Fuzzy Details Mar Tingo’s Obscure Billion-Dollar Business In Nigeria

The effervescence that filled African tech following the mega Series D round that saw the Nigerian fintech, Flutterwave, become the continent’s highest-valued startup at over USD 3 B was palpable.

That euphoria had barely ebbed when another surprise, somewhat strange revelation sneaked into local tech discourse less than a week later – suggesting Flutterwave might have only made second place. That’s because a certain little-known, self-described “agri-fintech company” called Tingo Inc. was, as conveyed in the status-boosting coverage on Bloomberg, in more fantastic shape, apparently.

Not only was it reported that Tingo had amassed a staggering 12 million mostly rural-farmer customers in Nigeria where it does most of its business, but it was also revealed that the strangely obscure business posted a revenue of USD 594 M million in 2020, with EBITDA at USD 212 M.

Rory Bowen, an executive at the company, did mention to WeeTracker that Tingo is on track to hit USD 1 B in revenue this year provided it maintains its growth pace.

On top of that, Tingo was reported to be trading on the U.S. over-the-counter (OTC) market where it was valued at over USD 6 B at the time, plus it’s raising USD 500 M in a combination of debt and equity financing via a private placement with work already in progress with the New York Stock Exchange (NYSE).

According to Mmobuosi Odogwu Banye (AKA Dozy Mmuobosi), the London-based Nigerian who is Tingo CEO, a successful fundraise would boost the company as it seeks to expand across Africa (19 countries in the next 3 years), partly through acquisitions.

That’s a lot of incredibly impressive information seemingly coming from out of the blue, thus it drew mixed reactions among stakeholders and observers in the local tech theatre – most of which surmised it was rather odd that a company responsible for the scale of impact of the sort claimed by Tingo was pretty much unknown and unidentifiable even among players in the Nigerian agribusiness landscape.

Keeping up with Tingo

While some of the reactions trailing the revelations gave Tingo the benefit of doubt on the grounds that it might be among an odd bunch of Nigerian companies that are very active in less-glossy environments while not standing a chance of winning any kind of popularity contests, there was more noise around the notion that the fogginess around Tingo, in general, didn’t quite fit with the perception its stop-start online PR efforts has attempted to create over the years.

2x Flutterwave and below the radar? This math no calculate, but there’s no miracle too big for who serves a living God🙏🏾

On a serious note who knows or has done business with this company? I’m sincerely curious as to what exactly they do + how they escaped @ulonnaya & @eajene https://t.co/s9HhRfu39d

— Oo Nwoye (@OoTheNigerian) February 21, 2022

As it turns out, Tingo has been around for quite some time, though the founding date oscillates between 2001 and 2013 depending on where one is tracing the origin story from.

“Tingo started as a value-added service provider to telcos over twenty years ago, developing ringtones and caller tunes,” Rory Bowen, Chief of Staff at Tingo, told WeeTracker.

“And then in 2013, Dozy and his team undertook a piece of work which is a data capture to understand the structure of the agric value chain in Nigeria and how losses can be cut out through the implementation of technology and value-added services for farmers mainly in the rural parts of the country. We then rolled out a product; providing smartphones to farmers on a 36-month financing plan,” he added.

By Dozy’s previous publicly available accounts, Tingo used to be a company known as Fair Deal Concepts Limited which, in 2002, implemented the design and launch of Nigeria’s first SMS banking solution, Flashmecash, that was eventually sold to a Nigerian bank, possibly First City Monument Bank (FCMB).

The company became Tingo Mobile PLC when it launched a Device-as-a-Service product leasing smartphones to farmers, though the details of how it happened are a bit staggered.

What checks out and what’s blurry

For instance, Bowen explained to WeeTracker that Tingo embarked on a one-year data capture project in Nigeria in 2013 which saw it cover all 36 states and the Federal Capital Territory (FCT) Abuja, to identify all individuals working across the entire agricultural value chain.

A similar account can be gotten from much of the aged and recent PR put out by Tingo online. This fieldwork is said to have enabled Tingo to capture around 14 million persons in the agric value chain and initially lease 9 million Tingo-branded phones.

However, there exist other accounts, including some from the company itself, indicating that Tingo didn’t necessarily capture millions of persons to create a database but mostly benefitted from the fact that the Nigerian government gave the company access to certain databases built during a special agric subsidy initiative while allowing Tingo to ride on some government initiatives.

In 2012, the Nigerian government, under the administration of President Goodluck Jonathan, kicked off the Growth Enhancement Support (GES) scheme which sought to uplift 20 million poor farmers across every region in Nigeria within a period of 36 months.

This programme leveraged e-wallet technology to offer farmers subsidies for agro-inputs. Some 14.5 million farmers were registered through that programme, with USD 1 B paid out in subsidies to farmers via the e-wallet system developed by a local tech firm.

It’s fair to assume Tingo leveraged this database when it announced it had distributed 9 million phones to farmers in 2014, which happened a year after the Nigerian government, through the Federal Ministry of Agriculture and Rural Development, announced it had decided to distribute 10 million phones to farmers across Nigeria.

However, two individuals close to the development who spoke to WeeTracker on the condition of anonymity, dispute the claim that Tingo distributed that many phones to farmers, citing “puffery camouflaging as reality.”

In any case, Tingo CEO, Dozy, claims he led a team of 123 Nigerian and Chinese engineers in 2013 to set up two mobile phone assembly facilities in Lakowe (in Lagos) and Lugbe (in Abuja), producing more than 20 million devices which have been distributed across Nigeria, mostly to farmers in rural Nigeria and other players associated with agriculture.

However, Dozy revealed in 2020 that the assembly plants had been shut down because local production had become too expensive. As an alternative, Tingo had opted for the less costly option of having its Tingo-branded devices temporarily produced in China as it plots the acquisition of a South Africa-based manufacturer; a deal that seems to have stalled.

Tingo claims to have leased up to 30 million phones to individuals in the Nigerian agric scene over the course of its existence but several field officials who spoke to WeeTracker anonymously were firm in their assessment that the phones either did not exist or their distribution has been extraordinarily overestimated.

“I’ve been in this field for more than 20 years and I have built agric distribution chains from all the key farming geographies in the country for some of the biggest companies. Trust me, if any platform has as little as 1,000 farmers, I would know. Let alone 12 million farmers? No single private platform has up to 500,000 farmers in Nigeria at the moment,” one field official told WeeTracker.

“Also, 30 million phones? Where are they? It’s not adding up, I have never encountered Tingo and I certainly would have, if they are as big as they claim,” they added.

Tingo claims it currently serves farmers in 19 states across Nigeria including Niger, Edo, and Taraba but contacts with some of the leading farm operators in those states revealed no knowledge of the company. Also, the company claims it has over 20,000 agents (including over 4,000 female agents) in the field but it’s been hard to track them down, nor is it clear how they fit into the plan.

More question marks

The lack of knowledge of the brand could, according to Bowen, be attributed to Tingo’s adoption of a customer acquisition model that does not reach the end-users directly but interfaces with farmers’ cooperatives in various parts of the country.

“The mode of customer acquisition for us since inception is not direct-to-consumer. We don’t deal with farmers directly, that may be why they don’t know the brand. We have relationships with two main cooperatives: Kebbi Multi-Purpose Cooperative Society and Ailoje Royal Farms Multi-Purpose Cooperative Society. They help us reach 4-5 million farmers each. Through the cooperatives, our services (phone and marketplace) are offered to interested farmers,” Bowen said.

WeeTracker reached out to the leaders of both cooperatives and, strangely, they claimed they had never heard of Tingo, nor did they have millions of farmers under their organisation with each of them volunteering that they have much less than 100 farmers.

“It is simply not true, I don’t know anything about this company and I’ve been running this cooperative for years,” one of the respondents said, in response to questions about the possibility of an existing relationship with Tingo.

There might be a mix-up somewhere but there appears to be considerable haziness around Tingo. This is observed in the series of disconnects between the nuggets of information in the company’s patchy footprint largely formed by press releases and media features that seem paid and actual substance on the ground. Beyond press releases and promotional online content, it’s difficult to place a finger on the existence and impact of Tingo.

One way to understand Tingo’s business is to think of it as a combination of four verticals in a closed loop: The Device-as-a-Service offering that leases Tingo devices; its very own cellular network supporting Tingo phones while offering voice, text, and data services; a digital marketplace for agricultural produce known as Nwassa which comes with the device; and a payment platform called TingoPay.

Nwassa, which the company says works like “Amazon for agricultural produce,” is reported to have recorded USD 120.7 M as income generated in the nine months ended September 30, 2021.

TingoPay, through which the company promises customers access to third-party services like utility bill payments, airtime top-up, insurance services, and alternative lending solutions, is being primed to follow up in Nwassa’s footsteps, extending Tingo’s shift from hardware manufacturing and sales to fintech and marketplace operations.

However, it’s hard to verify the reach and impact of Tingo’s platforms outside of information in the communications the company has sent out. Seasoned field officers say they are not aware of Nwassa; TingoPay appears to have been pulled off the app stores after a soft launch in April 2021 and it’s not clear when it’s coming back.

“All the platforms are housed within the Tingo ecosystem which is currently only available to our device owners and the only way to get our device right now is through the cooperatives. But we plan to launch Tingo Pay and Nwassa outside the installed customer base soon,” Bowen mentioned.

A confounding setup

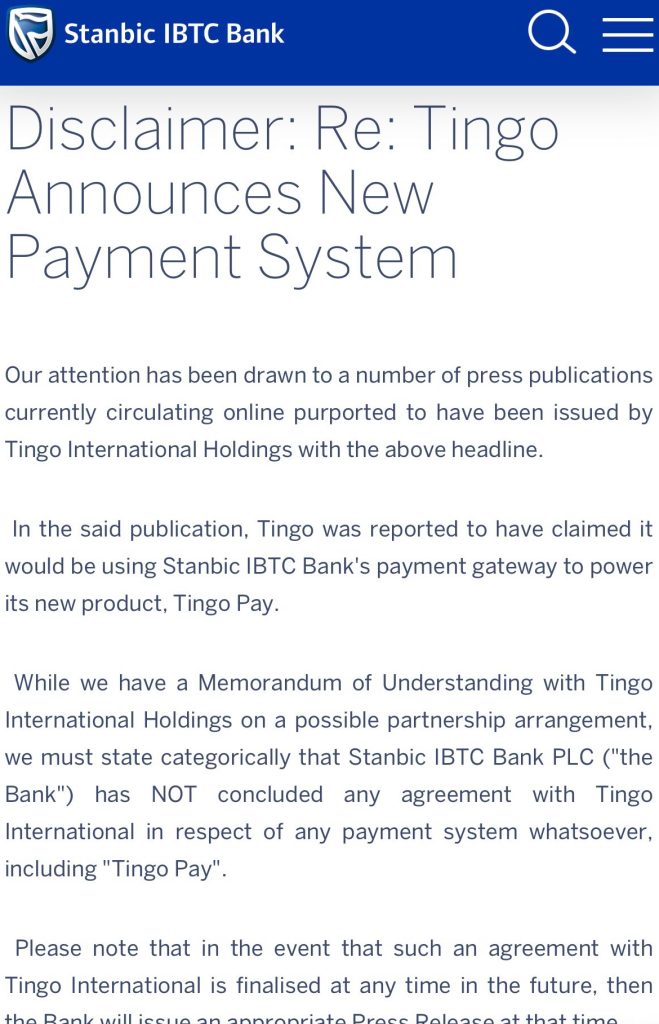

Tingo claims partnerships with Airtel and Visa have helped it roll out the Tingo Mobile network in rural areas and TingoPay respectively. Airtel and Visa did not respond to separate requests for comments on the nature and status of the announced partnerships with Tingo. Previously, Tingo was involved in a bit of a mortifying episode in which a press release issued by Tingo, stating it had reached an agreement with Stanbic IBTC Bank to use the bank’s payment gateway to power TingoPay, was disowned by the bank.

All these, in addition to past, reported incidents; including accounts from former Tingo employees recounting unpleasant experiences and suspicious activity during their time at the company – plus a matter that had Tingo CEO, Dozy, at the centre of a fraud case prosecuted by the Economic and Financial Crimes Commission – put the company under a cloud.

At the moment, Tingo has a corporate structure that sets it up as a significantly non-African company. Dozy has a supporting cast on the leadership team and the company’s board largely composed of foreign nationals. Previously, Tingo had announced the former President of Nigeria, Dr Goodluck Jonathan, on its board, as well as Reno Omokri, former spokesperson for Goodluck Jonathan. But it seems both individuals are no longer on the board.

Furthermore, OTCQB-listed IWEB, Inc. acquired Tingo Mobile PLC (Nigeria) from Tingo International Holdings, Inc (the Delaware parent of the Nigerian entity). in August 2021. The all-stock transaction reportedly valued Tingo Mobile PLC at USD 3.7 B.

Immediately following the completion of the acquisition, IWEB, Inc. filed to have its name changed to Tingo, Inc. As mentioned earlier, Tingo, Inc. recently submitted a listing application to the New York Stock Exchange in an effort to broaden its appeal to the U.S. and international investors.

Hence, Tingo trades on the mid-tier, highly-speculative OTC market and meets certain minimum reporting standards. Its share price has dropped since that Bloomberg article to just over USD 2.00 (from over USD 5.00), giving it a market cap of around USD 3 B currently. Listing on the top-tier bourse as planned would, according to Bowen, shield Tingo from the typically wild ups -and-downs of the OTC market.

“There is still, unfortunately, a bit of hesitancy among foreign investors who want to invest in African companies when it means backing a company that is not global. We recognise this and that is why we set up Tingo to be limitlessly global, so that we can tap into the world’s capital pool to power the enormous impact that would come from reforming the vast agricultural landscape across Africa,” Bowen said.

On its part, Tingo International Holdings, Inc. (TIH), is an investment company focused on identifying and making targeted acquisitions that have synergistic characteristics with its other portfolio companies. TIH is the majority shareholder in Tingo, Inc., and it’s announced a few acquisitions and partnerships outside Africa – including some that have links to Decentralised Finance (DeFi) and blockchain technology.

Although Dozy and the company’s top brass are based abroad, and the company only lists an address in New York on its website, Bowen mentioned Tingo has two offices in Lagos and keeps a field team, the identity of which – like most things about Tingo in Nigeria – is not well known.