Africa’s USD 100 M Funding Club

The trajectory of the African startup funding scene has been nothing short of remarkable and promising over the years. Not only is it characterized by a large flow of investment from reputable investors, but also large ticket funding rounds have revolutionized the game.

Before 2021, only Nigerian HRtech Andela and the fintech OPay had garnered more than USD 100 M in a single funding round. The two startups raised USD 400 M and USD 200 M respectively. According to several funding reports, startups that raised over USD 100 M in 2021 accounted for 40 percent of the total raised in that year with a staggering record of over USD 1.7 B.

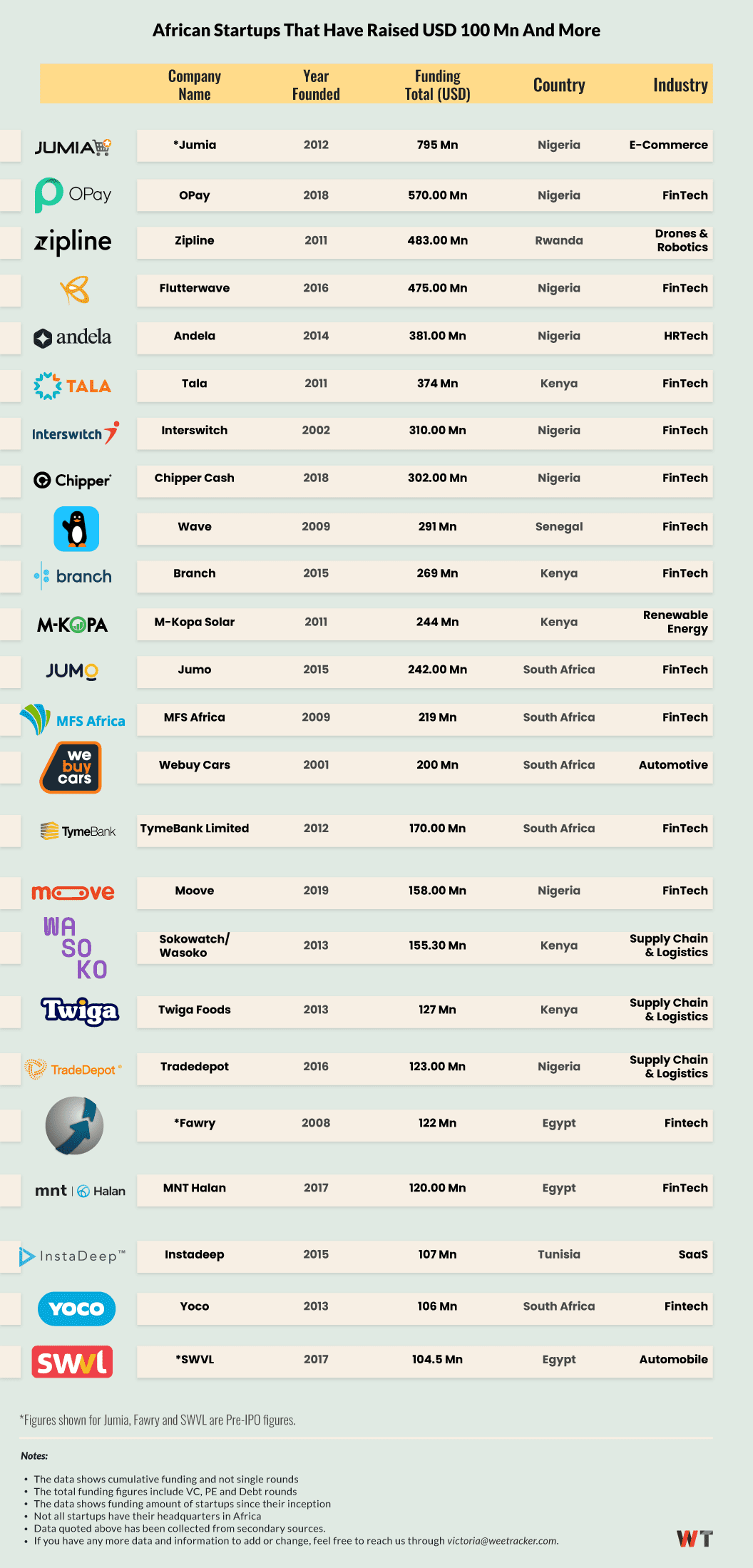

The number of African startups and scaleups that have raised USD 100 M and more is now a little over 20. Seven of these companies are what stand as Africa’s illustrious unicorns recording valuations ranging from USD 1 B to over USD 3 B. They include Jumia (Nigeria), Interswitch (Nigeria), Flutterwave (Nigeria), Chipper Cash (Nigeria), Opay (Nigeria), Wave (Senegal), and Andela (Nigeria).

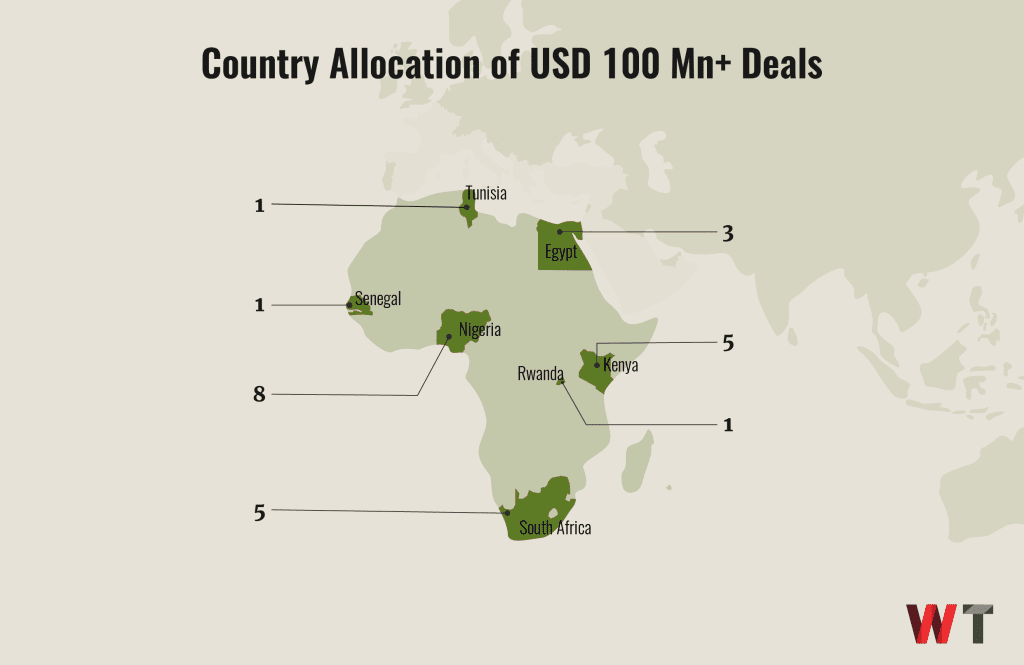

Nigeria (8), South Africa (5), and Kenya (5) have the highest number of startups and scaleups that have raised more than USD 100 M. The three countries represent 76 percent of the total number, with Egypt following closely with 3 startups representing 12 percent. Senegal (Wave), Rwanda (Zipline), and Tunisia have also claimed their position in the race with 1 startup each. Tunisian SaaS startup Instadeep raised USD 100 M in a single Series B round led by Alpha Intelligence Capital and CDIB early this year.

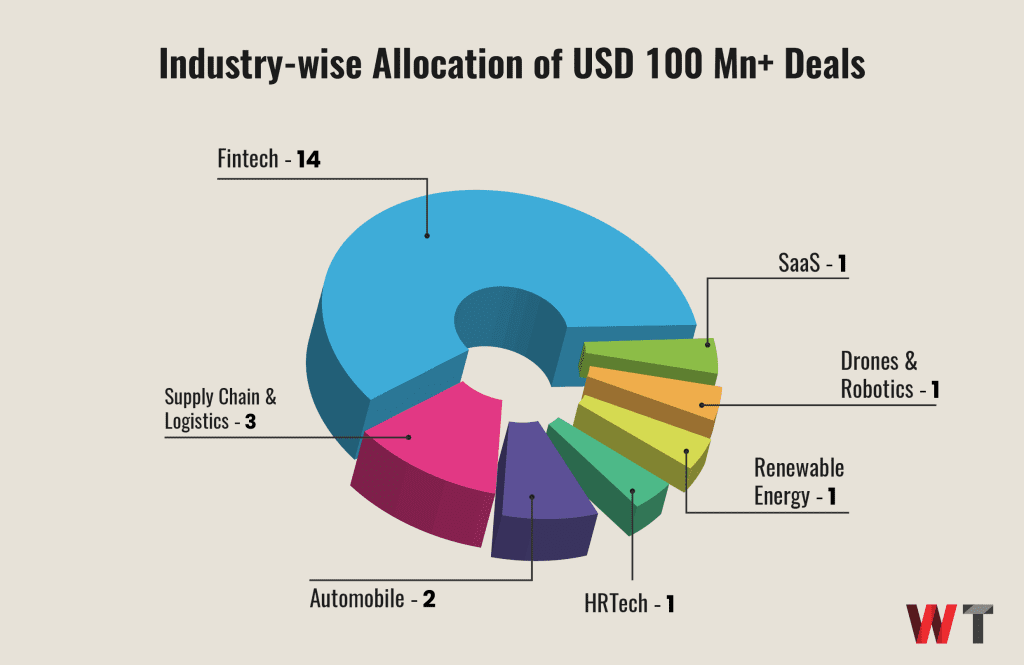

Fintechs lead the pack as is the norm with 14 startups, with a notable mention of Egypt’s MNT Halan, which has raised more than USD 120 M since its inception in 2017. South African fintech Yoco has raised USD 106 M+ and Kenya’s MFS Africa has raised USD 219 M+. Kenya’s Twiga Foods (USD 127 M), Wasoko (USD 155 M), and Nigeria’s Tradedepot (USD 123 M) hold the record in the supply chain and logistics industry. The renewable energy sector is represented by Kenya’s M-Kopa Solar, which has raised USD 244 M+ since 2011.

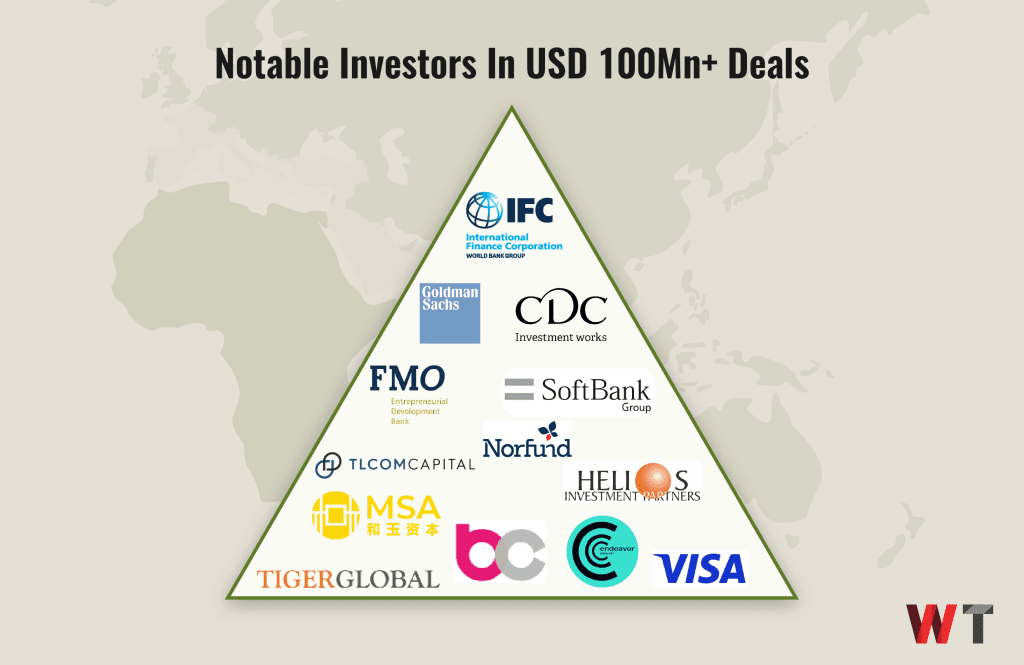

Some of the notable investors that have participated in several of these mega funding rounds include the International Finance Corporation (IFC), Tiger Global, Helios Investment Partners, CDC Group, SoftBank, MSA Capital, Endeavor Catalyst, FMO, Goldman Sachs, Visa, Barium Capital, TLCom Capital, and Norfund.