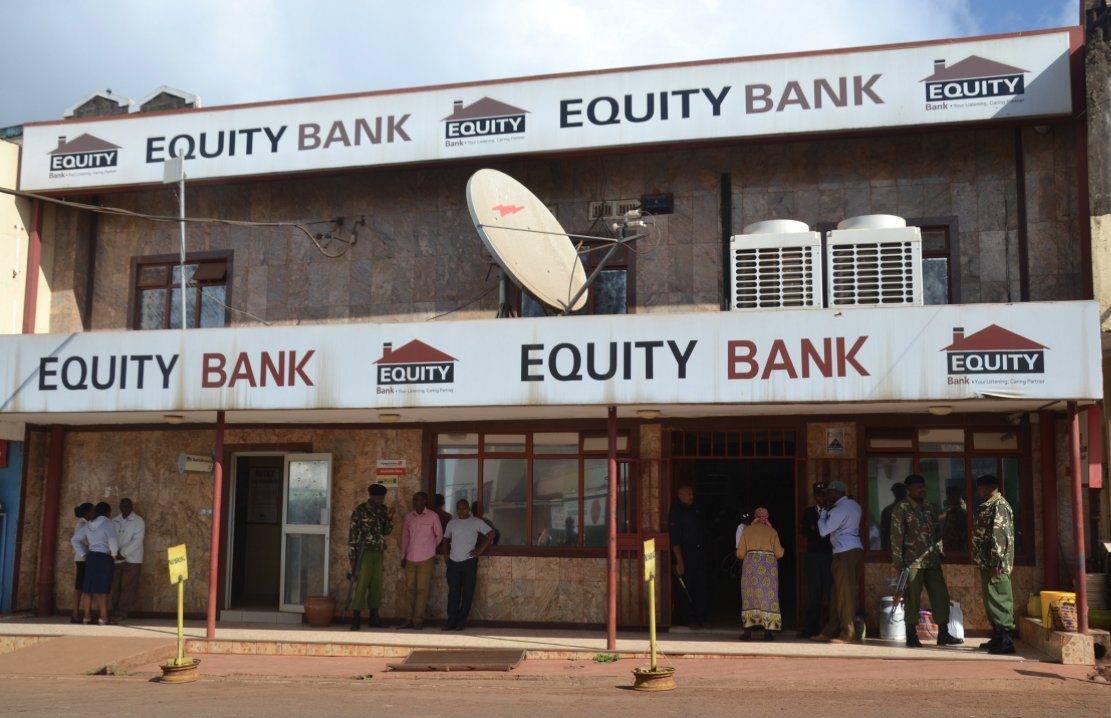

Kenya’s Equity Group Holdings Penetrates Deeper Into The African Market: Plans To Acquire DRC’s 2nd Largest Bank

After establishing its presence in Zambia, Mozambique, Tanzania, and Rwanda, Equity Group Holdings now plans to venture into the Democratic Republic of Congo by Acquiring its second-largest bank.

In a statement, Chief Executive Officer James Mwangi said it plans to acquire a controlling equity stake in DRC’s Commercial Bank of Congo (Banqué Commerciale du Congo -BCDC) which is the most profitable in the region with an asset base of about USD 700 million.

He said that it is part of the firm’s commitment to penetrate deep into the African market as it seeks to invest in better services across the continent.

“By acquiring BCDC, Equity will be able to expand its footprint in Africa. Through the proposed transaction, EGH aims to provide access to competitive, tailored financial services to improve people’s lives and livelihoods whilst also delivering significant value to its stakeholders.

“The Proposed Transaction is an opportunity for EGH to deliver the vision of building sub-Saharan Africa’s premier financial institution through delivering innovative products and services to customers, including, in particular, the effective use of technology,” he said.

In 2015, the Nairobi Securities Exchange-listed company entered DRC through Pro Credit Bank by acquiring 79 percent stake in Pro Credit Bank in 2015.

In 2017, the bank raised its stake by seven percent to 86 percent before eventually rebranding the subsidiary to Equity Bank Congo in 2018.

Equity Bank Congo is the most profitable bank in the Central African region.

The firm has previously announced plans to venture into the West African market with a key focus on Nigeria, Ghana, and Cameroon.

Featured Image Courtesy: Twitter