Kenya Airways’ Rightsizing Exercise May Not Be As Easy As Its Pay Cut Move

As the coronavirus pandemic takes its heavy toll on the world’s aviation industry, it is hardly an abnormalcy for an airline to consider restructuring its business to survive the pandemic’s financial/economic implications. Pay cuts are often a part of the business sustenance plan, but Kenya Airways (KQ) going a step further to furlough staff may run its entire survival plan into a brick wall.

Rightsizing Exercise

KQ, Kenya Airways, the flag carrier airline of Kenya, has informed its employees that it will be laying off an unspecified number of workers, reduce its network and shed some of it assets to survive the high tide of Covid-19. The internal memo passed indicates that the business’ short and medium-term projections show that it needs to reduce its operations before scaling back up. The rightsizing exercise will be completed by the end of September (2020).

The African bandwagon of carrier businesses are expected to lose up to USD 6 Bn in revenue this year, as planes have been grounded for the most time to curb the spread of the contagion. Even as airspaces carefully reopen, a substantial portion of Kenya Airways’ fleet will not get back in the air, even after it resumes flights in August (2020). The airlines, which had a 4,000-person workforce, a fleet of 36 and access to 54 global destinations, will operate with a minimal network when it resumes.

KQ Has Broken Wings

Even before the pandemic, Kenya Airways was not really in the right financial place, thanks to a familiar debt subject matter that seems to be a common problem in the African airspace sector. In December 2019, KQ issues a profit warning, indicating that its losses has increased to USD 129.7 Mn, up from USD 75.8 Mn in 2018. Staff costs subsequently went up by USD 9.1 Mn in to USD 158 Mn in 2019. This happened as the business’ total operating costs jumped to USD 1.3 Bn, thanks to increased operations and account estimate changes.

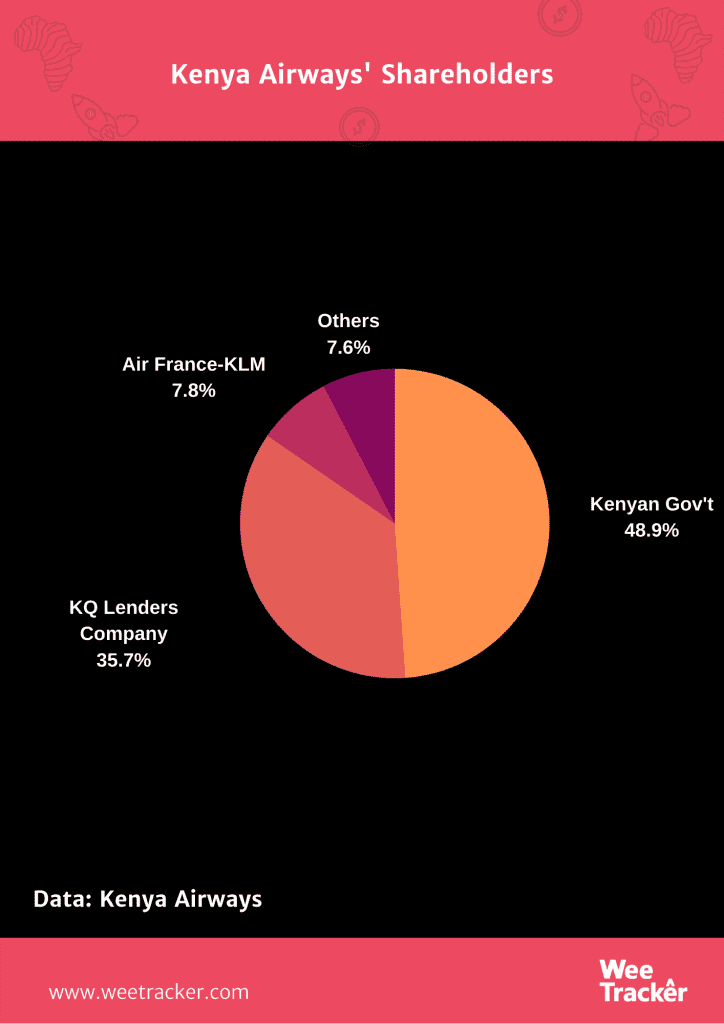

The last time KQ—which is mostly owned by the Kenyan government—reported profit was 8 years ago when it closed with a USD 16.6 Mn net earning. On the flipside, its worst financial year so far is 2016 when it recorded a loss of USD 262 Mn, more than double of the USD 102 Mn it forewent in 2017. In the past 5 years, the company has changed chief executives 3 times, struggling to compete with its regional rivals and to best is debt woes. KQ’s stock was suspended from trading on the Nairobi Securities Exchange (NSE) for 3 months effective July 3rd (2020) to pave way for the planned takeover by the government

The Paycut-Layoff Conundrum

As soon as the coronavirus crisis started affecting aviation in Africa, Kenya Airways cut the salaries of its workforce by as much as 80 percent. Amidst this, the airline was on the lookout for a government bailout to help it take care of running costs. The same employees that survived on only about 20 percent of their usual monthly paychecks now stand to lose their jobs altogether. The situation is already mixed in controversy, in part, because Michael Joseph, the airline’s chairman, said the decision to lay off workers and reduce operations is not informed by the failure to secure a bailout.

Normally pay cuts are a way to avoid laying off employees when the the dollar crunch does not allow a business to be flamboyant with its earnings, especially in times of such crisis. Laying off staff after they sustained months of only a fraction of their salaries isn’t so far from unusual. Nonetheless, long-lasting crises and continuously-shrinking economies make it a possibility that remuneration reductions won’t be enough to stave off layoffs. There are businesses who have wielded these two axes at the same time to keep their balance sheets healthy enough.

Not As Easy

A business like the Ethiopian Airlines has placed workers on unpaid leave, to report back to duty only when normal operations resume. Even though the decision was protested, a more severe one is laying off workers completely, as KQ is now set to do. As such, the Kenya Airline Pilots Association (KALPA) has poked holes into the planned sacking of staff because of its implications on their livelihoods.

“How is it that an organization which has been struggling to cover direct costs, including reduced salaries since April, now claim to be planning an expensive and costly staff rationalization exercise? The government is amid an initiative to nationalize the airline and this envisions not only retention but the creation of employment of opportunities. Your trajectory works against this endeavor,” says Muriithi Nyagah, General Secretary and CEO to KAPA.

Featured Image: Suhyeon Choi Via Unsplash.