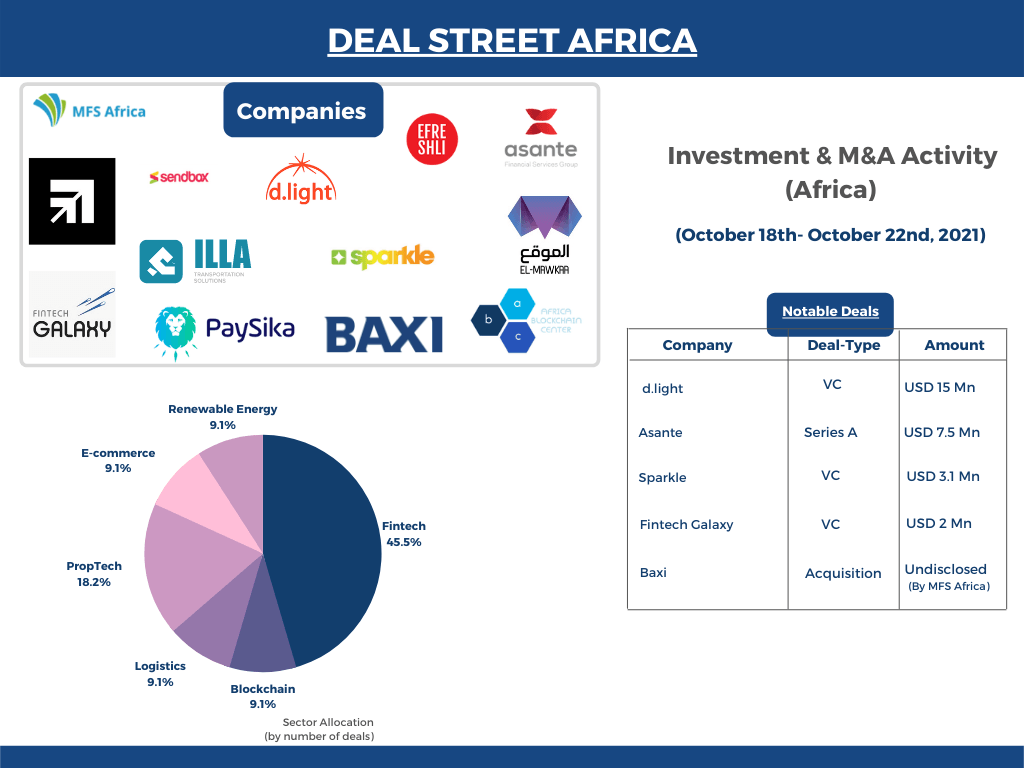

Deal-Street Africa [October 18-22]: Twelve Startups Funded; 1 Acquisition

![Deal-Street Africa [October 18-22]: Twelve Startups Funded; 1 Acquisition](https://weetracker.com/wp-content/uploads/2021/10/April-19th-23rd-3.png)

Nigerian E-commerce Startup Sandbox Raises USD 1.8 Mn Seed Round

Sendbox, a Nigerian e-commerce fulfillment startup, raised USD 1.8 Mn in seed funding to help small-scale merchants get access to new markets and develop West Africa’s e-commerce operating system. Investors in the round include 4DX Ventures, Enza Capital, FJLabs, Golden Palm Investments, Flexport, and Y Combinator.

Egyptian Logistics Startup ILLA Raises 7-Figure Seed Round To Scale

ILLA, an Egyptian logistics startup, raised an undisclosed seven-figure seed round to accelerate its market expansion and diversify its offering to the FMCG value chain. Watheeq Financial Services and Golden Palm Investments led the round, with LoftyInc Capital Management, Kepple Africa Ventures, Cubit Ventures, AUC Angels, Oqal Angel Network, and Flat6Labs also participating.

Egyptian Construction Tech Startup Elmawkaa Raises Seed Round

Cairo-based construction tech startup Elmawkaa raised a six-figure Seed round headed by Flat6labs and joined by a group of Oqal investors from Saudi Arabia. Elmawkaa plans to use the funds to onboard more suppliers and expand into Saudi Arabia.

Digital bank PaySika secures USD 349 K Startup Capital

PaySika, a digital bank focusing on Francophone Africa, received startup capital of EUR 300,000 K (USD 349. 6 K) from a consortium of French, British, and Nigerian investors. The company intends to use this funding to attract new additional profiles and continue its development by creating more fluid, safe services that fulfill user expectations. The startup plans to first deploy in Cameroon and Gabon, the two countries selected to test its solution, before moving on to Benin.

Nigerian Digital Bank Sparkle Raises USD 3.1 Mn Seed Round To Scale

Sparkle, a Nigerian startup that provides financial, lifestyle, and business support services to Nigerians across the world, raised USD 3.1 Mn in seed funding to help it invest in infrastructure and scale across the diaspora. The round included n all-Nigerian group of investors including Leadway Assurance, Trium Networks, and a number of Nigerian HNIs.

Solar Power Provider d.light Secures USD 15 Mn Funding Round

d.light, a leading innovator of solar, lighting, and sustainable products secured a USD 15 Mn funding round led by Inspired Evolution via its Evolution II Fund. Shell New Energies, FMO, Norfund, Swedfund, and KawiSafi Ventures were among the other investors in the round.

MFS Africa Acquires Nigerian Fintech Startup Baxi

MFS Africa, a pan-African payments company, acquired Baxi, one of Nigeria’s largest super-agent networks, to enable its growth into the country. MFS Africa will also expand Baxi’s proposition for offline SMEs to select markets within MFS Africa’s footprint.

Kenyan Fintech Asante Secures USD 7.5 Mn Series A Funding

Asante, a Kenyan fintech startup, has raised USD 7.5 Mn in Series A funding to expand its credit offerings to a host of African countries. The round was led by Goodwell Investments with participation from other investors including, Sorenson Impact Foundation and Forsage Holdings.

Egyptian Startup Efreshli Raises USD 550 K Seed Round

Egyptian online interior design firm Efreshli raised a USD 550 K seed round led by angel investor Tarek Sakr and property developer Marakez. The startup plans to use the funds to finance Efreshli’s geographical expansion and develop its tech infrastructure.

South African Clean-tech Startup Brayfoil Technologies Secures Investment

Brayfoil Technologies, a cleantech startup based in Johannesburg, received an undisclosed amount of funding from Katapult Ocean. In addition, the innovative tech startup has been selected to participate in the Katapult ocean accelerator program that will start at the end of this year.

Nigerian Digital Bank Brass Closes USD 1.7 Mn Funding Round

Brass, a Nigerian digital bank delivering easy access to affordable premium banking services for small and medium-sized businesses (SMEs), secured USD 1.7 Mn in funding to address the heavily underserved banking needs of local entrepreneurs, traders, and fast-growing businesses. The funding round saw participation from Olugbenga ‘GB’ Agboola (Co-Founder of Flutterwave), Ezra Olubi (Co-Founder of Paystack), Hustle Fund, Acuity Ventures, Uncovered Fund, and Ventures Platform. The new funding will play a key role in accelerating Brass’ expansion into South Africa and Kenya.

Fintech Galaxy Raises USD 2 Mn Seed Funding, Partners GIZ

Fintech Galaxy, the UAE-based open innovation platform, raised USD 2 Mn in seed funding to further bolster the development and rollout of its Open Finance platform, as it looks to expand its reach and boost financial inclusion across key the Middle East and North Africa (Mena) markets. The seed round was led by Jordan’s Ahli Fintech and joined by Raz Holding Group, OMQ Investments, Egypt’s EFG EV Fintech, and INSEAD Saudi Angel Investors. Fintech Galaxy has also partnered with the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) to launch a new cross-border accelerator program to help startups from Egypt and Jordan expand into both markets.

Kenya’s Africa Blockchain Center Raises Seven Figure Seed Investment

The Africa Blockchain Center (The ABC), a Kenyan startup focused on building technology capacity and offering blockchain solutions to key sectors announced it had raised a seven-figure investment from Next Chymia Consulting HK Limited, an Asian based company that provides blockchain solutions, consultancy services, and training to global entities. The investment will help The ABC set up structures across 6 markets in Africa including, Kenya, Tanzania, Zambia, Nigeria, Uganda, and South Africa, and build a community of blockchain stakeholders for knowledge sharing and best practice guidelines.