US-Listed Nigerian ‘Agri-Fintech’ Firm Tingo Rocked By Allegations Of Brazen Fraud

Tingo Group Inc, a self-described “agri-fintech” company with operations in Nigeria and headquartered in the U.S. where it is listed, has come under fire following investigations that allege wide-ranging fraud and malfeasance.

The company—the subject of a March 2022 report by WT highlighting spurious claims and fuzzy details around the substance of its business—is alleged to be operating an “exceptionally obvious scam with completely fabricated financials,” according to well-known short-seller Hindenburg Research which released explosive findings Tuesday while revealing it had taken short positions on the now-plummeting stock.

Tingo first went public in August 2021 on the OTC market, per the Hindenburg report, through a reverse merger with a Thai company that originally intended to acquire a third-tier crypto exchange. In December 2022, Tingo entered the Nasdaq by closing another reverse merger with a listed Chinese fintech company. The new executive setup had Darren Mercer as Group CEO; Dozy Mmobuosi as CEO of Tingo Group Holdings LLC/Founder of Tingo Mobile Limited and Tingo Foods PLC; and Hao (Kevin) Chen as Group CFO.

The company was renamed Tingo Group Inc and the ticker changed from MICT to TIO on February 27, 2023. Tingo had a recent peak market value of ~USD 3 B as of May 22, which has tanked to below USD 100 M at the time of publishing. At various periods, short-sellers who have been circling the company over several months shared with WT that they suspected Tingo to be an overvalued sham enterprise.

Tingo was founded in 2001 and is led by Mmobuosi Odogwu Banye (AKA Dozy Mmuobosi), CEO of the key holding company entity who drew significant coverage in the media earlier this year for his attempted takeover of newly-promoted English Premier League club, Sheffield United; a deal that ultimately fell through reportedly due to question marks over his finances.

The firm, which claims to have several business segments focused on providing mobile phones, payments, food processing and an online food marketplace for farmers primarily located in Nigeria, has over the last few years projected an image of progress and impact that has proved difficult to substantiate. Further findings now put forward by Hindenburg Research allege Tingo is a brazen fraud in its entirety.

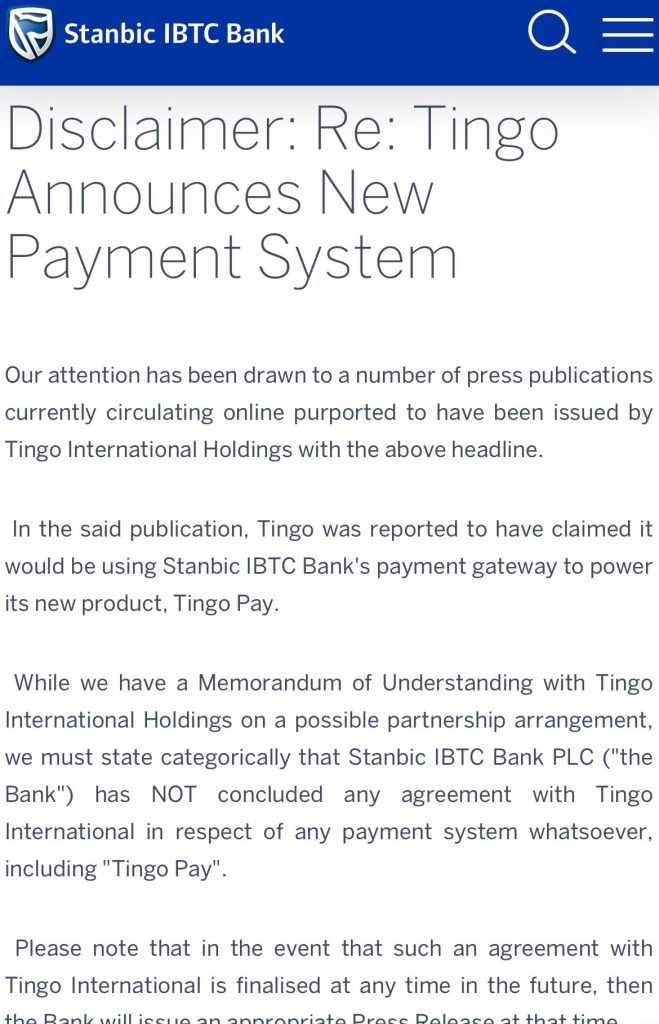

Last year, WT discovered discrepancies in several claims made by members of Tingo’s leadership past and present, as attempts to verify stated achievements and milestones returned responses refuting them. The alarm bells were set off when TingoPay (part of Tingo Mobile) claimed in 2021 to have launched a partnership with Stanbic IBTC Bank, a major local bank. Two days after Tingo’s announcement, the bank put out a statement calling Tingo’s claim false and that it had “NOT concluded any agreement with Tingo International in respect of any payment system whatsoever.”

Additionally, Tingo’s claims of capturing some 14 million persons via fieldwork and leasing 9 million mobile phones to farmers as of 2014, as well as talk of setting up two mobile phone assembly facilities in Lagos and Abuja in 2013 which churned out 30 minion devices, proved either bogus or extremely embellished upon investigation.

Further claims by the CEO and other executives that suggest Tingo has leased up to 30 million phones to individuals in the Nigerian agric scene over the course of its existence were rebuffed by officials who participated in a government-assisted programme that Tingo may have been piggybacking on. Named farmers cooperatives through which Tingo claims to be reaching millions of farmers via Nwassa; an online marketplace platform, denied any knowledge of or association with Tingo when WT reached out. Field workers in Nigeria’s key agric zones also noted claims of 20,000 Tingo agents pushing its services at the grassroots to be unfounded.

Tingo’s leadership also claimed that its Nwassa platform was doing USD 1 B per month of transaction value, as seen in filings and as heard in an audio recording of a March 31 earnings call obtained by WT. When questions were raised on the apparent inactivity of the online platform upon exploration, Dozy stated on the call that the Nwassa app was not yet in service and all transactions were being done through a USSD channel for now. Attempts by WT to carry out transactions via the stated USSD code *347*711# proved abortive – it seemed to be a dud.

New findings by Hindenburg Research highlight a raft of issues. In April 2023, Tingo’s Co-Chairman Christophe Charlier wrote a public letter to Dozy, filed with the SEC, saying he could not approve the company’s annual report and felt it “necessary to recuse myself by resigning” due to “many critical questions, comments and recommendations” that went “unanswered and unheeded”, the report says.

In addition, it was noted that Tingo’s food division is 7 months old, yet claimed to generate USD 577.2 M in revenue last quarter alone, representing 68 percent of total reported revenue. If accurate, its claimed 24.8 percent operating margins would exceed those of every major comparable food company, Hindenburg notes.

However, Tingo has no food processing facility of its own. Rather, it claims its explosive revenue and profitability is derived from acting as a middleman between Nigerian farmers and an unnamed third-party food processor.

In February 2023, the company held a groundbreaking ceremony for a planned USD 1.6 B Nigerian food processing facility of its own. It was found that the rendering of the planned facility, featured in Tingo’s investor materials and on a billboard at the ceremony, is actually a rendering of an oil refinery from a stock photo website.

Following its groundbreaking, Tingo reported in a May 2023 SEC filing that it made “significant progress” on the facility, including laying “the foundations of its numerous buildings”. Hindenburg says its team visited the site a week later and found zero signs of progress; it was empty except for the plaque and billboard commemorating the groundbreaking ceremony, surrounded by weeds.

Further Tingo claimed its mobile handset leasing, call and data segments generated USD 128 M in revenue last quarter (~15 percent of total), claiming these services are provided through an agreement with Airtel in Nigeria, even as the type of license they claim did not exist until June 2023. Also, WT recently obtained a statement from Airtel denying any ties to Tingo.

“Airtel Nigeria does not have any MVNO arrangement with any company called Tingo Mobile,” reads the email from an executive in charge of investor relations at Airtel Africa.

Tingo now claims its payment group has a point of sale (PoS) system and other merchant products. Hindenburg says it found that pictures of Tingo’s claimed PoS system were taken from a different PoS operator’s website, with a Tingo logo photoshopped over them. The report by Hindenburg also lists several other issues related to Dozy’s questionable background history, shoddy financial reporting, an obscure online marketplace, and purported international operational divisions.

While there has been no communication from Tingo’s leadership following the development, Block & Leviton, a law firm that previously sued Elon Musk over his Twitter stake, has announced an investigation into Tingo Group for potential securities law violations, opening its resources to anyone who purchased Tingo Group, Inc. stock and has lost money, whether or not they have sold their investment.

*At 12:10 WAT, 07/06/2023: Update on the Nwassa USSD platform added to the article