South African E-commerce Startup SnapnSave Secures Unspecified Investment From Vunani Capital

SnapnSave, a South African e-commerce startup, has raised an undisclosed amount of funding. The investor is Vunani Capital, a financial services firm based in the same country. There is no information about the startup’s valuation or the administrative implications of the funding.

Nonetheless, the investment will help the startup grow and scale its shopper and vendor base. So SnapSace is now ready to advance its position as the leading grocery coupon cashback app in South Africa.

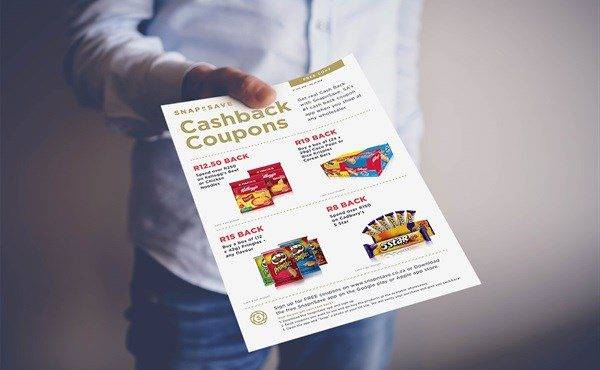

Snap And Save For Cash!

.jpg)

The service gives shoppers cashback on their favourite products, anywhere and anytime they shop. All the customer has to do is take a photo of the till slip.

The e-tailer was founded in 2015 by Mark Bradshaw and has a co-founder Tina Fisher on the team. This seed capital will help Snapsave secure its Series A round in August 2020 and possibly expand.

The company has witnessed impressive growth since it was launched and its user number now stands at 35,000. The startup has seen a 50 percent lift in the activity of the past year.

The platform has collected more than 1.5 million tills slips and over ZAR 14 Mn in cash rewards has been given back to South African consumers. However, it seems as though there’s more to come – because cashback is a huge trend in South Africa.

Its numbers are perhaps the reason SnapnSave was able to ink a deal with Kalon Venture Partners and Smollan Group SA. The VC firm and the group increased their stake to over 50 percent. The deal which was concluded last November availed the startup ZAR 14 Mn (nearly USD 1 Mn).

‘New Wave Of Fintech Business’ Like SnapnSave

Vunani’s Executive Director, Mark Anderson, stated: “Vunani Capital, through the Vunani Fintech Fund, is delighted to acquire an equity interest in SnapnSave.

This investment offers Vunani exposure to a new wave of fintech businesses that are using digital platforms to bring benefits to ordinary consumers. SnapnSave is our first fintech investment.”

Equally important, Vunani expects to enter into more transactions in the fintech space as we diversify our financial services offering.

In addition, Anderson said: “We have confidently invested in South Africa’s #1 cashback rewards app.

We believe SnapnSave has shown exceptional ability to disrupt the loyalty market and we look forward to seeing SnapnSave accelerate further under the leadership of Mark Bradshaw and Tina Fisher.”

Likewise, SnapnSave are delighted to be working closely with the team at Vunani. An official statement from the startup cites their expertise in understanding corporate finance.

“Their relationships in Africa will aid the company as we prepare for a Series A raise that will allow us to expand into new markets in 2020,” said SnapnSave co-founder Mark Bradshaw.

Featured Image: Kalon Venture Partners