Jason Njoku Hints At USD 120 Mn+ iROKOtv IPO In London By H1 2021

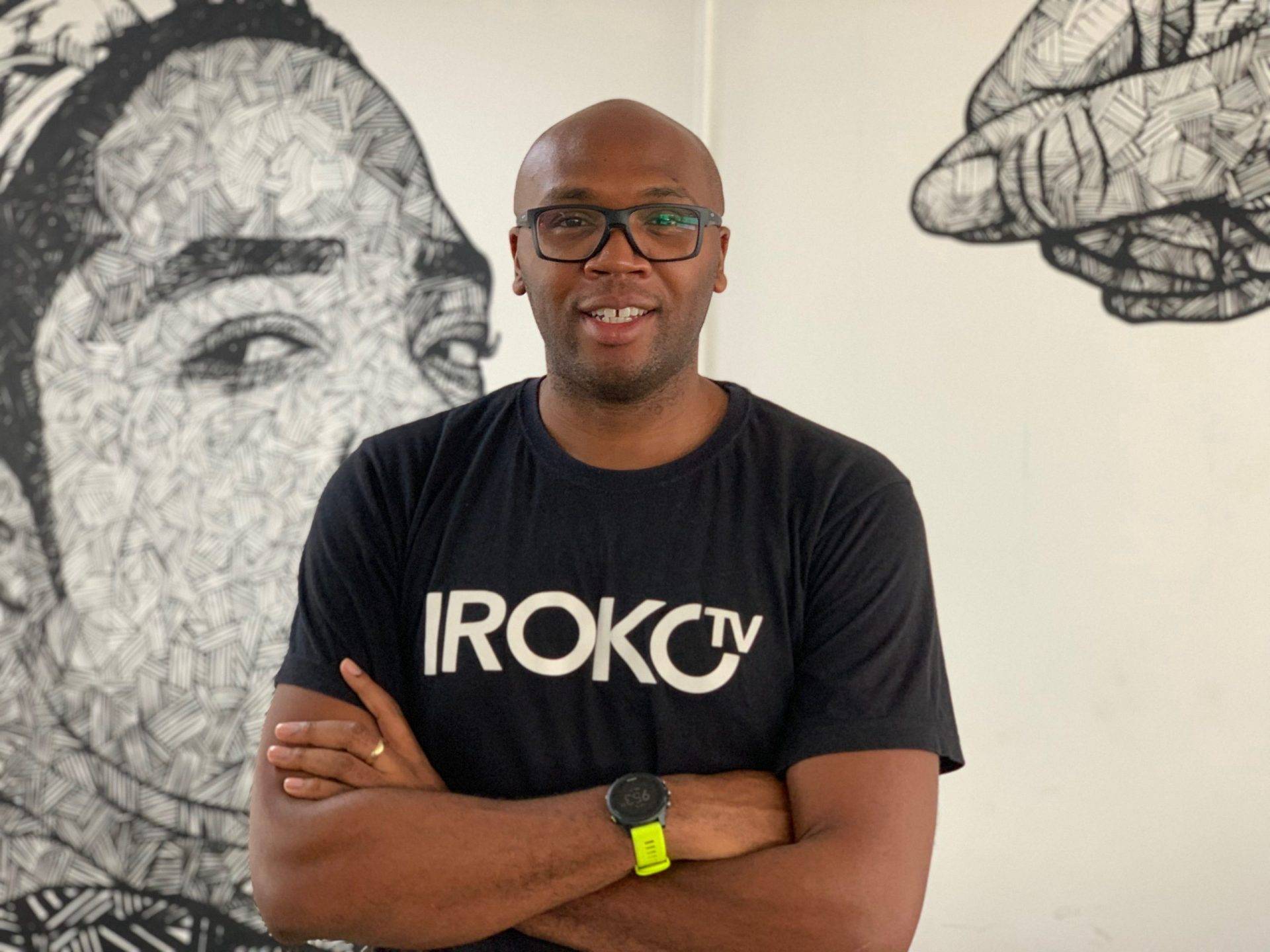

Anyone who follows Jason Njoku on Twitter must know two things. Firstly, the iROKOtv co-founder now spots a “mean-and-lean look” thanks to shedding some serious weight in the past year. Secondly, the man is obsessed with numbers.

And his latest “number obsession” is somewhere between USD 120 Mn and USD 150 Mn, which is the figure he is talking up as the value of iROKOtv’s next big move — an IPO on the London Stock Exchange (LSE) in the first half of 2021.

Njoku made this known in a recent Medium post in which he pretty much confirmed the speculations that have been building up in the last few months since Canal+ acquired iROKOtv’s film studio — ROK — in a transaction that is considered the largest of its kind in Africa (outside of South Africa, at least).

In the post, Njoku confirmed that he had indeed helped build out ROK alongside his wife, Mrs. Njoku, who still maintains her shares in the company even as iROKOtv divested its share in the company to Canal+. iROKOtv had made an equity investment of around USD 1.4 Mn in ROK and exited five and a half years after.

In the months since that deal, Njoku has taken to Twitter to hint at an IPO exit for iROKOtv’s earliest investors.

Understanding exit opportunities and IPOs at the London Stock Exchange. pic.twitter.com/hCyi7LchZT

— JasonNjoku (@JasonNjoku) October 23, 2019

The iROKOtv founder, in a recent tweet, shared a video of a dashboard from the London Stock Exchange with the caption: “Understanding exit opportunities and IPOs at the London Stock Exchange.”

After this weeks IPO meetings. It’s the only thing which matters full stop. Now and forever. https://t.co/R1aRW4SfUa

— JasonNjoku (@JasonNjoku) October 25, 2019

In another tweet, quoting Gloopro founder, Olumide Olusanya, Jason hinted at having weeks of IPO meetings.

And in today’s “number-riddled” Medium post, Njoku all but confirmed the intention to take iROKOtv public in the next two years.

“Based on our direct conversations with stockbrokers, NOMADs, auditors, and lawyers, an LSE AIM-listed company valued at USD 100 Mn would need to have (ultra conservatively) USD 8–10 Mn in revenue and USD 0–1 Mn in EBITDA,” the post reads.

“They are willing to fund losses for high growth, but that always changes. I would prefer to be conservative. For that same company to be at USD 250 Mn-USD 300 Mn valuation, it would be required to generate USD 25-USD 30 Mn in revenue, USD 2–5 Mn EBITDA and have a clear multi-year annual growth outlook of 15–20 percent.”

He goes on to say: “BOKU, SUMO, and DOTD are examples of this — although their losses and profits swing outside of this conservative range). IROKO is not there today. But we expect 2020 to be our foundation year which will give us the clear path to run at an IPO in H1 2021.”

Another part of Jason Njoku’s post reads thus:

“For Tiger Global, our first investor and largest shareholder (33.36%), I think an IPO in 2021 would be a good step forward for them to close out a decade of ownership and see a return on their original investment from 8 years ago. Ideally, we would be able to solidly beat the 10-year S&P 500 index return over their investment period. Cherry meets cake.”

Njoku also adds: “Going public isn’t the end of the journey. But it can be seen as the end of the beginning. IROKO is a multi-decade company and ending the first 10 years with a liquidity event feels like a fantastic outcome.”

Then, he goes on to reveal that he will put out the mechanics and technical details around the listing based on the experiences he garnered while meeting with the folks at LSE and the advisory.

Launched in December 2011, iROKOtv is a web platform that provides free and paid-for Nigerian films on-demand. It is the largest, legal online distributor of Nollywood films, with a library of more than 5,000 movies.

Dubbed the ‘Netflix’ of Africa, iROKOtv is the world’s largest legal digital distributor of African movies. Njoku established iROKO Partners, iROKOtv’s parent company, alongside co-founder, Bastian Gotter, in 2010.