EXCLUSIVE: Did Miniso Just Run Away From South Africa With Franchisee Money?

Miniso Accused Of “Ponzi-Like” Ploy In South Africa

On Wednesday, November 27, 2019, the directors of Miniso — the Chinese budget household and consumer goods retailer which likes to pretend to be Japanese — allegedly executed a stratagem that they could have only been plotting for months in South Africa.

Facing self-inflicted struggles with salvaging its ailing retail business in South Africa, the Chinese directors of Miniso seemed to have resorted to the next best thing in their playbook;

“Get on a plane and flee the country with money that is not ours to keep, damn the franchisees! Then, text everyone affected via WhatsApp that the Miniso SA business has closed, unfortunately.”

Yes, that is the account of what went down towards the end of last year, as recounted by aggrieved franchisees in South Africa, including Damian Archer who owned the Miniso franchise store at Mall of the North, Kevin Chen who invested in two stores at Fourways Shopping Centre and Canal Walk Shopping Centre, as well as Zeyn and Tasnim Osman who owned the Miniso store at The Glen, and Loni Mamatela of Rosebank Mall, just to mention a few.

These aggrieved franchise holders claim to have bought into the Miniso brand on account of its many promises which, according to the affected parties, all turned out to be hollow. By their accounts, Miniso promised to zig but only zagged.

Source: BizCommunity

In other words, Miniso, the Tencent-backed consumer goods retail company that is currently planning a USD 1 Bn IPO, is being accused of “defrauding, cheating, and lying to” the parties who bought into the ill-fated franchise in South Africa.

The affected franchise store owners also label the company as a sham brand that not only ruined its business in South Africa with its own hands but also pulled off a move that is typical of Ponzi schemes when it absconded with no less than ZAR 12 Mn (almost USD 800 K) belonging to the franchisees; money that was supposed to stay untouched in a trust and only be refunded to the franchisees after the dissolution of the franchise agreement.

How Miniso Entered South Africa

Since throwing its doors open for business with the launch of its very first store in China back in 2013, Miniso may have subtly wriggled its way into the subconscious of the average lifestyle shopper in various world countries as the go-to store for all things chic and cheap.

If there is anything that can be taken home from Miniso’s moves in the last few years, that would be the brand’s belief in proliferation – some would even say the company might just take the saying; “the more, the merrier” a little too seriously.

In the seven short years since the combined efforts of Japanese designer, Junya Miyake, and Chinese entrepreneur, Ye Guo Fu, resulted in Miniso, well over 3,000 stores have been opened in up to 70 countries, and there are even lofty ambitions to see those figures surge to 10,000 stores in 100 countries by the year 2022.

Source: las2orillas.co

Once Miniso had gotten some sort of foothold in parts of Asia, while also making successful entries into a number of markets in Australia, Europe, and the Americas, a move for Africa was always on the cards.

With the exit of brands such as Mango, River Island, and Topshop creating holes in the South African retail space, Miniso unveiled its very first African outlet at Menlyn Park Shopping Centre, in Pretoria, South Africa, back in August 2017. (Miniso’s African footprint currently spans Nigeria, Kenya, Tanzania, Egypt, Morocco, Madagascar, and Mauritius).

The Chinese low-cost retailer chain that specializes in household and consumer goods such as cosmetics, stationery, toys, and kitchenware, invested more than USD 5 Mn (about ZAR 67 Mn) in South Africa and opened a number of stores in major shopping malls across the country.

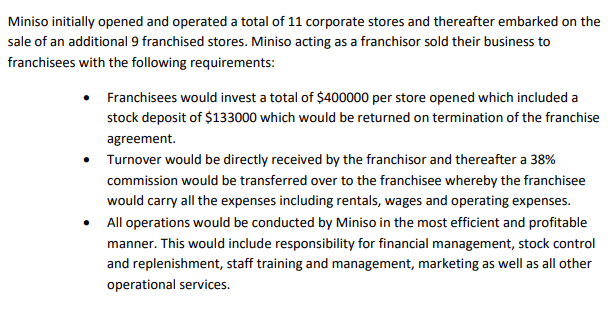

The store at Menlyn Park Shopping Centre was the first of a total of 11 corporate stores which Miniso opened in South Africa before going on to add a further 9 franchise stores, starting from 2018.

And Then, Things Went South!

Damian Archer, an operating partner in two 10-year-old Pick n Pay franchise stores with a combined annual turnover of over ZAR 400 Mn, was one of the first franchisees for Miniso South Africa.

Archer, who claims over 35 years’ experience in retail trade, told WeeTracker that he opened a store at Mall of the North in Limpopo in November 2018, encouraged by the recommendation of a long-time friend who had just taken up a Franchise Manager role at Miniso South Africa.

And the warning signs may have been there. According to Archer, his friend certainly had some misgivings about the way the company handled some of its operations in South Africa but he could afford to overlook that because of the “impressive” franchise model that Miniso was bringing to South Africa.

“His early observations were, that his seniors at Miniso were incredibly arrogant with scant regard for general rules and regulations within South Africa,” said Archer.

“An example of this is they once had a junior employee going around the county signing leases at will across the country, with the intention of then cherry-picking the ones they decided to honour later.”

He added,

“My friend, the newly appointed franchise manager, had to use all his experience and contacts to try and get Miniso released from many of these leases.”

Minsiso’s franchise model seemed tailor-made for businessmen who have the cash to invest but not the time to run the day-to-day affairs of a business.

The Chinese company offered to completely manage the business from top to bottom. The Miniso model also provided that the stock would be owned by the franchisor, as would the responsibility of buying and selling.

All that was required was that the franchisee put down a fully refundable ZAR 2 Mn (about USD 133 K) deposit to cover the stock for the duration of the franchise agreement. Franchisees were entitled to 38 percent of all sales which would, in turn, cover the costs of the employee wage bill, rent, and occupation.

It seemed a fair offer and once a vacant shop popped up on the Mall of the North in Limpopo, Archer spent just a few cents shy of ZAR 5 Mn (nearly USD 400 K as of that year) buying into the franchise and setting up a Miniso store. His spouse became part of the management team and a store manager was also brought in from Miniso corporate.

As Archer put it,

“Like all the other franchise stores the business took off tremendously in the first two months. But sales were soon plummeting as 2019 progressed and we were eventually left high and dry by the franchisor, who it turned out, was at best hugely incompetent and at worst downright dishonest, and bordering on criminal.”

Mapping Out Miniso’s Many Misdemeanours In South Africa

Just two weeks into the business, Archer’s store manager was screaming for more stock. But Miniso said other new stores that were opening at the time were to take priority.

According to Archer, one small delivery came in around early December 2018 but it was barely enough for the busy Christmas period during which Miniso also closed its warehouse which couldn’t keep up with the demand for stock replenishment, apparently.

“December was as busy as we had hoped but our stock was decimated. Due to store openings and the warehouse closing for Christmas, we were told nothing more could be done about stock replenishment,” lamented Archer.

“Miniso did manage, however, on the busiest trading month of the year, to arrange a stocktake in every individual store across the country, which meant each and every store had to close for trade for the day.

“Had it not been the relationship was still so new, I would never have agreed to this. I was told the instruction had come directly from China, so I bit my lip and agreed to close for the day.”

It later transpired the stocktake had been ordered because the General Manager for South Africa had been replaced and there appeared to be a lot of stock missing from the warehouse

This was the first real warning sign. And by the new year, that’s 2019, there wasn’t much to sell.

Archer also recounted another event that transpired during the stocktake debacle, which he said summed up the ethics of Miniso almost perfectly.

“Their HR asked my store manager to interview local people to count stock for the day, and they would be joined by a specialist stocktake team from China on the day of the stocktake. My store manager was told what rate of pay to offer casual labour and he arranged them accordingly,” said Archer.

“However, somewhat typically, given their disdain for employees both permanent or casual, they failed to pay any of the casual staff as agreed. As Christmas day grew closer, my store manager began receiving calls from the disgruntled, unpaid casuals.”

To ensure the safety of his staff, Archer arranged the payment of the casuals that helped in the stocktake immediately from his own pocket. He also emphasized that he had to raise this matter several times before the Miniso executives eventually deducted the amount owed him from a transport invoice due by him some 4 months later.

Miniso’s new stock eventually arrived in January and February of 2019 as planned but it was not “the good kind of stock”. This new stock was simply “unsaleable” in the South African market. Hence, sales dipped in March and April. Miniso’s Chinese executives were mostly busy at the time, hiring and firing General Managers for Miniso South Africa at will.

By that time, Archer had gotten in touch with some other Miniso South Africa franchisees who shared his fears, their investment was disintegrating daily and they were powerless to stop it.

“I, like all the others, requested an urgent meeting with the new General Manager, a Chinese lady called Angel. The previous GM had been swiftly removed and Angel had, by all accounts, been brought in to implement a turn-around strategy for South Africa, or at least that is what we were told.”

According to him, sales were dipping by the month. The 10 or 11 corporate stores that had been open in 2018 showed a drop of more than half their sales across the board. It was an unprecedented downturn.

PS: The 2nd & 3rd Columns Show Sales Figures (In ZAR) For March & April 2019 Respectively

This table was supplied by Damian Archer via email

Archer recounted further, “When I got to meet her that month, I learned she could only communicate through a translator. She tried to put the poor sales down to the depressed South African economy. I countered by saying I had two mature stores, both growing in sales in double digits.

“She then asked if I would be interested in buying and owning the stock, to which I declined. I asked when new stock was coming, a question on everyone’s lips for months already, and was assured it was on the way.”

It was later on that the franchisees got to know what the “real” issue was and in Archer’s hindsight, perhaps Angel was never there to attempt a turnaround but a clearout.

Archer and other franchisees gathered from a South African franchise manager that Miniso was stuck with over ZAR 70 Mn (nearly USD 5 Mn) worth of stock in South Africa and management in China had refused any requests for new stock until the current stock had been sold.

The problem was that large amounts of this stock was not suited to the South African market and were not selling. To compound this issue, the products had not opened anywhere near the amount that was initially planned with the franchise stores. In fact, they had managed less than 20 percent, but the stock was there and the franchisees were seemingly stuck with it.

“Without the constant newness on a monthly basis, that I had been told about when I invested, the sales continued way below break-even. After discussions between me and some of my fellow franchisees, we decided to initiate legal action and we approached a law firm that specialises in fighting for franchisees.”

Attempts to bring Miniso to the table for a meaningful resolution didn’t yield much fruit. After a couple of meetings with the lawyers representing the Chinese company, it was clear that Miniso was not prepared to assist the franchisees in any way, who by now were bleeding cash and going under.

What they were able to discover, however, was Miniso’s financials, which showed the company to have been technically insolvent when they started marketing their franchise in South Africa a year or so earlier.

How Miniso Allegedly Faked A Turnaround While Plotting SA Flight

After huffing and puffing through the early parts of 2019 with no new deliveries and plummeting sales, Miniso’s Chinese management told franchisees in September that it had ordered the uplifting of all slow-moving stock from stores.

These were to be replaced with fresh, fast-moving products. Within a matter of days, a team had proceeded from store-to-store across the country, removing stock, and in some cases, leaving the shelves bare or almost empty.

PS: The image and the two other ones below were supplied by Loni Mamatela

Soon after, Miniso informed franchisees of a Birthday Sale, with 40 percent off everything-in-store. But this didn’t help much. The Birthday Sale ran for weeks but sales remained poor at franchise level, as there was almost nothing to sell anyway — their shelves were almost empty due to the “raid” Miniso initiated earlier.

Bizarrely, Miniso then called an urgent Motivational Meeting, for all corporate and franchise management. This meeting took place in Johannesburg and it ran for a couple of days.

There, they admitted there had been a lot of mistakes, according to Archer, but assured everyone that new stock was on the way and that they would be rejuvenating the business.

But it seems Miniso was plotting something devious the entire time. Not long after the meeting, Miniso announced a Fire Sale in October 2019 for corporate stores only. Everything-in-store was up for sale at ZAR 40.00 only, regardless of what the original price was.

Corporate stores saw their shelves wiped out, franchise stores could only look on. Of course, Miniso insisted it was to clear out the old stock before the new stock arrived. All the stock removed from the franchise stores had, in fact, been moved to the corporate stores and sold off at a giveaway price. Miniso’s deceitful plan was now coming together.

As of November 1, Miniso had stopped delivering stock to any of the 9 franchise stores. The Miniso franchise stores in Boardwalk, Mall of the North, Fourways, and Canal Walk, were forced to close shop on October 31 as there was nothing left to sell.

On November 18, Miniso informed franchisees of a Black Friday special sale. Considering that four stores had been forced to close down because Miniso failed to supply, Zeyn Osman, the franchise holder of the Miniso store at The Glen, plus the holder of the last franchise store to open in SA, that’s Eastgate, decided to visit the Miniso Head Office to find out what was going on.

By now, even Miniso’s local corporate staff had become apprehensive. Within a few days in November 2019, the Sherriff of the Court had arrived at Miniso’s Head Office to remove furniture and equipment following complaints from landlords who had not been paid, and there was even talk of payments made by the company’s accountant into the personal account of her spouse, with no invoice or paperwork.

On one dramatic Monday morning in November — the same day Osman and the Eastgate franchise holder visited the Miniso Head Office — it was found that local corporate managers had organised themselves and were effectively holding all senior management hostage, demanding answers about rumours of a planned escape from South Africa.

The duo pretty much walked in on the fracas when they went to demand answers of their own from Miniso.

Angel, the GM for South Africa who is said to be very close to the Miniso co-founders and is possibly acting on their orders, was put on a video link to assure the disgruntled staff that nothing was happening. But by now, the local staff had discovered all senior management of Chinese origin had flights booked for China before the end of the month.

Although it was still mid-November, the Miniso South Africa staff demanded their salaries, not only for November but for December too. Miniso’s senior Chinese management quickly agreed to this and obliged.

A day later, there were armed guards at the Miniso Head Office to prevent anyone from getting in. Within a few days, all the Chinese nationals had left South Africa without making any arrangements with franchisees who, by now, had suffered huge losses.

The image was supplied by Damian Archer

In keeping with good HR practice, Miniso’s senior management sent WhatsApp messages to their managers in South Africa some days later, informing them that the business had closed, unfortunately.

The franchisees are now facing a loss of at least ZAR 6 Mn (about USD 400 K in today’s rates) per store.

What Miniso Had To Say

WeeTracker reached out to Miniso to clear the air on the cloud of dust that was left behind by its abrupt, unceremonious South African exit.

As per an emailed response, the company seems to be adamant that there was no wrongdoing in the manner in which it conducted its business in South Africa while also claiming that the business closed shop in the country because franchisees froze the accounts of Miniso South Africa.

“Any suggestion of impropriety concerning the business and its financial affairs is false. The business was forced into liquidation as a direct result of the franchisees freezing the business accounts of Miniso SA, the master licensee of the Miniso brand. You will appreciate no business can meet their obligations without operating bank accounts,” reads the company’s statement.

“At no stage has the master licensee, that is Miniso SA, or any persons set out to deliberately avoid its statutory obligations. The master licensee is under forced liquidation and that process will ensure a fair distribution of assets to its creditors.”

But How True Are Miniso’s Claims?

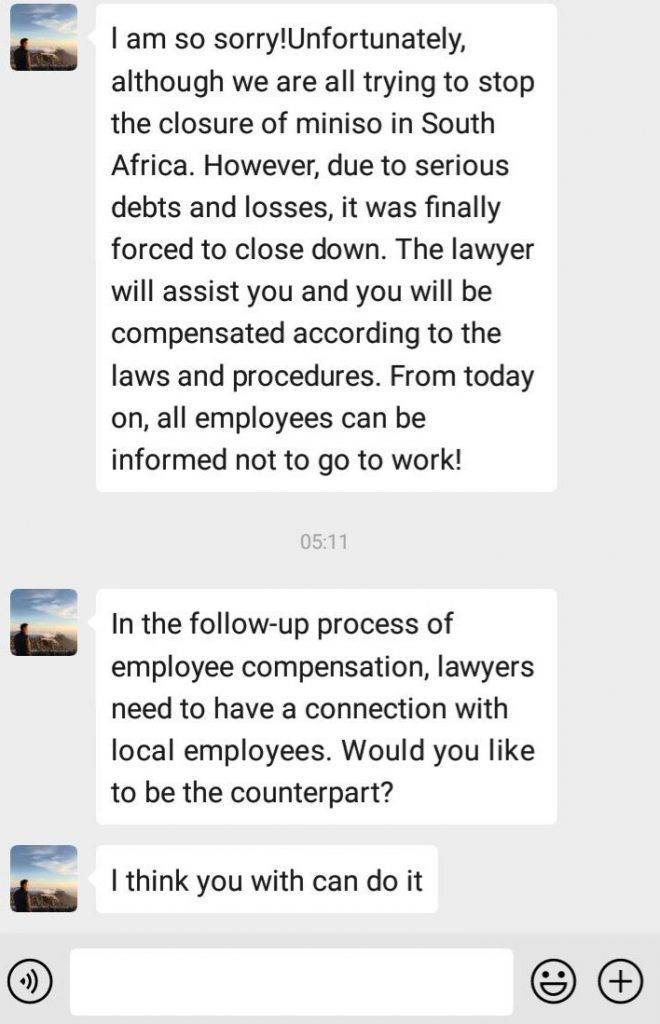

The holders who bought into the ill-fated Miniso SA franchise maintain that the application to freeze Miniso’s accounts only happened after the company’s top-level management had surreptitiously moved all the cash and were plotting a clandestine exit. Court documents seem to support this.

“We have frozen their accounts but there is less than ZAR 2 Mn in them, almost 20 accounts,” Archer told WeeTracker.

“The deposit monies alone belonging to franchisees is ZAR 18 Mn and its supposed to be in a trust. But all that money is nowhere to be found. Some of the banks tell us that the franchise fees were all moved 48 hours after they were deposited to banks in China.”

All the franchisees are united in their claim that Miniso was bankrupt and effectively fled South Africa with their deposits. According to them, the company had been hatching an evil plot the entire time under the guise of fixing things, which is why it defaulted on the rent on its corporate stores for months and sold off all the goods.

Kevin Chen, who is associated with two Miniso SA franchise stores at Fourways Shopping Centre and Canal Walk Shopping Centre, said, “Miniso is hiding behind their Japanese international brand image to exploit opportunities abroad. Their aim is to build the image of global retail so as to attract investment and stock listing.

“The business model is to utilize investors money as much as possible while providing no protection whatsoever. They do not have management skills to manage international operations. So far, they have failed most of their international operations, especially in Africa.

“The reason they are doing well in some regions is because of the sale of license rights. The only way to sustain their business model is to keep new stores opening faster than existing stores are closing. They are reckless to open in new countries and once they see the model is not working, they will run with the investors’ money just like what happened in South Africa.”

Tasnim Osman, another affected franchise holder, bared her thoughts on the matter to WeeTracker.

“My husband, Zeyn Osman, and I owned the Miniso store at The Glen Shopping Centre in Johannesburg. In October last year, Miniso simply abandoned its operations in South Africa without any correspondence or notification and 19 stores were forced to close overnight,” she said.

“South Africans lost their jobs, they left a trail of huge debt behind and investors such as ourselves were literally dumped.”

Loni Mamatela owned the Miniso franchise store at Rosebank Mall, Johannesburg, South Africa, and to him, the Miniso experience was a total nightmare.

“Miniso is unscrupulous, totally dishonest and has low or no business ethics. The company presented a picture of a caring and successful company while, in fact, they did not care about our investments,” he said.

“Their only interest was for franchisees to set up stores so the company could get rid of their stock in the warehouse. They probably knew as they were rolling out stores that they were planning to leave the country.

“Miniso gave us half-hearted promises of some turnaround plan. A lady by the name of Angel was ‘deployed’ to the country to turnaround the business. In hindsight, she was sent here just to wrap up.”

Mamatela stated further, “Angel, who is also a country manager for Egypt, spent very little time in South Africa. Last month, she was awarded a prize somewhere as the best performer (or some such award) after financially ruining South African investors.

“There’s a rumour that she is very close to the founder of Miniso. This means that the highest level of authority at Miniso knew about plans to leave South Africa without any regard to the franchisees.

“They were all aware that the company is required to ring-fence the ZAR 2 Mn inventory deposit paid by the franchisees and pay it back upon dissolution of the franchise relationship. They are also aware that this money was never paid back.

“The so-called franchise network is just a scheme to get unsuspecting investors to invest their hard-earned money in a business that is designed to benefit Miniso alone.

“Up till now, there’s been no communication from Miniso concerning their disappearance from South Africa. We just assumed they left the country. I will never recommend Miniso business to anyone.”

Archer, who is still baffled by Miniso’s total disregard of laws and contractual terms, hinted at further legal action.

“I am still aghast that a multi-national company could act in the manner it has. The feeling I have now, I’m sure is not dissimilar to the feeling someone has who’s been the victim of a Ponzi scheme.”

The Mall of the North Miniso franchise store owner added, “Hopefully, we will learn from it, and some of us intend to seek justice, no matter how long it takes.

“For now, though, most of us are trying to tie up settlements with landlords we had leases with so we can put this awful experience behind us and move on.”

Indeed, Tracey Swanepoel of Seton-Smith & Associates, a lawyer representing five of the franchisees, told WeeTracker that legal measures are being pursued on an ex-parte basis to bring Miniso to book and get justice for clients who unsuspectingly bought into the botched franchise.

Note: This is a developing story. The article is based on the claims made by the South African franchise owners of Miniso. The documents and screenshots are also supplied by the claimants in the article.