South Africa’s Fintech Boom Is Stirring Fresh Investor Appetite

South Africa’s fintech sector is rapidly growing and attracting significant investment, positioning the country as a leader in African financial innovation, says Antonia Bothner, Capital Markets Lead at entrepreneurship network Endeavor SA. Bothner highlights the market’s shift from cash, with a huge majority of transactions across Africa still cash-based, creating vast opportunities for fintech solutions.

Despite global challenges, venture capital investment in South Africa has remained relatively steady. Payment solutions dominate fintech innovation and attract substantial venture capital across Africa.

Africa’s young, tech-savvy population provides fertile ground for tech development. South Africa stands out with its mix of first and third-world attributes, developed tech ecosystem, and strong business-to-business (B2B) network. Its relatively low costs and large market offer ample opportunities for innovation.

Many fintech solutions developed in South Africa are entering new terrains. For example, TymeBank has expanded to the Philippines and Vietnam, while Entersekt has taken its transaction authentication solutions to developed markets.

“Fintech development often starts with payments, a ubiquitous problem to solve,” Bothner explains. “This creates numerous opportunities for companies in payments, remittances, and B2B solutions.”

Despite a global decline in VC investment in 2023, South Africa saw significant fundraises, showcasing investor confidence. Notable funds include the SME Fund’s Venture Capital Fund of Funds, Partech Africa II, Norrsken22, Convergence Capital, Al Mada, Knife Capital, Sanari Capital, Quona, and Havaic.

Recent investments in companies like Stitch and Peach Payments highlight the growing investor interest. South Africa’s stability amid currency fluctuations in other African countries, such as Nigeria and Egypt, makes it an attractive destination for investors seeking balanced risk and return.

“There is increased inbound interest from investors, many of whom felt under-allocated in South Africa,” says Bothner. “It’s a market with lower volatility, strong asset management, and promising investment opportunities in profitable companies with strong management and affordable talent.”

Quona Capital, a global fintech investor, has invested in local payments company Yoco. Partner Johan Bosini says: “There’s been a huge influx of foreign capital into the fintech ecosystem, creating early and late investment opportunities and evidence of exits, providing comfort for investors.”

Bosini adds that fintech has evolved from simple products to financial infrastructure, lending, banking-as-a-service, and banking orchestration. Embedded finance continues, where companies start by solving larger problems rather than focusing solely on financial services.

Allan Gray, an investment firm connected to the entrepreneurial sector, invests in fintech through 3 Capital Ventures, backing companies like Peach Payments and Onafriq. Sizwe Nxumalo, Managing Partner at 3 Capital Ventures, states: “South Africa’s mature and sophisticated market creates a unique ecosystem for fintechs like Weaver, TymeBank, Yoco, and Retail Capital to thrive and scale.”

Bothner notes significant opportunities for later-stage investing: “At this stage, companies are less affected by market cycles and continue their growth trajectory. Once they find market fit, they can grow through disruption or creating new industries.”

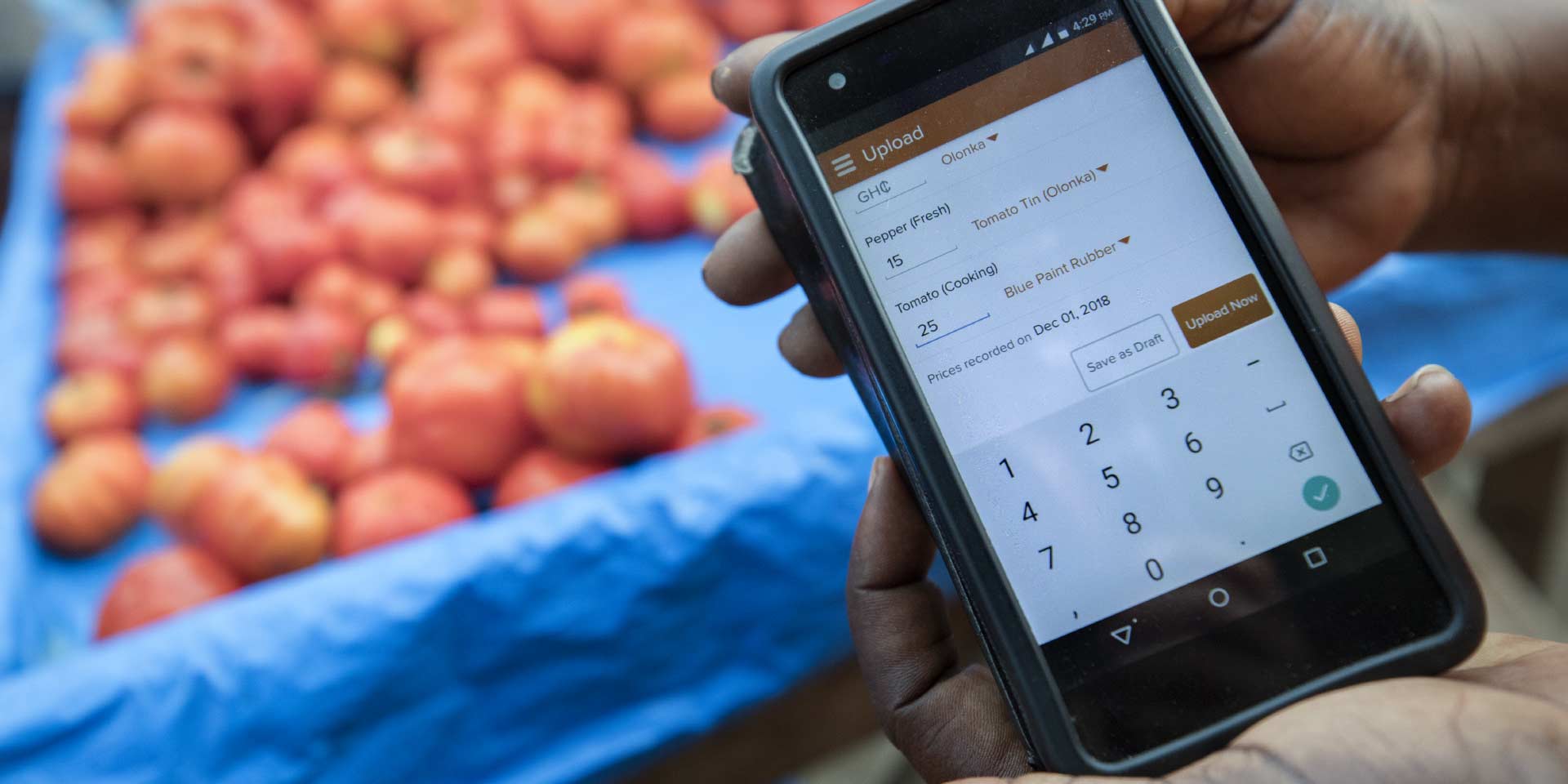

Featured Image Credits: IFC