To whom it may concern; nine is just fine and ten is the new when.

Okay, that’s not even a thing – but maybe we could all pretend it sounds cool given that it’s probably okay for at least one day every year; that’s May 27th – International Children’s Day. Now you know the motivation behind the lame attempt to sound cool.

Well, it’s that day of the year again when children from all over the globe get to do whatever they want and get away with it (okay, just kidding, that’s definitely what Children’s Day is about).

But then, you get the idea – it’s a special day for kids all over the world; be it the adorable, little ones that reduce all you want to say to “aww,” or the mischevious little ‘Miss Smartypants’ that appears to be growing up too fast, or the downright nasty ones that you just want to give a good hiding sometimes.

There was a time when being a kid pretty much meant being on the receiving end of the affection and care of doting parents and basking in that comfort and safety up until someone says; “Hey, you’re not a kid anymore, you’re 20 now.”

There was a time when being a child implied that you didn’t get stuff done because you were made to believe that you’re just not grown up enough to get anything right. But if we’ve learnt anything from the present generation, it’s that “catching them young” really means doing remarkable exploits and working your way into global reckoning before you even got the hang of doing the collar of your shirt right.

Today’s world is awash with several young ones who are making a name for themselves in areas that would’ve probably been thought of as “out-of-their-league” before they made it their turf. And there are many others who clawed their way to the top as kids even though they may have outgrown that tag.

In commemoration of the International Day of Children, we cast the spotlight on some of the notable innovative efforts and monumental achievements recorded by African children whose exploits have been a source of pride to the continent in recent times.

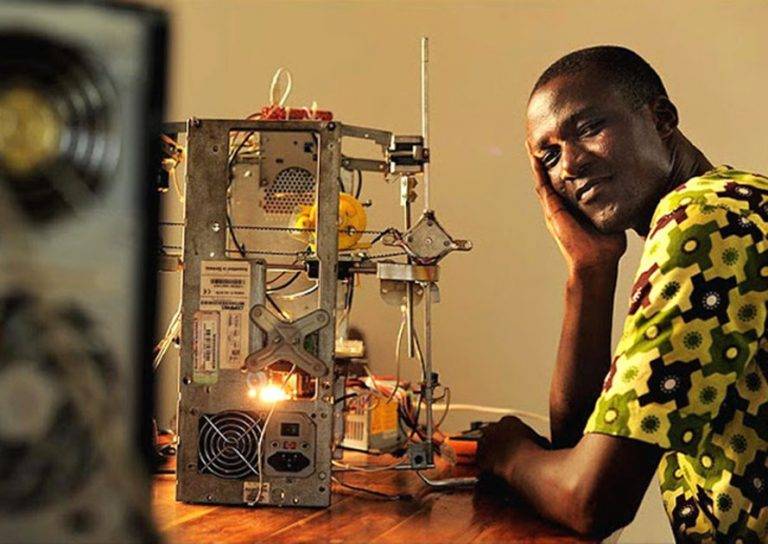

William Kamkwamba (Malawi)

Now 31, this young Malawian innovator came to light at the age of 14 when he developed a windmill to produce electricity and water for his home. From then on, he has gone on to produce more windmills and a solar-powered water pump that supplied the first drinking water to his community.

The story of Kamkwamba is quite interesting. After he graduated from primary school, he proceeded for his secondary education. As a result of poverty, however, he was forced to drop out of school at 14.

At this point, he began borrowing books to read, and that was how he came into the generation of energy. He began with a prototype which he built using a blade, an old shock absorber, and blue gum trees. Following its success, he went on to generate electricity.

His next project was to use his invention to generate clean water, fight malaria, and provide solar power and lighting for the six homes in his family compound.

With the success of his inventions, people became interested in him and soon he was able to make it back to school. He graduated from Dartmouth College in 2014 and has published his autobiographical work; The Boy Who Harnessed the Wind, which has since been adapted into a film that was released on Netflix earlier this year.

Kelvin Doe (Sierra Leone)

Kelvin Doe (AKA “DJ Focus”) is a Sierra Leonean self-taught engineer who built his own generator and radio transmitter at the age of 13.

At 16, he was able to build a battery that will provide electricity to homes within his community where there is no constant power supply. The battery was made from acid, soda, and metal parts scavenged from trash bins.

Kelvin’s talent was noticed by David Monina Sengeh, who encouraged him to participate in GMin’s Innovate Salone idea competition where he emerged one of the finalists.

Kevin is today the youngest person to participate in the “Visiting Practitioner’s Program” at MIT. He has also signed a USD 100 K solar project pact with Canadian High Speed Service Provider, Sierra WiFi. The little boy from Sierra Leone has met several world leaders/influential personalities around the globe and spoken at various local and international institutions/events where his visionary ideas have earned him global fame and acclaim.

Zuriel Oduwole (Nigeria)

Zuriel Elise Oduwole is a Nigerian education advocate and filmmaker best known for her works on the advocacy for the education of girls in Africa. She is of Nigerian and Mauritian descent, while also being a U.S. citizen.

Her advocacy has since made her the youngest person to be profiled by Forbes. In November 2014, at age 12, Zuriel became the world’s youngest filmmaker to have a self-produced and self-edited work after her film showed in two movie chains, and then went on to screen in Ghana, England, South Africa, and Japan.

Oduwole has met with 24 presidents and prime ministers in line with her education advocacy work. Some of these include the leaders of Jamaica, Nigeria, Kenya, Tanzania, Malawi, Liberia, South Sudan, Malta, St. Vincent & the Grenadines, Guyana and Namibia. She has also appeared in popular television stations including CNBC, Bloomberg TV, BBC, and CNN. In 2013, Oduwole was listed in the New African Magazine‘s list of “100 Most Influential People in Africa”.

Erica Armah Bra-Bulu Tandoh (Ghana)

Erica Armah Bra-Bulu Tandoh (born December 12, 2007) known by the stage name DJ Switch, is a young Ghanaian female Disk Jockey. She is a multi-talented entertainer who can also sing, rap and dance. She is the second child and the only girl among five siblings. She lives in Dadieso in the Western Region of Ghana and attends Talented Royals International School at Weija in Accra. Her career took off when she was seven years of age.

Erica Armah Bra-Bulu Tandoh rose to international fame through a mixture of her feisty attitude, online music videos and total cuteness.

She learned how to DJ roughly a year ago, in a village bar where the local DJ taught her how to use a laptop. After a couple of days learning the basics of playing on decks, “he’s teaching me what he knows and I’m teaching him what he doesn’t know,” she says.

In June 2018, Erica became the youngest person to win Ghana’s annual DJ award and three months later, she opened the Bill and Melinda Gates’ Foundation’s annual Goalkeepers event in New York, as the warm-up act to French President, Emmanuel Macron.

In May 2019, she was in New York to perform at the NGO ”Room to Read” gala with Wyclef Jean also on the bill.

Betelhem Dessie (Ethiopia)

Twenty-year-old Betelhem Dessie born is an Ethiopian web and mobile technologies developer. She is currently a Founder and CEO of iCog – Anyone Can Code (ACC).

She owns four patented projects individually and an additional three in collaboration. Betelhem has been named “the youngest pioneer in Ethiopia’s fast emerging tech scene” by CNN.

Betelhem was born and raised in Harar, Ethiopia. Her career started at the age of nine. She notes that her father has been one of the biggest supporters of her ambition. Betelhem was able to become familiar with computers by using her father’s computer at his electronic shop.

In her interview with the Ethiopian digital news platform, Addis Insight, Betelhem tells a story of how she asked her father for money to celebrate her 9th birthday. Her father replied that he did not have money because he was busy with work. In response, Betelhem decided to work in his electronic shop and make the money herself.

She made money by sending customers audio and video files. After this incident, her interest in computers gained momentum. She improved her skills in video-editing, computer maintenance, and installing cellphone software. By the age of ten, Betelhem had started coding in HTML by herself. Alongside her regular school work, she taught basic computer skills to her classmates from school.

After moving from Harar to Addis Ababa with her parents, Betelhem was employed as a developer for the government at the age of twelve by the Ethiopian Information Network Security Agency (INSA) from 2011 to 2012. As of 2018, she was studying Software Engineering at the University of Addis Ababa while juggling several other coding projects.

Stacy Owino, Cynthia Otieno, Purity Achieng, Mascrine Atieno, Ivy Akinyi (Kenya)

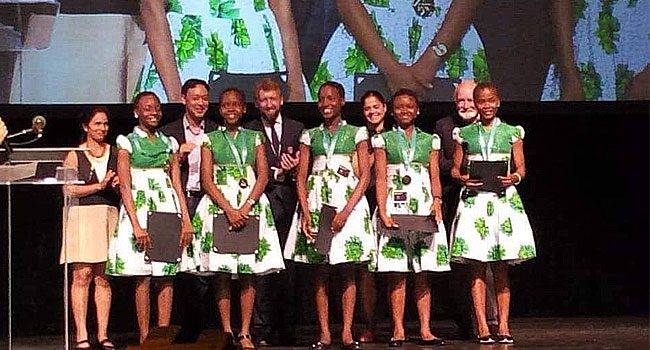

It was around August 2017 when five teenage girls from Kisumu, Kenya, took everyone by surprise by beating the massive odds that were stacked against them and becoming Africa’s sole representative at the finals of the Technovation Challenge which took place in California that year; being the only African team whose app was accepted into the challenge sponsored by Google, Verizon, and the United Nations.

A group of Kenyan schoolgirls aged between 15 to 17 created an app called i-Cut to help girls affected by Female Genital Mutilation (FGM).

The students; Stacy Owino, Cynthia Otieno, Purity Achieng, Mascrine Atieno and Ivy Akinyi, are better known as ‘The Restorers’, and they were the only Africans that participated in the 2017 Technovation Challenge in Silicon Valley which took place in August 2017..

The app is designed to offer help by connecting affected girls to legal and medical assistance. Girls who are forced to undergo the procedure can also alert local authorities by pressing a panic button on the app.

The Restorers may not have gone all the way to clinch the grand prize at that year’s Technovation World Pitch Summit, but they sure won over many hearts in their bid to proffer a lasting solution to a social ill. They may not have gotten the laurels, but they certainly deserved all the accolades and global acclaim that accompanied the buzz their app created.

Ayesha Salle, Brittany Bull, Bhanekazi Tandwa, Sesam Mngqengqiswa (South Africa)

Those aren’t random names. They are part of a group of 14 South African high school girls who are looking to scribble their names on the scrolls of history by taking on something of an extraterrestrial expedition.

These are not your typical schoolgirls with perhaps those ‘Cheerleader’ and ‘Prom Queen’ ambitions that we tend to see in some of those Hollywood movies. With their target being the launch of Africa’s first private satellite into space this year, they have their sights trained on a bullseye in outer space.

The girls, who are students of various high schools in Cape Town, South Africa, took on a project which involved designing and building payloads for a satellite that will hover in space, orbit the earth’s poles, scan the surface of Africa, and gather/transmit data that will be useful for agriculture and food production within the continent.

The data obtained is expected to come in handy in the determination of the continent’s current position in the area of food production, as well as the prediction of future problems that may arise. Going forward, this could inform the formulation of agricultural policies that can avert the looming food and environmental crisis.

Promise Nnalue, Jessica Osita, Nwabuaku Ossai, Adaeze Onuigbo Vivian Okoye (Nigeria)

Five girls aged between 13 and 15 from Regina Pacis Secondary School Onitsha, Anambra state, Nigeria who represented Nigeria and Africa at the 2018 World Technovation Challenge in Silicon Valley, San Francisco, U.S., brought home the gold after staving off competition from teams from 115 countries at the qualifiers and 12 teams from across the globe at the finals.

The girls, who have now become Africa’s Golden Girls is made up of five brilliant girls including Promise Nnalue, Jessica Osita, Nwabuaku Ossai, Adaeze Onuigbo and Vivian Okoye.

The team, led by Uchenna Onwuamaegbu Ugwu, held their own while competing against representatives of other technological giants including the USA, Spain, Turkey, Uzbekistan and China to clinch the gold medal.

The world champions who are reported to be attracting a lot of attention in the world’s greatest technological hub won the Challenge with a mobile application called the FD-Detector which they developed to help tackle the problem of fake pharmaceutical products in Nigeria.

Under the tutelage of Uchenna Onwuamaegbu-Ugwu the CEO of Edufun Technik STEM, the Golden Girls spent five months researching and developing FD-Detector which swept through over 2000 competing applications to get to the finals in San Francisco and ultimately claim the top laurel.

Noah Walakira (Uganda)

Noah Walakira spent most of his holidays at his grandma’s, but for him, it was not about listening to folktales and getting some of ‘granny’s goodies.’ Long before he was a teenager, he had made a habit of shifting base to the old woman’s quarters during school vacations, and his mission there may have been as close to “watching paint dry” as kids his age could get to when trying to describe the expression.

But the little boy saw things differently. Through those years, he was mastering a skill; one that was to pay off big time in the end, and make us use catchy lines like; “From Uganda comes the story of a young boy who got his company off the ground at 14.”

Noah Walakira had barely turned 14 when he decided to put the knitting skills he had picked up from his grandma into something profitable. Having started by knitting jerseys for schools in Kampala, he laid the foundation for the community-based organisation now known as Namirembe Sweater Makers.

The company currently manufactures various uniforms – from sportswear to ties, T-shirts, and woollen scarves – for no less than 45 schools in Uganda, as well as other institutions such as security companies and petrol stations. It also boasts clientele in countries like Rwanda, South Sudan, and Tanzania.

Employing up to 20 locales as members of its staff, Noah’s company – one he started at 14 – claims to produce as many as 500 sweaters on average monthly, with each costing around USD 7.00. Now aged 27, Noah has been able to see himself through school, together with his siblings and some of the other young employees, with parts of the business’ earnings.

Sam Kodo (Togo)

It was at the age of 7 that Sam Kodo began working on his first Robot. The advantage this scholar has was that his father was a physics lecturer at the University of Lomé. Utilizing the opportunity, he stuck around the library going through things most of us would only go through for the sake of passing exams. That led to his romance with electronics.

With the help of his parents, he got toys and old gadgets which he broke down and built back up. By the time he was fifteen, his robot could do some important things like recognize faces and objects, as well as speak and understand.

His journey took him to build smartphones and PCs which he makes through a company he founded called Infinite Loop.

The company deals in the production of low-cost personal computers for students. More so, he developed a very small PC called Lifebook PC. Because of its size, you could actually fit that into your pocket and you need to connect it to the television or phone for it to function as an internet-enabled PC.