After Initial Blip, Airtel Finally Lists On The Nigerian Stock Exchange Today

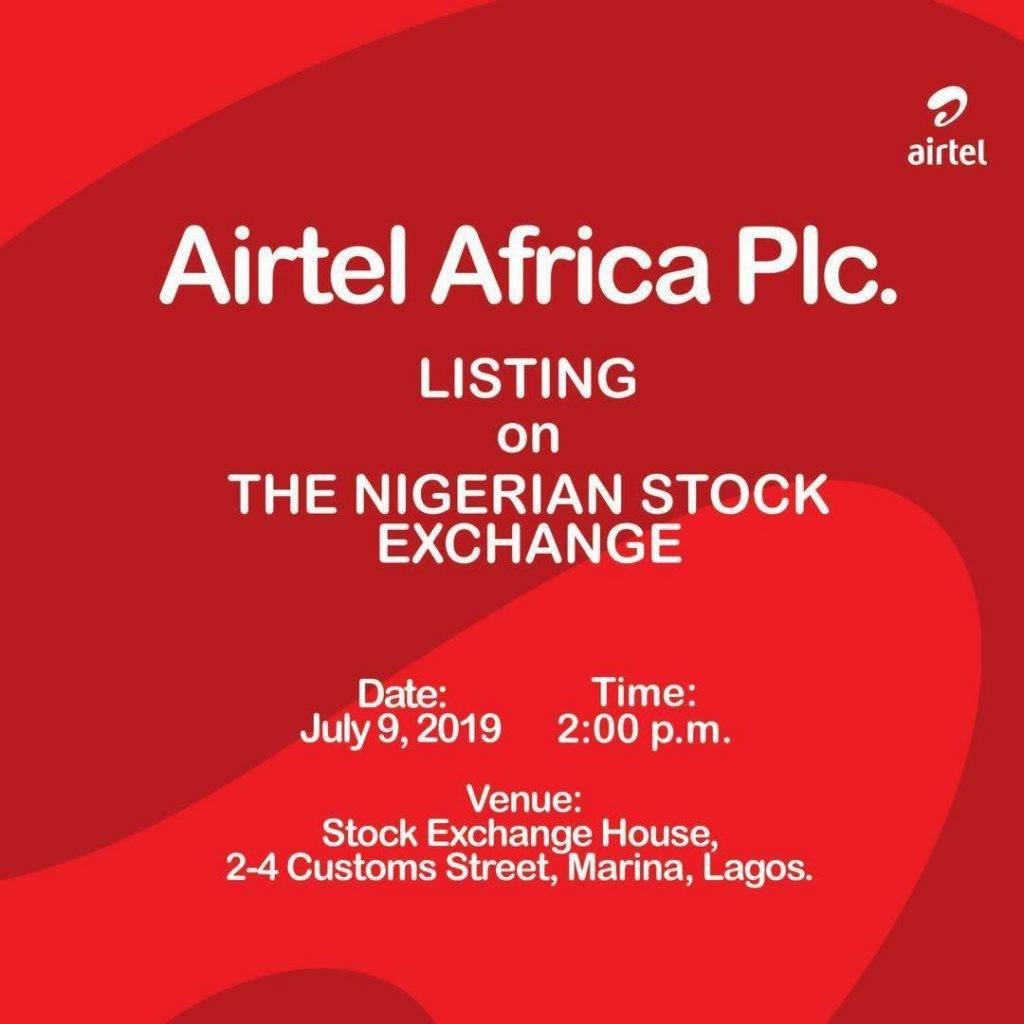

Come 2 p.m. today (WAT), Airtel Africa will be formally listed on the Nigerian Stock Exchange.

After initially falling short of the Nigerian Stock Exchange (NSE) Premium Board listing requirement by failing to provide the minimum number of high net-worth investors — which meant that the listing couldn’t happen last Friday as planned — Airtel Africa, the holding company for Airtel Nigeria and 13 other African countries, has listed on The Exchange of its largest African market.

Last week, Airtel Africa listed on the London Stock Exchange (LSE) and it has followed that up by listing its entire share capital of 3,758,151,504 ordinary shares on the Nigerian Stock Exchange. The listing price is NGN 363.00 per share. This implies a market capitalisation of NGN 1.36 Tn, which is half the size of shares its competitor, MTN Nigeria, listed on the NSE in May.

Today’s listing sees Airtel Nigeria become one of the top five most capitalised stocks on the Nigerian Stock Exchange, behind Dangote Cement, Nestle, and MTN Nigeria. The listing follows an Initial Public Offering (IPO) held separately on both the LSE and the NSE.

The Nigerian IPO was made available to qualified institutional and high net-worth investors. The Securities and Exchange Commission (SEC) defines a high net-worth investor as an individual whose aggregate net-worth of investment assets exceeds NGN 100 Mn.

Airtel Africa is doing a cross-border listing. A cross border listing is when a company is listed on two or more stock exchanges. The listing on the Nigerian Stock Exchange is also a secondary one since the firm was listed on the London Stock Exchange.

Featured Image Courtesy: businessfocus.co.ug