Does The eSIM Spell The Beginning Of The End For Telcos’ SIM Card Revenue?

It may well take several decades before the ‘shiny new tech’ that is the embedded SIM (eSIM) or virtual SIM becomes commonplace but one thing that is certain is that it is already here. However long it takes the eSIM to go mainstream is a separate matter.

The well-known Subscriber Identification Module (SIM) is the small chip that is inserted into mobile phones which identifies an individual as a subscriber on a mobile network. It is associated with a unique number and it enables users to make calls and send messages, among other things.

The eSIM, however, can be described as the latest upgrade on SIMs. The eSIM is quite unlike the physical SIM cards that are currently the norm and the eSIM packs some advantages in that no physical SIM cards are involved and no physical swapping of cards is required if a user wants to swap networks.

While a regular SIM card is capable of holding just a single profile for one customer, eSIMs allow multiple network profiles on a single embedded chip.

Also, the information on an eSIM is rewritable or reprogrammable, meaning that users that change their network operator at will without fiddling with SIM card jacks. Unlike regular SIMs, the virtual SIM can be used on multiple devices at the same time.

Vodacom was the first network to launch support for eSIM devices in Africa, unveiling the service in South Africa in March 2019. MTN Group had soon followed, launching the service in the same country last October. And just last month, MTN Nigeria unveiled the same service, though eSIMs have been around since 2015.

Due to the fact that the eSIM is essentially a small chip that is built into smartphones at the point of manufacture, telcos merely support the service (at no cost to the user at the moment). This would imply that eSIMs take away the ability of telcos to make money off of the sale of those underrated tiny chips.

At the moment, there is a scarcity of reliable data on the exact amount of revenue telecom operators make off of SIM card sales. But some basic extrapolation would suggest that it is not exactly a negligible sum.

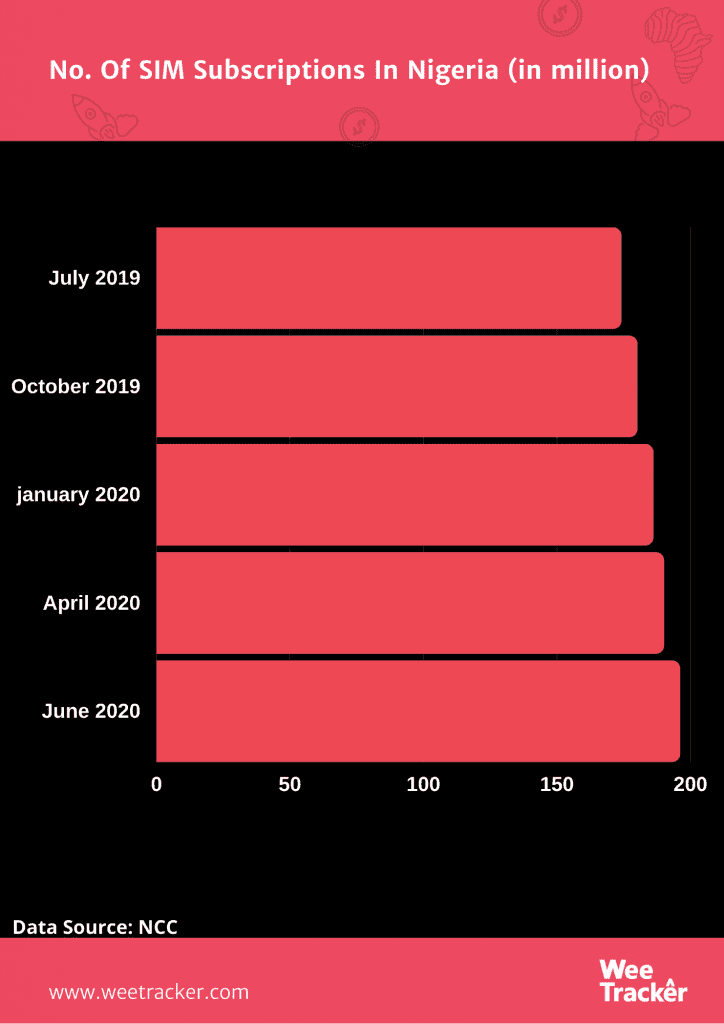

Take Nigeria for instance, data from the Nigerian Communications Commission (NCC) shows that the number of SIM subscriptions has grown from 174 million in July 2019 to 196 million in June 2020.

If telcos made as little as NGN 100.00 (USD 0.26) on every SIM card sale recorded in that time, they would have realised NGN 2.2 Bn (USD 5.69 Mn at the current exchange rate) from SIM card sales.

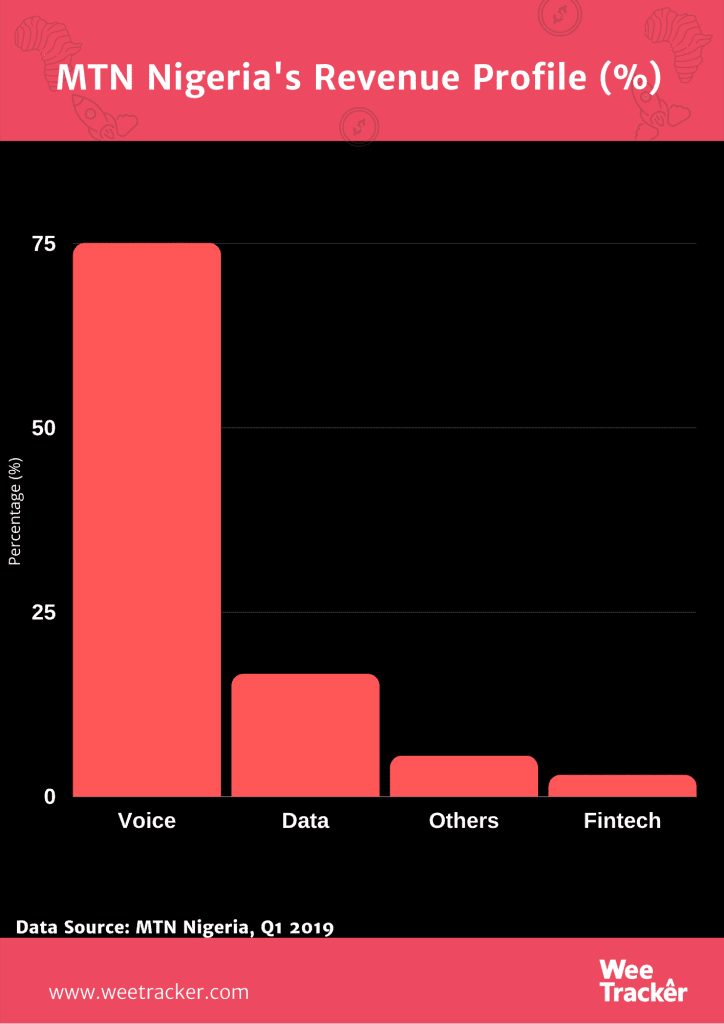

Sure, that figure pales in comparison to the contribution of voice and data services to the revenue profile of the country’s “Big Four Telcos”.

For instance, MTN Nigeria’s voice revenue was NGN 227 Bn (USD 580 Mn at the current rate) in Q1 2020. For Airtel Nigeria, voice revenue was USD 739.8 Mn in Q1 2019.

But are the telcos willing to give up an extra stream of revenue so easily in an industry where every penny counts?

Funso Aina, Senior Manager, External relations at MTN Nigeria, told WeeTracker that there are currently no concerns on what the coming of eSIMs mean for SIM card sales revenue, and perhaps rightfully so, seeing as virtual SIMs only just arrived. He also reckoned that enabling support for eSIMs does come with benefits.

“Enabling connectivity for eSIM compatible devices rather opens up a new revenue stream,” said Aina. “In addition, revenues from SIM card sales will continue as the vast majority of mobile phones available in Nigeria are not eSIM enabled.”

Of course, eSIMs are nowhere near scratching the surface, let alone making a dent visible enough to spark any talk of eSIMs going on to replace regular physical SIM cards.

At present, eSIMs are only found in a small group of high-end smartphones such as Google’s Pixel 2 and Pixel 3, Apple’s newest iPhones (from iPhone XR to iPhone Pro Max), Samsung’s newest S20 series, and a number of others whose pricing points imply that they aren’t exactly tailored for mass-market consumption in these parts.

MTN, on its part, hasn’t exactly dived into eSIMs per se, as things are still at a trial phase.

“We have approval from the NCC to trial 5,000 eSIMs. We will determine future projections during the course of the trial,” said Aina.

But when technology progresses as it so often does — such that the shiny new expensive creation that was only initially available to a few becomes the “no-longer-special” ubiquitous tool that is the bare minimum — telcos would surely be paying attention.

Featured Image Courtesy: Citynews