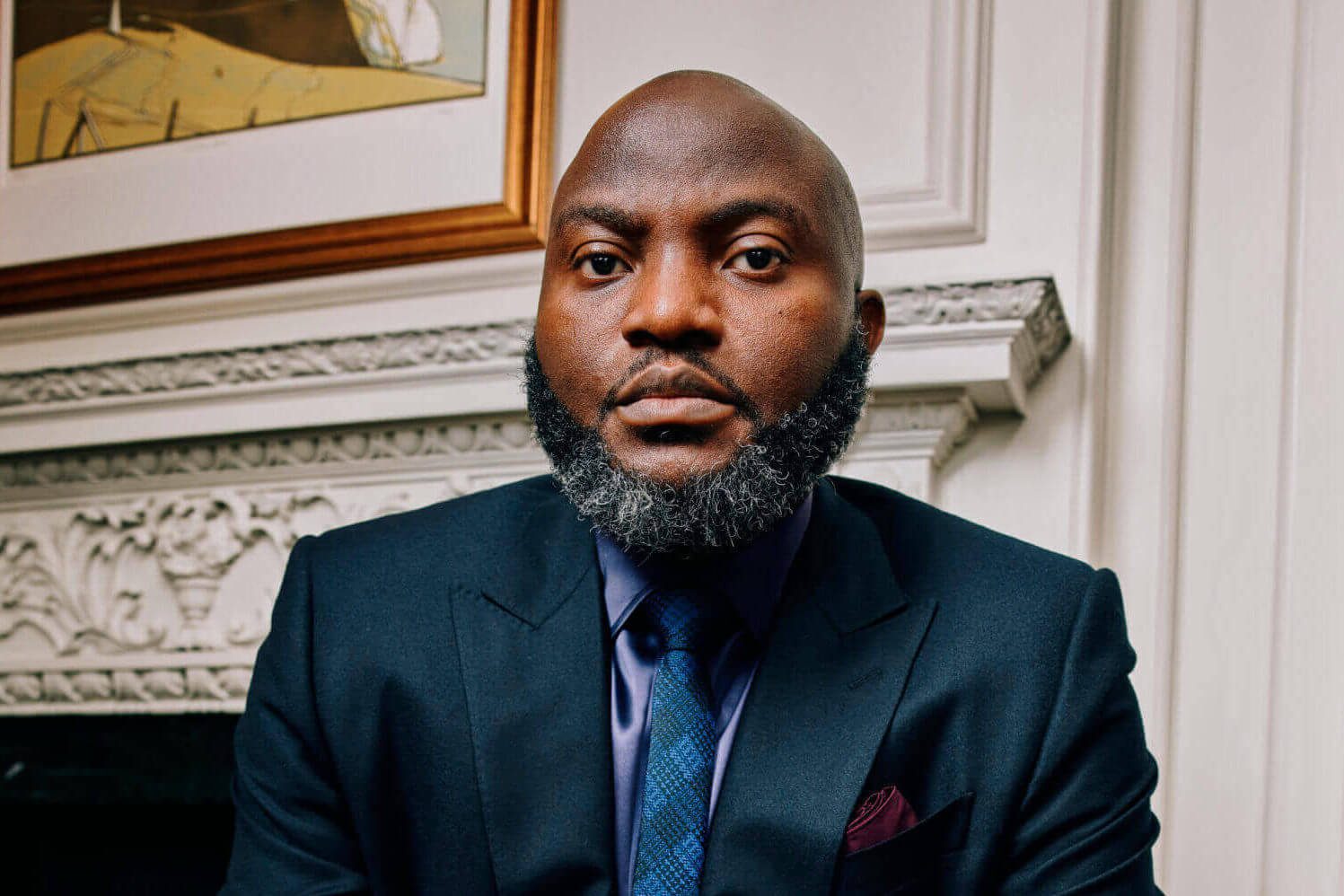

Dozy Mmobuosi’s ‘Fictional Empire’ Faces A Costly Reckoning

Few stories have captured the attention of industry watchers as dramatically as the controversy around Nigerian businessman Dozy Mmobuosi over the past year. Once regarded, however self-promoted, as a savvy player in tech and finance, Mmobuosi’s claims of a booming business empire have come crashing down amid allegations of massive fraud, resulting in a U.S. federal court order to pay over USD 250 M in fines and a ban on serving as a director of any public company.

The Final Judgment

The U.S. District Court for the Southern District of New York, under Judge Jesse M. Furman, has issued a default judgment against Mmobuosi and his companies—Tingo Group, Agri-Fintech Holdings, and Tingo International Holdings, reports the FT. The court’s ruling came after Mmobuosi failed to respond to a civil complaint filed by the U.S. Securities and Exchange Commission (SEC) in December 2023. The complaint accused him of orchestrating a wide-ranging fraud that inflated the financial performance of his companies, duping investors worldwide.

Judge Furman noted that Mmobuosi and his companies had “failed to answer, plead, or otherwise defend” themselves in the case. As a result, the court ordered Mmobuosi and his entities to pay fines exceeding USD 250 M, marking the end of what the SEC described as an “empire of fiction.”

The Unraveling of Tingo Group

Mmobuosi’s fall from grace began with the rise of Tingo Group, a fintech company that claimed to have over 9 million customers in Nigeria, most of whom were farmers. Tingo Group reported substantial revenues, with Tingo Mobile—a subsidiary—claiming to have USD 461.7 M in cash equivalents in Nigerian bank accounts for fiscal year 2022. However, the SEC’s investigation revealed that these claims were almost entirely fabricated, with Tingo Mobile’s actual balance being less than USD 50.00.

The SEC’s complaint painted a picture of deception stretching back to 2019. Mmobuosi allegedly used falsified financial records to depict Tingo Mobile as a thriving business. In reality, the company had no meaningful operations, a negligible customer base, and virtually no cash in its accounts.

The scale of the fraud was staggering. Mmobuosi reportedly sold Tingo Mobile to two public companies at inflated prices, using fabricated financial statements to justify valuations exceeding USD 1 bB each time. These mergers, conducted entirely through stock, allowed Mmobuosi to secure substantial shares in the newly formed entities, which were then listed on U.S. capital markets.

The Hindenburg Report and Its Aftermath

The beginning of the end for Mmobuosi’s empire came in mid-2023 when U.S.-based short-seller Hindenburg Research released a damning report labelling Tingo Group an “obvious scam,” following an earlier May 2022 article by WT that revealed questionable details at the heart of Tingo. The report highlighted the fraudulent nature of the company’s financials, triggering an immediate collapse in the stock prices of Tingo Group and Agri-Fintech Holdings.

Despite the mounting evidence against him, Mmobuosi doubled down, continuing to deny the allegations and even appointing himself as co-CEO of Tingo Group in September 2023. Public filings from Tingo Group and Agri-Fintech Holdings continued to present fake operations as real, issuing false financial statements and withholding or providing deceptive information to the SEC.

But the SEC investigations alleged that Mmobuosi and his companies had forged bank statements, altered documents, and even bought domain names to impersonate fake suppliers and customers. These tactics were designed to deceive auditors and create the illusion of a thriving business, when in fact, the entire operation was a house of cards, the investigators emphasised.

The Sheffield United Debacle

Adding to the intrigue of Mmobuosi’s rise and fall was his audacious attempt to purchase Sheffield United, an English football club then competing in the Premier League. The bid, which ultimately failed, was funded through the same fraudulent means that characterised his business dealings. The SEC’s complaint noted that Mmobuosi had misused Tingo Group’s assets for personal expenses, including the failed acquisition of Sheffield United.

The SEC’s findings revealed a fraud that was not sophisticated or complex, but rather a brazen facade built on forged documents and hollow claims. The case also underscores the importance of regulatory oversight in protecting investors from such schemes.