The Poor Orphan Boy Who Became One Of Kenya’s Richest Businessmen

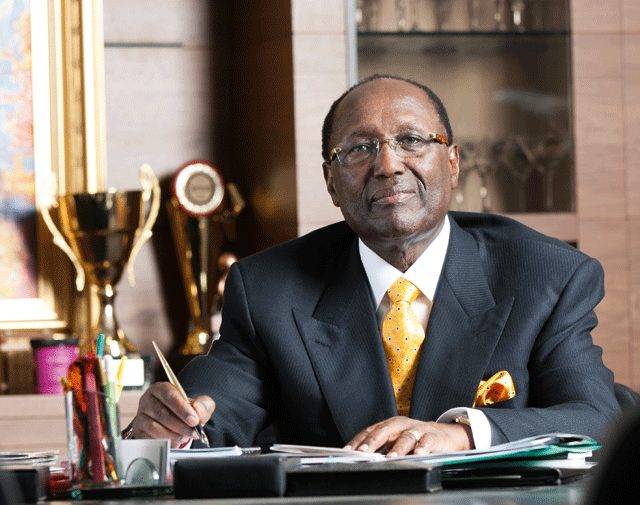

“Bold,” “bullish,” “bubbly,” “boisterous” – no, those are neither words from some class in basic phonetics, nor are they from some spelling bee organised for pupils in elementary school. They are just a few of the more honest words that can be used to paint a candid picture of Chris Kirubi; one of Kenya’s richest businessmen

“Bold,” “bullish,” “bubbly,” “boisterous” – no, those are neither words from some class in basic phonetics, nor are they from some spelling bee organised for pupils in elementary school. They are just a few of the more honest words that can be used to paint a candid picture of Chris Kirubi; one of Kenya’s richest businessmen.

If all the whispers making the rounds are anything to go by, the business mogul sits atop a fortune of around USD 300 Mn. And that figure might as well use some updating.

At the tail end of last year, the Kenyan tycoon was reported to have been bought out by

Source: newsday.co.ke

If the word that got out is anything better than a rumour or a grapevine, the Nairobi-based businessman made quite the killing in the buyout. And now, you get why his net worth could use some upward review.

Kirubi has been active on the Kenyan business scene since 1971 and during that time, he has managed to forge actual gold out of what was no better than iron pyrites. You could think of him as the modern-day “King Midas.”

But even as it currently seems like everything he touches turns to gold, there was a time in his life when most people wouldn’t want to be within ten yards of him.

Kirubi’s is the quintessential poverty-to-paradise, hardship-to-heaven story. Born Christopher John Kirubi in 1941 into a family that was even struggling to keep up with feeding from hand to mouth, there were very few ways it could have gotten worse for him as it seemed life had done its worst.

But it did get worse, though. Life dealt young Kirubi and his siblings an even harder blow when both father and mother passed on within a few months of each other. It was bad enough that they struggled with both parents around, now it seemed they were heading for new levels of hardship as orphans.

The demise of both parents had all the makings of a knockout punch, but instead of falling face-down on the canvass, Kirubi took it to the chin like it was just a pat.

After several months of grieving and living at the mercy of relatives and neighbors, it occurred to Kirubi that he was not prepared to live a life of pity for the rest of his existence.

Being the eldest, he took it upon himself to dust himself up and get up even as others were down and out. Kirubi took on a number of odd jobs so as to be able to fend for himself and his siblings.

Read more: Kenya Earned USD 1.53 Bn From Fresh Produce Export in 2018

At various points, he was putting in multiple shifts on multiple jobs. That way, he was able to make just about enough money to take care of some domestic needs and put himself through school.

But it was no easy task. It was utterly exerting, but he pulled it off. And all that hard work and persistence soon paid off when he landed his first job with oil and gas giants, Shell, upon graduation.

It wasn’t exactly some super job that fetched him a fat paycheck every other month. He was basically a salesman whose job involved selling gas cylinders and fixing faulty ones. But, at least, he was now earning a reasonable sum without having to over-exert himself by juggling several jobs.

Kirubi was to severe ties with Shell after some years, but that was not before he was offered a position at Kenatco; a government-owned transportation company.

He worked as an Administrator at the firm for several years and during all that time, he laid the foundation for his next big move; one that would eventually put the course of his life on a steady upward trajectory.

It was the year 1971 and Kirubi had just used up the bulk of his savings in buying a dilapidated, run-down property in Nairobi and giving it a facelift. The same property was sold off at a good profit and just like that, the poor boy from Nairobi had found his turf in property development and real estate.

It became his signature move. Kirubi would buy decayed properties which no one else would touch with a ten-foot pole and renovate it.

Then, those revamped structures would be re-sold for a profit or rented out. This strategic move proved quite the cash cow and he was soon raking in huge sums from a string of properties, while also building a reputation.

That pedigree was instrumental in securing loans from Kenyan financial institutions with which he acquired strategic pieces of land in some of Nairobi’s choicest areas. On those plots, he went ahead to erect a number of residential and commercial properties which were eventually put up for rent.

Also Read: 5 Powerful Business Tips That Can Be Picked Up From The Richest Black Man

To this day, his property management company, International House Limited (IHL), owns and manages over 40 residential and commercial buildings in Nairobi (collectively worth up to USD 200 Mn on their own), including the iconic International House Building and Two Rivers Mall. But all that property talk is no more than ‘Part One’ in the making of the man.

The foray into property development did not only make Kirubi reasonably rich. It also gave him a third eye; one that recognised business opportunities from miles away. And when the opportunity to acquire Haco Industries came around, he didn’t need a second invitation.

He acquired the company for an undisclosed sum back in 1998 and transformed the company from a distributor of American and British brands into a leading indigenous manufacturer of consumer goods.

Haco also formed a joint venture with Tiger Brands; one of South Africa’s largest food manufacturers, back in 2008. Thus, Haco Tiger Brands was born. The company manufactures a variety of consumer goods that are quite popular in the East African market, while also posting impressive revenue and employment numbers.

That same year, Chris Kirubi purchased Capital FM; a radio station that was struggling to keep the lights on at the time. According to him, the acquisition was borne out of his passion for the media than any promise of future financial dividends and the radio station has since developed into one of Kenya’s top radio stations.

At some point, he even DJ’d and hosted a rock show on the station which only increased his popularity and made him a fan favourite. By becoming some sort of cult hero amongst radio enthusiasts, Capital FM’s ratings shot through the roof and it appears to still defy gravity to this day.

It would appear the Kenyan businessman, entrepreneur, industrialist, and philanthropist has his fingers in a lot of pies as his diversified holdings include the highest individual shareholding in Centum Investments, as well as stakes in DHL Express Kenya Limited, UAP Provincial Insurance, Nairobi Bottlers Limited, Kiruma International, and many other companies. Kirubi can also be linked to Coca-Cola and Safaricom (Kenya’s leading telecom company).

Apart from a botched paint manufacturing operation which turned out a fiasco, and some controversy surrounding his role in the fall of Uchumi; a publicly-listed retail chain, it’s been pretty much smooth-sailing for Kirubi in the past three decades.

An avid tweeter, Chris Kirubi is known to be quite active on Twitter, where he has built a following of over one million Twitterati. When he is not adding more gloss to his fame, flamboyance, and fortune, he is probably mentoring thousands of young Africans via social media.

Featured Image Courtesy: capitalfm.co.ke