Kenya: More Job Losses Expected in the Banking Sector in Favour of Technology

Kenyan banks are seeing lower employee costs by employing technology in serving their clients. A new report states that this trend will continue in the banking sector as it aims to shed off its tax contribution.

According to the Total Tax Contribution of the Kenya Banking Sector report by Kenya Bankers Association, investment in technology by banks was Kshs 23.2 Bn and Kshs 24.2 Bn in 2017 and 2018, representing an overall growth of 4 per cent. Out of the total technology investment, Kshs 18.5 Bn and Kshs 19.6 Bn was contributed by Tier One banks in 2017 and 2018 showing a growth of 6 per cent.

“It is expected that investments in technology will with time lead to lower employee costs which will inevitably lead to lower growth in PAYE contribution by the sector. However, this should translate to higher corporate profits, higher corporate taxes and withholding tax on dividends,” the report said.

| BANK | JOB CUTS | YEAR |

| Stanbic Bank | 225* | 2019 |

| Kenya Commercial Bank | 200 | 2019 |

| National Bank of Kenya | 112 | 2019 |

| Barclays Bank | 142 | 2018 |

| Kenya Commercial Bank | 709 | 2018 |

| Equity Bank | 400 | 2017 |

| Standard Chartered Bank | 300 | 2017 |

| Barclays Bank | 323 | 2017 |

| Kenya Commercial Bank | 223 | 2017 |

| National Bank of Kenya | 150 | 2017 |

| First Community Bank | 106 | 2017 |

| Sidian Bank | 108 | 2017 |

| NIC Bank | 32 | 2017 |

| Family Bank | 150 | 2017 |

| Coop Bank of Kenya | 78 | 2017 |

Some of the notable bank layoffs in the last two years

*Projected layoffs

“The number of employees employed by the study participants reduced from 29,058 in 2017 to 28,352 in 2018. This represents a marginal reduction of 2.4%,” the report denoted. The reduction in employee numbers is in tandem with the overall reduction in operating expenses of banks by 4% over the period 2017 to 2018.

However, the technology implementation did not reduce the PAYE to the government according to the report.

“Despite the decline in employee numbers, the amount of PAYE collected by participating banks grew from Kshs 18.7 Bn in 2017 to Kshs 19.2 Bn in 2018. This trend is due to the increase in wages paid to higher cadre employees in the sector and the continued replacement of lower cadre jobs within banks as the sector increasingly adopts technology,” it added.

The sector’s decrease in employment numbers was due to restructuring activities within the industry over the period due to the challenges banks have been facing since the introduction of the interest rate regime as well as migration by banks to digital distribution channels away from the traditional ‘brick and mortar’ channels.

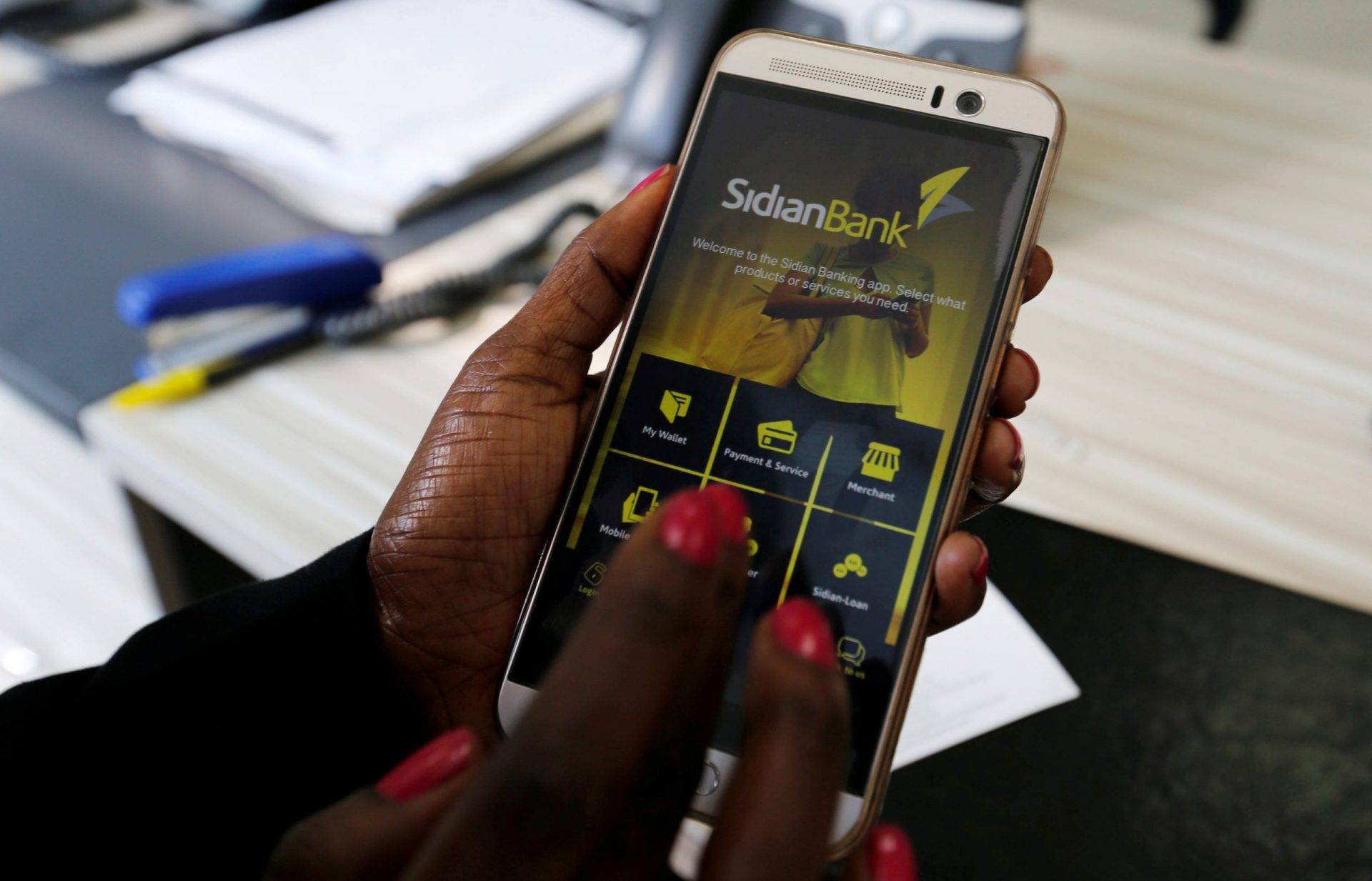

Feature Image Courtesy: Brookings Institution