Flutterwave Is Scrambling To Put Out A Barrage Of Fires As It Enters Crucial Phase

Flutterwave, the Nigeria-based digital payments company and Africa’s most valuable startup, is tasked with putting out a barrage of fires as it navigates its path to a public listing and global prominence. After coming through a series of controversies over the past year, the company is mired in yet more troubling news.

The most recent setback, occurring just one month after Flutterwave obtained a court order to recover USD 24 M lost in a breach that originated back in October, puts the startup at the centre of yet another breach, estimated by multiple reports to have led to losses ranging between NGN 11 B (USD 7 M) and NGN 20 B (USD 13.5 M).

Perpetrators reportedly executed a convoluted scheme, transferring stolen funds across multiple accounts in various financial institutions over four days avoiding detection by dispersing small amounts to evade fraud checks, reports say.

These successive security breaches heighten broader concerns surrounding Flutterwave’s vulnerability to cyber threats and its capacity to safeguard sensitive financial data. The company’s track record reveals a troubling pattern, with losses exceeding NGN 22 B (USD 14 M) in multiple incidents throughout the preceding year.

“As is common in the financial services industry, there will always be attempts by bad actors to compromise the security of systems set up to protect and monitor services,” Flutterwave said in a statement released to multiple publications.

“In April, we detected unauthorised activities inconsistent with usual customer behaviour on one of our platforms used by a small subset of our customer base.”

Despite assertions from Flutterwave that no customer funds were compromised and data integrity remains intact, the frequency and magnitude of these breaches cast a shadow over the operation.

Since launching in 2016, Flutterwave has swiftly expanded, now operating in ~30 African countries. Led Co-Founder/CEO by Olugbenga Agboola, the startup has closed substantial funding rounds, with a February 2022 round tripling the company’s valuation to USD 3 B.

Headquartered in Lagos and San Francisco, Flutterwave has garnered investments from notable venture capital firms like Tiger Global. The company collaborates with industry giants including Alibaba’s Alipay, Uber, and Netflix.

However, the startup has seen its fair share of controversy. In April 2022, harassment allegations rocked Agboola who subsequently denied accusations that the company had refused to honour former employees’ stock rights, and that staff were bullied.

Having survived the backlash, the Flutterwave CEO maintained these were “very, very isolated,” cases and they wouldn’t affect the company’s plans.

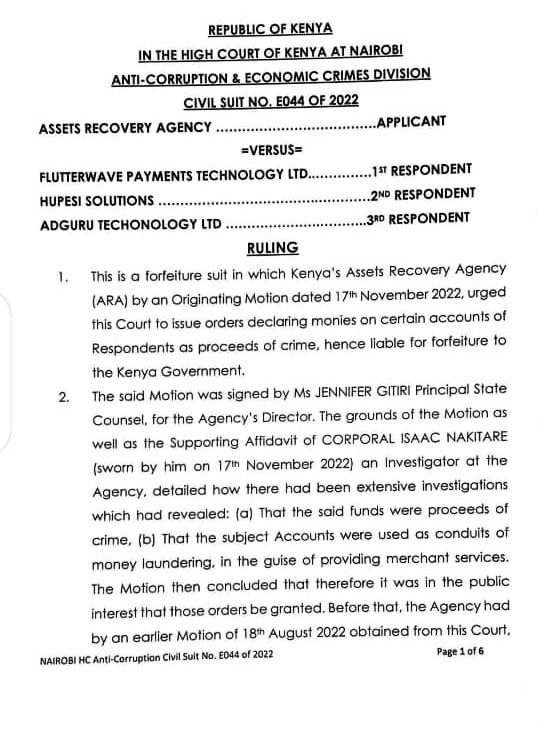

In July of the same year, the Kenyan High Court froze Flutterwave’s bank accounts holding more than USD 40 M over anti-money laundering concerns, as the central bank declared the company lacked the required payment services license in the country.

Despite progress in resolving these issues, including the withdrawal of charges by Kenya’s Assets Recovery Agency (but not without some initial pushback by the presiding judge, Prof (Dr) Nixon Sifuna, who in his ruling subsequently issued a stern statement tugging at possible collusion to kill the case, the regulatory hurdles highlight the challenges confronting Flutterwave on its path to global standing.

On its part, Flutterwave is doubling down on global ambitions, pushing international business development in the U.S. and Europe, built on recent partnerships including one with Microsoft.

“The goal is to make merchants across Africa, consumers across Africa use us more and know that we are the most reliable platform to use,” Agboola told Bloomberg last year. “Africa is huge, the potential is huge.”

In addition to its new payments app Send App which reportedly grew 23-fold in 2023, the company has floated plans to introduce education payments and international aviation payments.

Additionally, the wave of departures and arrivals around Flutterwave’s top brass of late, which has been perceived as curious in some circles, are among changes being made to its corporate team as part of moves aimed at preparing for an initial public offering, its chief executive said at a Semafor event in April.

“Right now our goal is to be IPO-ready, ensuring we have the right corporate governance in place, making sure we are operating well,” Agboola said. “We want to be a long-term company in Africa, for Africa – and so the goal is building the right infrastructure to be here for the next ten-plus years.”

While Flutterwave faces obstacles on its path to global prominence, its strategic partnerships, ambitious goals, recent hires, and IPO plans signal its determination to press forward. As the fintech aims to go public and expand its global footprint, it faces intensified scrutiny from regulators and investors and its response to setbacks would be crucial to its future and arguably Africa’s tech scene in general.

Featured Image Credits: TechCabal