Super-imposing Western models In E-commerce Does Not Work In African Markets

The rate of internet penetration in Africa has been increasing. With over half a billion Africans now connected to the internet, it’s no wonder that e-commerce companies would be seen emerging in the continent. E-commerce in Africa is arguably fast-growing. The increase in logistics companies across the continent has also helped boost e-commerce in Africa as last-mile delivery is slowly becoming a reality.

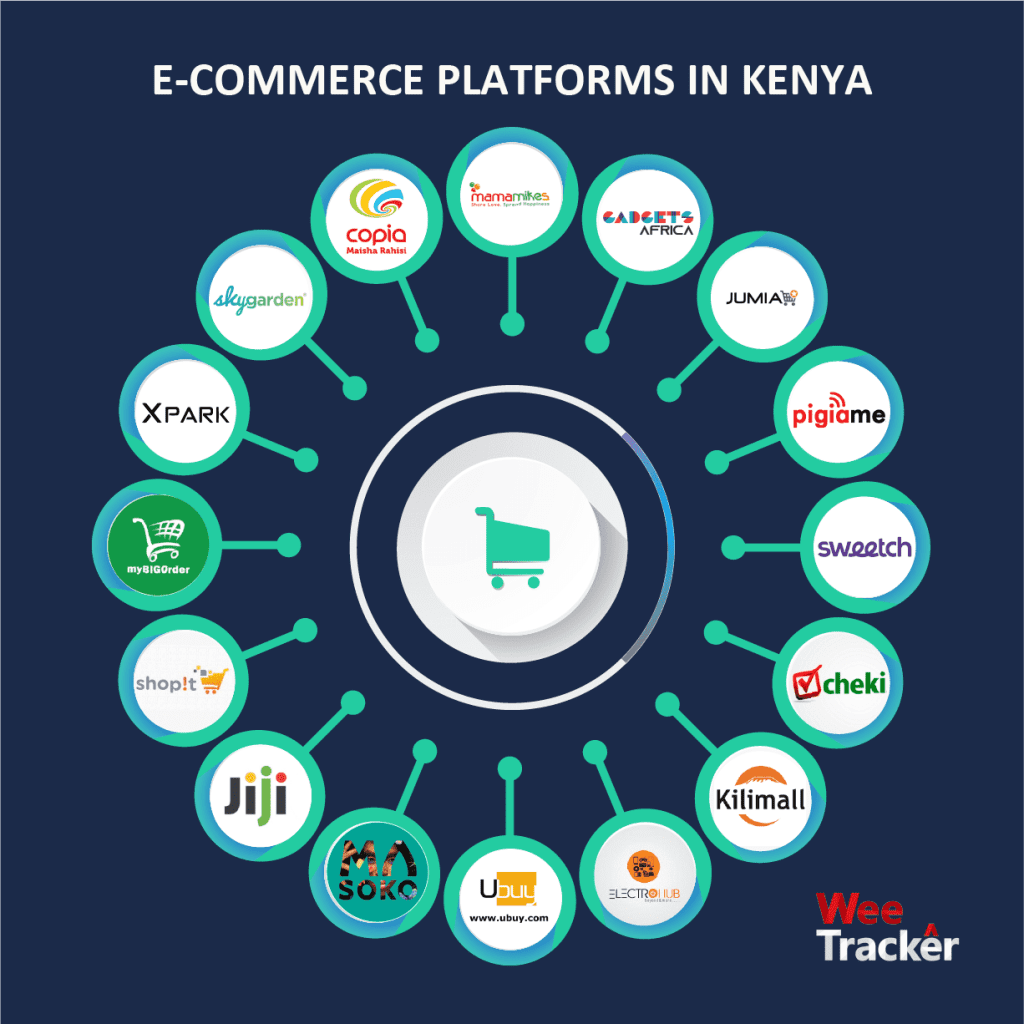

Players in e-commerce like Jumia have dominated the African space and it even went public earlier this year. Others include Takealot, which was acquired by Naspers, Konga and Bidorbuy. International brands like Amazon and Aliexpress have also turned their eye to Africa.

However, the e-commerce space has been riddled with a couple of challenges ranging from facing a large unbanked population, to lack of payment options in a number of countries.

Jumia too has seen challenges of its own post IPO. It has since shut down its offices in Cameroon and Tanzania and has even recently laid off some of its Kenyan workers in a downsizing move.

Despite this, Jumia remains a major player in Kenya, dominating the e-commerce scene. Others e-commerce marketplaces include in this scene include Sky.Garden, Kilimall, MallForAfrica Jiji, My Big Order, Masoko, Ubuy, Shopit, Cheki, Mama Mikes and Electro Hub.

Although they offer a variety of options of consumer goods, they have one thing in common; they focus primarily on users who have access to the internet, often the middle to the upper-income class who are located in urban areas.

However, the tier 2-3 towns and rural areas of Kenya is still not doing commerce online, yet they represent a larger market than the urban middle demographic. Meanwhile, there are a few innovative solutions and VC backed startups that are trying to tap the unbanked and low-middle income population.

One of them is Copia, an m-commerce company, delivering consumer goods to rural and urban areas of Kenya, with the help of its network of local agents.

The company claims to have more than 5000 agents spread across central and western Kenya. An agent carries a smart device, through which a Copia customer can browse a product catalogue and place an order. Copia claims to deliver products within 2-4 days to the agent’s location, which then can be picked by the customer. Orders can also be placed via USSD, through Copia’s website or by placing direct calls to Copia’s customer care agents.

“Players have brought in a western model and tried to superimpose it on the African market,” says Tim Steel, CEO of Copia.

These e-commerce companies often target urban dwellers who have internet access. This often leaves out low-middle income urban and rural dwellers who lack a variety of options of consumer goods to choose from as compared to their urban counterparts.

“With 750 million people in the middle to low – income bracket in Africa, there exists a USD 680 Bn market,” adds Tim.

Having a different approach and model, Copia certainly didn’t have much trouble wooing global investors. The startup has so far raised USD 38 million and recently announced the closure of its Series B round of USD 26 Mn.

With Copia carving out a new path for itself, we can only wait to see how well its model will do in Kenya and the rest of Africa.