Mara Phones’ South African Ambitions Come To A Pandemic End

A little over two years ago, a flagship smartphone manufacturing facility was launched in Rwanda by Mara Corporation, a company billing as the first indigenous smartphone manufacturer in Africa.

With the promise of producing smartphones specifically tailored to the African consumer, the assembly factory was set up in October 2019, a month after which a similar facility was unveiled in Durban, South Africa.

Mara Phones’ South African launch was celebrated by hopefuls, and significant results were expected since the country is the most industrialized, educated and innovative in the African continent. The factory was South Africa’s first high-end smartphone manufacturing plant, one which looked to create jobs for 450 people in the next half a decade.

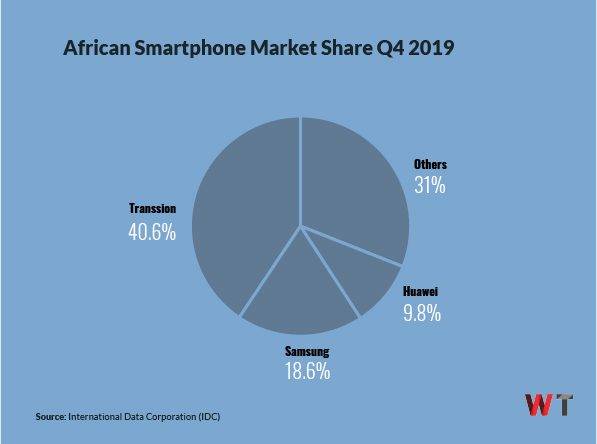

It has always been questioned whether Mara’s idea would fly, considering that it is setting up shop and aiming big in the continent with shackled supply chains and low purchasing power. Launching the factory in Rwanda took USD 50 M, and there is no telling the costs of the Durban branch. At the time, whether Mara Phone could outdo Transsion, Africa’s largest smartphone maker, among other contenders such as Samsung and Huawei.

Now, word on the street is Mara Phones South Africa is in a fix. The smartphone assembly plant is receiving backlash from its employees over unpaid wages and poor working conditions.

According to local news, the factory has been shuttered, and the venture has been placed on auction, seemingly right in the middle of a Management By Objectives process meant to enhance the organization’s general performance.

Per a Business Insider publication, the workers were promised to be permanently employed in the company after three months of temporary work. The permanent placements were also supposed to be accompanied by pay raises.

“But after the three months, they were offered new six-month contracts similar to the first, but with a new permanent probation clause, and remuneration was raised to ZAR 4,500. The contracts were never revised to permanent. There was no straightforward contract that stated that you were hired as a permanent employee. So, we asked for our contracts, and they kept telling us we will get them,” the report reads.

The fiasco started in the middle of last week when word broke out that Mara Phones South Africa is visiting the auction rooms shortly after the company’s investors took over the reins. As the story goes, rights to the company will be sold to whatever is the highest bidding. Meanwhile, the factory’s equipment is going out to a single buyer, but if not, just about any buyer.

Is the South African government the thorn in Mara’s flesh? Last week, the country’s leadership officially embarked on its first legal crackdown on the South African unit of Huawei, a tech giant whose African operations, unlike its European activities, have not come under any fire. But, South Africa is taking Huawei to court for a completely different reason.

As it turns out, the Cyril Ramaphosa-led administration has been supportive of Mara’s manufacturing ambitions in the country.

In February 2020, the government granted the company a ZAR 100 M tax break, promising to patronize Mara Phones for work-related smartphones in its departments from now till 2026. The same year, Mara received a green light under the deceased Section 12I tax allowance initiative. Meanwhile, Standard Bank and state-owned Industrial Development Corporation (IDC) injected capital into the business.

In April last year, South Africa’s government recognized Mara Phones as its choicest phone brand, along the lines of the communications contract that is valid until 2026. Under this scheme, all government departments were mandated to buy from Mara, except they could tender a solid reason to prefer another maker.

According to Mara Phones, the business fell victim to the unprecedented coronavirus pandemic which struck in 2020; South Africa has had one of the world’s highest infection rates for a prolonged period. The company also blamed the situation on the slow uptake of its mobile phones, in a country where 51 percent of adults own smartphones, and where 40 percent of the populace own mobiles.

“Our ambitious plans to launch two subsequent facilities in Africa to manufacture ‘Made in Africa’ devices was untenable in South Africa due to the pandemic and lockdowns that followed only four months after opening,” Mara Phones said in a statement.

It has been established that the pandemic revealed the fault lines in global supply chains, more so in Africa, where underdeveloped commercial systems prevail to the detriment of new consumer-facing companies. The reality appears to have been more severe in South Africa, whose economy was in recession until three months ago.

How about Mara Phones’ Rwandan factory, the birthplace of the African smartphone idea? Unlike its South African counterpart, the facility in Kigali is still operational and is reported to have been consistently producing phones.

Moreover, in December 2021, the Rwandan business minted a partnership with MISALEI- Comércio e Prestação de Serviços to export its smartphones to Angola, one of Africa’s largest economies. While announcing this development, the company’s Managing Director, Eddy Sebera, mentioned that the factory has exported to 76 countries [in Africa and beyond], “We are happy with the progress in the domestic market,” he said.

Rwanda is the second easiest place to do business in Africa, coming only after the much-admired Mauritius. In 2018 and 2019, the East African country ranked higher than first-world countries like Italy, Belgium and Israel. One too many times, the country has been pointed to as the ideal tech testbed for African markets.

Nevertheless, Mara’s Rwandan unit admits it currently runs at 20 percent capacity due to the adverse implications of the COVID-19 pandemic and the economic instabilities of 2020 and 2021.