5 Powerful Business Tips That Can Be Picked Up From The Richest Black Man

A life of huge success; marked by great wealth and true happiness, is the dream of many but the accomplishment of only a few. Courted and wished for by many, it is almost something of a paradox that only a handful of people ever get to taste that cloud. And while there may be some truth in the idealistic assertion that real success and fulfilment is not entirely hinged on amassing millions or even billions in fortunes, there is no denying that being financially independent gives you a lot less to worry about.

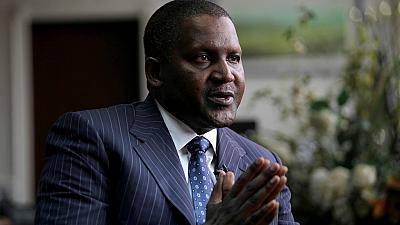

In Africa’s wealthiest man; Aliko Dangote, is a quintessential illustration of some of the world’s few businessmen who have attained the highest of levels, who have achieved remarkable financial success by redefining the concept time and again, and whose entrepreneurial journeys can serve as a compass to help budding and aspiring entrepreneurs steer clear of troubled waters and steady their ships, can be cited.

Nigeria’s Aliko Dangote is the wealthiest black man alive. His journey, up to this very moment, encapsulates the very essence of doing business and being successful at it. And it’s easy to be in awe of the man.

But if you could set aside that “teenager-who-just-met-her-celebrity-crush-for-the-first-time” demeanour so as not to lose sight of the important stuff which borders on business, you may find yourself looking for answers to such questions as; How did he manage to do it? How could he have pulled it off? What did he do right or wrong? What investing tips did he use? And can someone else use his playbook to achieve a similar feat? Well, for starters, this piece will certainly give you something to go by.

Sure, it’s pretty much public knowledge that Dangote made the foray into business in 1977 at the age of 21 with an initial capital of around USD 1.3 K. But it’ll be hard to wholly attribute his progress and success to mere startup capital.

Okay, it’s not that far from the truth that a sum like that was colossal in those days. And maybe 21-year-olds these days are too busy trying not to get crushed by the workload in college, or perhaps they spend too much time on social media. But it will also be wrong to tether his remarkable success to a significant starting sum and different times.

Related Story: Adopting The Richard Branson Model – Becoming A Relatable Entrepreneur

There’s more to building and running a successful conglomerate than affording a bit of runway with substantial initial capital. It’s not a one-off or a lucky break; it takes years of consistently making the right calls and doing successfully. Dangote’s stock has since skyrocketed (forgive the pun), not because he had access to a generous chunk of startup capital but because he made a habit of making smart business decisions. And here are a few lessons that can be taken from the billionaire.

Only Invest In What Completely Makes Sense To You

Aliko Dangote revealed that he takes a pass on putting his money into any business that he does not entirely understand, and this does a good job of helping both himself and his company maintain focus. This was in an interview with MTV Base back in 2012.

Ever heard the saying; curiosity killed the cat? Ever wondered why the cat died? Well, there are many different interpretations for the scenario, but the most popular opinion would probably be that the cat turned up dead because it tried to handle what it couldn’t and didn’t understand.

Okay, that’s enough cat talk, here’s the crux of the matter. Curiosity is not exactly a bad thing. As a matter of fact, some of the world’s greatest discoveries were spurred on by the curiosity of some of the most inquisitive people that ever lived. But in as much as it could be a gateway to paradise, it could also be the mouth of the abyss, and so, must be threaded with caution.

Smart caution has created some of Africa’s billionaires, and it must not be thrown into the wind. Throwing your financial weight behind something you do not fully grasp just because everyone is calling it the next big thing is a sure fire way of seeing your finances go down the drain. When people talk a big game, and you hear stuff like successful entrepreneurs take risks, they sure as hell aren’t talking about stupid risks. Those only put your finances in jeopardy. So choose your battles wisely.

Thorough feasibility studies and necessary due diligence should not be sidestepped when deciding on a proposed business idea. This will help you determine if the business solves a real problem and only then can you have a good shot at succeeding.

Don’t Rest On Your Laurels – Diversify Your Investments

With holdings in sugar, textiles, real estate, steel, cement, telecommunications, food and beverage, poly products, port operations, and most recently, an eight-billion-dollar oil refinery on the cards, Aliko Dangote can be said to have his fingers in many pies. He could’ve easily gotten complacent with the success of his first few ventures, but the astute businessman was far-sighted enough to recognise that every finish line is the beginning of a new race and times are always changing.

By spreading his tentacles, Dangote now boasts a largely fail-proof conglomerate that employs nearly 30,000 people. Such is what is in the offing with diversifying portfolio.

Becoming a successful entrepreneur these days entails having access to multiple income streams, lest you risk going under when what once seemed a cash cow begins to wane. Dangote’s business profile does reflect a tendency to venture into different highly profitable businesses, and this is known to have been instrumental to his success.

When oil prices plummeted in the global market, it had little effect on his cement and sugar businesses. Although the prices of the products have taken a hit somewhat, his sugar and cement businesses have only grown in leaps and bounds, with sales projections estimated to surge even higher.

One lesson that can be drawn out of his entrepreneurial journey so far is that having numerous investments helps to cushion the effects of a blow caused by economic recession or unforeseen challenges to one or more of those investments. Some other streams of income will surely remain unaffected, and like a lifebuoy, they are guaranteed to keep you afloat until the storm is gone.

Don’t Just Sell – Start Producing Too

Aliko Dangote’s initial business moves mainly involved importing and trading commodities. Business was going reasonably good, and he kept at it for a while. But it wasn’t until he made the decision to become a producer and not just an importer that he indeed began to hit the heights.

In the years that followed, his factories were popping up in various places, and he had launched a manufacturing business. Yes, manufacturing is serious business, and it does require a lot of capital, but there is no better way to really control pricing and bring products down to the consumer level at really affordable rates than by setting up your production plant.

If you’re looking to have the edge over the competition and grab a massive slice of whatever market you have a presence in, it could be a worthwhile move to quit making only sales and start manufacturing your products too. This business tip is a key secret of many of the world’s famous billionaires, and you might want to take a cue from it.

Don’t Just Sell A Product – Sell A Brand

Does the name Amancio Ortega Gaona ring a bell? If you genuinely know your onions in fashion circles, you’ll connect that name to the billionaire founder of Zara. And you’ll probably also recognise that you can’t do as much as him or better if you can’t get the hang of building a brand around your products and services.

And it’s pretty much the same story with Aliko Dangote. Sometimes, it’s not even about “what” you’re selling; it’s about “who’s” selling. And that is why you have some work cut out for you in building a brand that is the toast of the market.

The Dangote brand has become one of the most valuable in Africa, so much so that you could almost sell anything with the name “Dangote” on it. You can’t fight it; the brand practically always wins the market’s trust.

This places a premium on making sure people can identify your business through its brand image as you grow the business. This business tip implies that the onus is on you to leave an impression on the minds of customers about the experience your products or services serve up to them.

Embrace Networking

Your net worth is only as good as your network, and the way you arrive is who you are. That’s the norm these days. It will just be wishful thinking at best if you intend to reach the heights of the billionaire someday but fail to surround yourself with those that can take you there.

Networking is, therefore, imperative. And the trick lies in identifying and getting close to the people you need. Now, how do you go about that? You can start by getting those folks to respect you and what you do by investing in both yourself and your business. You need to get the hang of emotional intelligence, get good grips on human behaviour, and somehow work yourself into being able to tell a person’s motives from the off nearly accurately. This can help you forge vital connections and build essential networks.

These five business tips have seen Aliko Dangote become not just a billionaire, but the wealthiest black man in the world. When applied in your entrepreneurial journey, these principles could well keep you on course towards setting up the next big thing and writing your own success story.

Read More: Five Young African Entrepreneurs Who Are Making Waves In Technology

Image Courtesy: Africanews.com