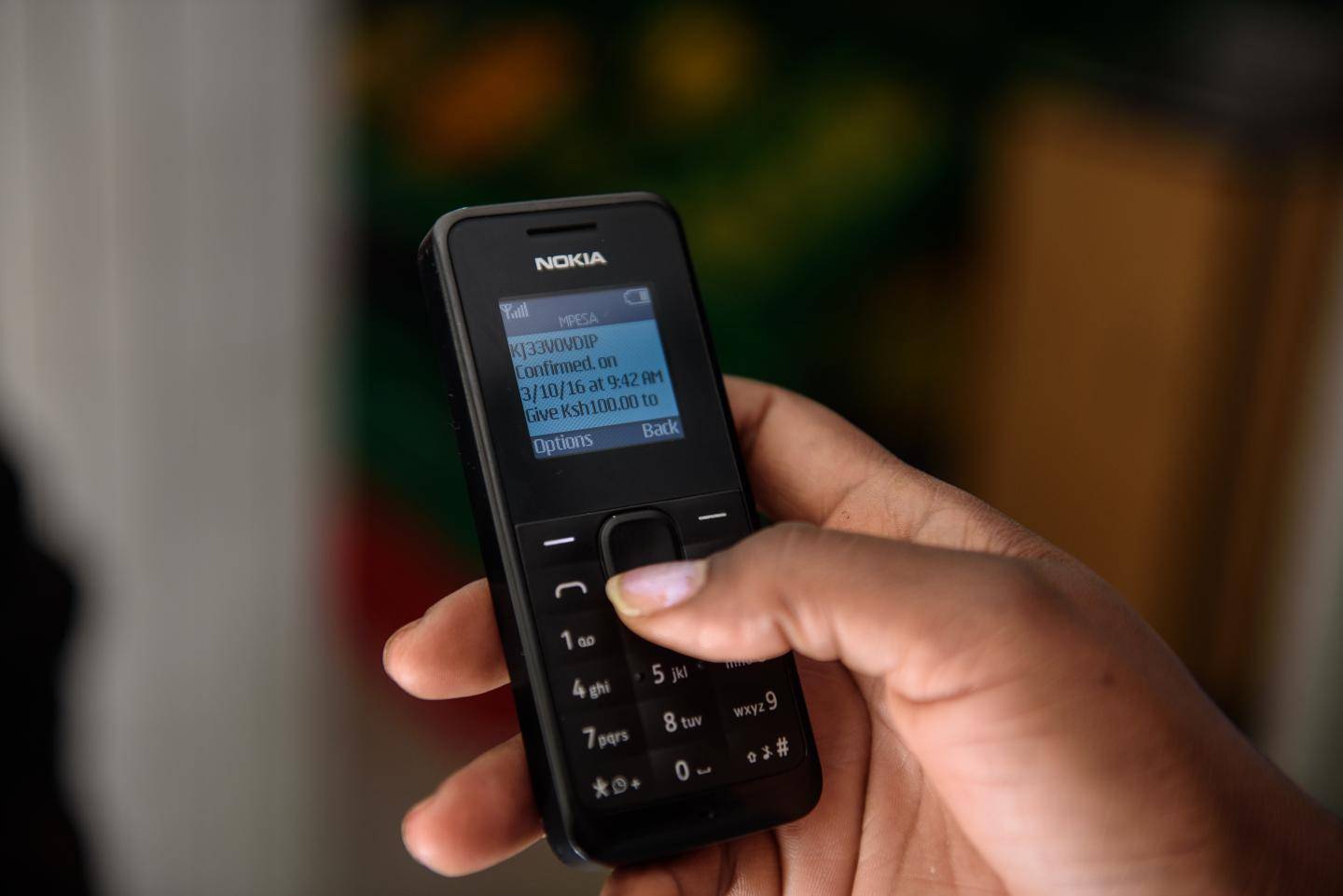

Could This Company Upset Safaricom’s Mobile Money Dominance?

There is no doubt that Safaricom has dominance on mobile services, mobile data and commerce transactions, pushing over 640 million transactions between April and June 2019.

However, it could be a matter of time before Safaricom faces real competition from another entity in the mobile commerce and payment sector.

Only second to Safaricom, Equity Bank’s Equitel is making strides to capture the payment market in Kenya. Unknown to many, the company has more agents than second-placed operator Airtel Kenya, according to Communication Authority. Interestingly, the impending merger between Airtel Kenya and Telkom Kenya will not eliminate Equitel from the second position.

| SERVICE | AGENTS |

| M-Pesa | 176,184 |

| Equitel | 59,082 |

| Airtel Money | 20,199 |

| T-Kash | 27,991 |

Data courtesy of Communication Authority

Additionally, the company is second placed in moving mobile commerce transactions. Equitel had 101,110,828 transactions compared to 486,315,618 transactions on M-Pesa. Airtel Money and T-Kash had 3,086,739 and 638,589 transactions respectively.

The only bank-led mobile money platform’s mobile commerce transactions increased to Kshs 378.9 Bn, a 15 per cent increase from Kshs 328 Bn that was processed over the same period in 2018.

“Our customers are digitizing their money. Once the money is deposited on their mobile phones, they are not withdrawing but transacting with it on a digital platform and that to us is the best change we are seeing in the overall market,” said Equity Group CEO and Managing Director James Mwangi.

He added, “Our effort to digitize retail commerce operations through enrolling retail shops to transact through EazzyPay has paid off. The number of EazzyPay transactions has grown suggesting the size of transactions are increasing and the country is accepting the risk of digital money,”

However, Equitel’s subscription base as at June 2019 stood at 1.88 million accounting for only 3.6 per cent of the market. Airtel Money’s subscribers stood at 3.6 million while T-Kash was at 76,061.

According to the CA report, the number of active mobile money subscriptions in the country stood at 32.5 million as at the end of June 2019, compared to 29.7 million as at June 2018 translating to a 10 per cent increase, while the value of transactions increased by 11 per cent to stand at Kshs 2.18 Tn from Kshs1.92 Tn.

Feature Image Courtesy: EurekAlert