Companies Are Delisting From Africa’s Largest Stock Exchange

The actual number of African companies looking to delist from the Johannesburg Stock Exchange this year remains unascertained. Nevertheless, there is definitely an increasing number of them who have thought it necessary to get their stocks off what is Africa’s largest stock exchange.

Better Off Delisted

The latest firm to consider delisting from JSE is African Phoenix, an investment holding company formed from now-defunct African Bank Investment Limited (ABIL). Effective June 30th (2020), the company’s shares ceased to be traded on the exchange. Importantly, the South Africa-headquartered firm’s financials are not in the right order, as African Phoenix was previously in business rescue.

When the firm first mentioned its intentions to delist, its shareholders were told that the significant costs associated with remaining on the JSE coupled with poor market ratings by small capitalization investment holding companies, made it look all too burdensome to remain on the exchange. According to Phoenix, its private equity will be best served in an unlisted environment.

Major investment holding companies here and there—like the PSG Group and African Rainbow Capital—have little to no option than to trade on JSE at a big discount to their net asset value. For instance, African Rainbow is quite difficult to value because its main asset—Rain 5G—is an unlisted startup. Investors are unsure of its valuation methodology and the firm gets a hefty fee structure.

It could be easier for firms to achieve and maintain 51 percent ownership—also called Broad-Based Black Economic Empowerment ownership objectives—when they are in unlisted environments. This may be as a result of the fact that rising investment in indexed exchange-traded funds (ETFs) focuses primarily on large cap firms, so small firms who do not have that much investor interest have little to no option.

Economic Crunch

When Tiso Blackstar, a major media company in South Africa, first said it wanted to list on JSE, it looked to have access to capital through the stock markets. But, in the past year, the firm’s aspirations to do so have been cut short, making it opt to sell its shares so as to realize the actual value of the investment.

Tiso, who is the former owner of Sunday Times and Business Day, said delisting is a better play for the firm as its investments in South Africa have gone down significantly in the past year, which is why it is delisting its shares from the Johannesburg Stock Exchange.

Indeed, the Johannesburg-based firm has dialled down its investments in the past year, as it sold some of its media titles—like Sunday Times and BDFM—in 2019. Also, as per an agreement with Tiso Investment Holdings, it will sell its interests in Kagiso Tiso for a ZAR 850 Mn consideration.

It makes sense for businesses to make such moves, since South Africa’s present economic dip is all too glaring, coupled with the current—and future—effects of the coronavirus pandemic. Even Group Five, a construction company that has been trading on the JSE for 46 years, is deciding to cut its umbilical cord from the stock markets.

To save money in a tough economy, South Africa has reined in spending on huge infrastructure projects, effects of which have led Group Five struggling to survive in the past 5 years. While it no longer complies with JSE’s requirements, the construction company’s shareholders believe that there isn’t any realistic prospect of there being any residual value available for or attributable to the company.

JSE Woes

Economic recession, volatility of prices and the poor growth prospects plaguing the South African equity market, all in tandem with the pressures of Covid-19 and the ripple effects of lockdowns, firms in small and medium cap categories are bound to experience a crunch in cash flow. As such, a big drop in their share prices in an inevitability. With a specific problem for each, company founders and shareholders currently undervalued or facing financial problems see a perfect time to pull their stock plugs from the JSE.

The problems with financial markets are often worse for a company like Mauritius-headquartered Grit Real Estate Income Group which is listed on three different bourses—London, Mauritius and Johannesburg stock exchanges. Due to the tough economic situation in South Africa, the firm is delisting from the JSE and giving local shareholders the option to sell their shares at a premium.

The pan-African real estate company said the cost and complexity of being listed on three exchanges does not currently offer commensurate benefits, while eroding shareholder value. Trade in its JSE shares has also been illiquid for an extended period of time. By consolidating the three registers into two, it expected liquidity in its shares to improve.

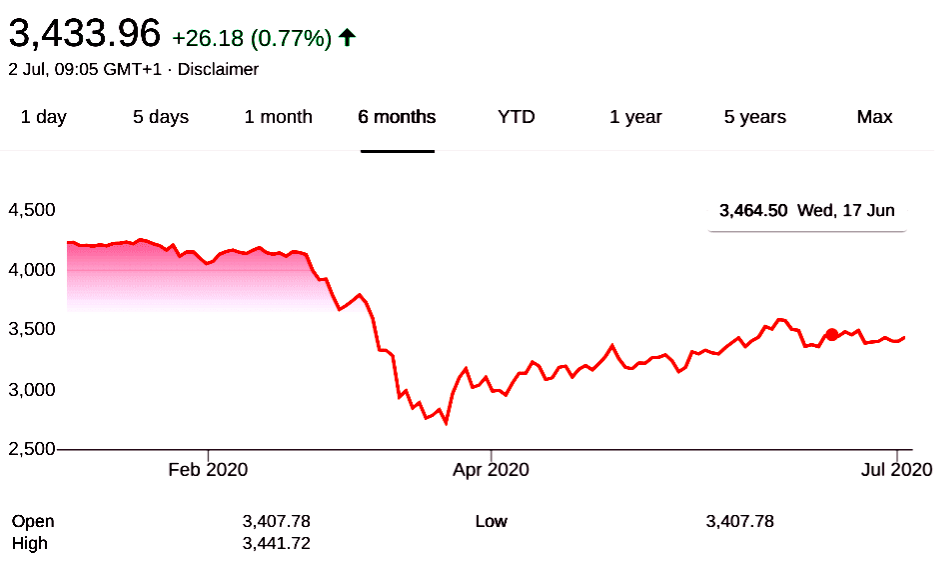

The Johannesburg Stock Exchange was not immune to the financial disruption caused by the pandemic, as stock prices went downhill. It kept trading open, though, even inside what was one of the world’s most severe lockdowns and offered relief to companies whose financials were tattered by the outbreak.

Photo: Ishant Mishra Via Unsplash.