African Banks Want To Donate Billions To COVID-19 Relief & Lay Off Staff To Offset Costs

Barely 24 hours after committing up to KES 1.1 Bn (USD 10.29 Mn) to COVID-19 relief, one of Kenya’s largest banks sent home up to 60 employees.

According to reports on local media, just a day before taking the chop to the employees attached to its Financial Access to SMEs and Rural Population in Agriculture using Technology (FASRAT) project, Kenya’s Equity Bank had donated a huge sum through Equity Group Foundation.

The KES 1.1 Bn donation was made up of KES 300 Mn (USD 2.8 Mn) and KES 500 Mn (USD 4.6 Mn) from Equity Bank and Mastercard Foundation respectively, plus another KES 300 Mn (USD 2.8 Mn) from the family of Equity Bank CEO, James Mwangi.

That episode was yet another example of a corporate institution doing the most to keep up appearances on the increasingly cliched “corporate social responsibility” front, even though it would mean a sacrifice of domestic responsibility. As in, what’re a few lost jobs compared to the goodwill and optics of forking out billions to aid the fight against a common foe?

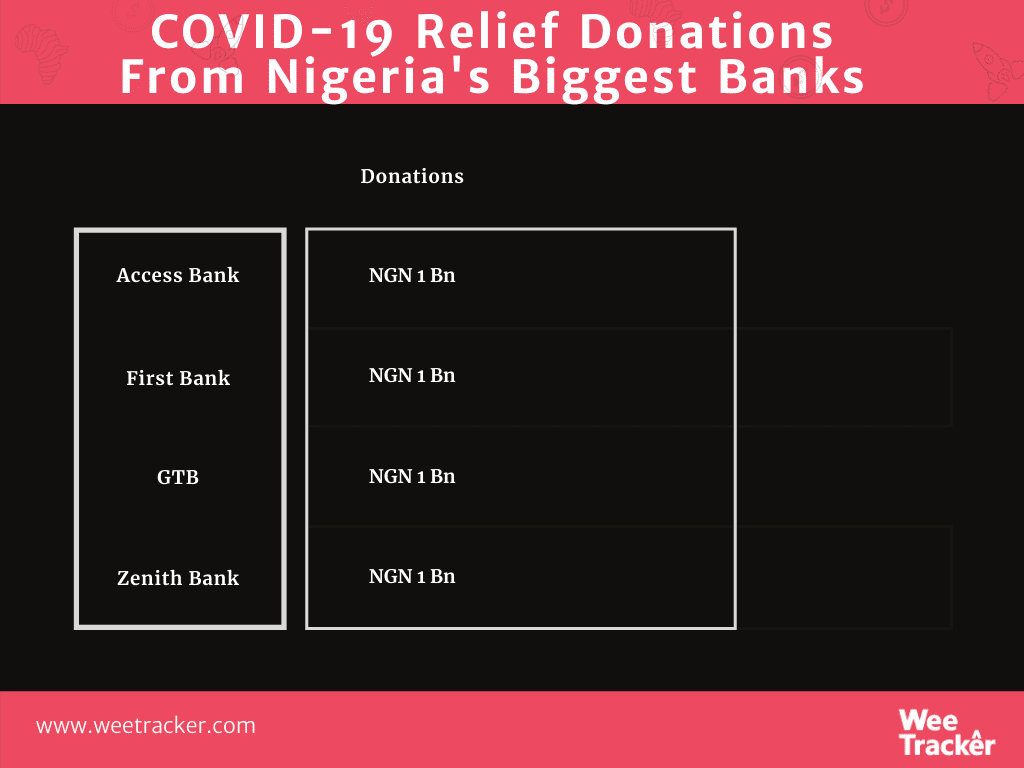

Last Friday, it was “Nigeria’s biggest bank by “number of outlets” who got some of the vitriol. Access Bank became Nigeria’s bank by “number of branches and number of staff” when it acquired a popular rival, Diamond Bank, last year. The same Access Bank also managed to acquire Kenya’s Transnational Bank last year.

But even as all these acquisitions reportedly triggered a 31 percent increase in its operating expenses in Nigeria alone where it has nearly 7,000 employees, Access Bank’s CEO, Herbert Wigwe, still announced a NGN 1 Bn (USD 2.56 Mn) donation to COVID-19 relief in March.

It was regarded as a noble and generous gesture up until last week when word got out that the bank has decided to cut jobs and slash pay by as much as 40 percent.

This is the reason why access bank want to lay off 75% of its staff.. From the mouth of the MD himself pic.twitter.com/dUDBeozLCu

— ??????? (@TzOlawale) April 30, 2020

In a leaked video, the Access Bank CEO was spotted saying the bank could no longer support all of its staff across all of its thousands of branches. There were also indications that some branches may have to be shut altogether as the triple blow of the oil price crash, naira devaluation, and COVID-19 threatens to cripple businesses in the country and beyond.

Many aggrieved individuals took to various media to express their displeasure. To them, there was no merit in forking out a huge amount to support the COVID-19 fight and then turning around to cut employees loose while blaming it on the cash crunch.

Indeed, there are rumours that many other banks that had contributed large sums to the COVID-19 fund were looking to do the same. Nigerian Deposit Money Banks (DMBs) have collectively donated over NGN 10 Bn (USD 25.6 Mn) as part of COVID-19 philanthropy.

With business stalling sector-wide due to the pandemic, the banking sector — which is the biggest employer of labour in corporate Nigeria — was thought to be headed for a bloodbath.

However, the Central Bank of Nigeria (CBN) has since moved to stop the rumoured widespread retrenchment exercise in the banking sector.

The latest data from the International Labour Organisation (ILO) on the impact of the pandemic on the labour market reveals the devastating effect on workers in the informal economy and on hundreds of millions of enterprises worldwide.

According to the organisation, nearly half of the global workforce is at risk of losing livelihoods as job losses escalate.

The first month of the crisis is estimated to have resulted in a 60 percent drop in the income of informal workers globally. This translates into a drop of 81 percent in Africa and the Americas, 21.6 percent in the Asia Pacific region, and 70 percent in Europe and Central Asia.

Also, the continued sharp decline in working hours globally due to the COVID-19 outbreak means that 1.6 billion workers in the informal economy stand in immediate danger of having their livelihoods destroyed. And apparently, workers in the formal economy are not safe either.

Photo by Christina @ wocintechchat.com on Unsplash