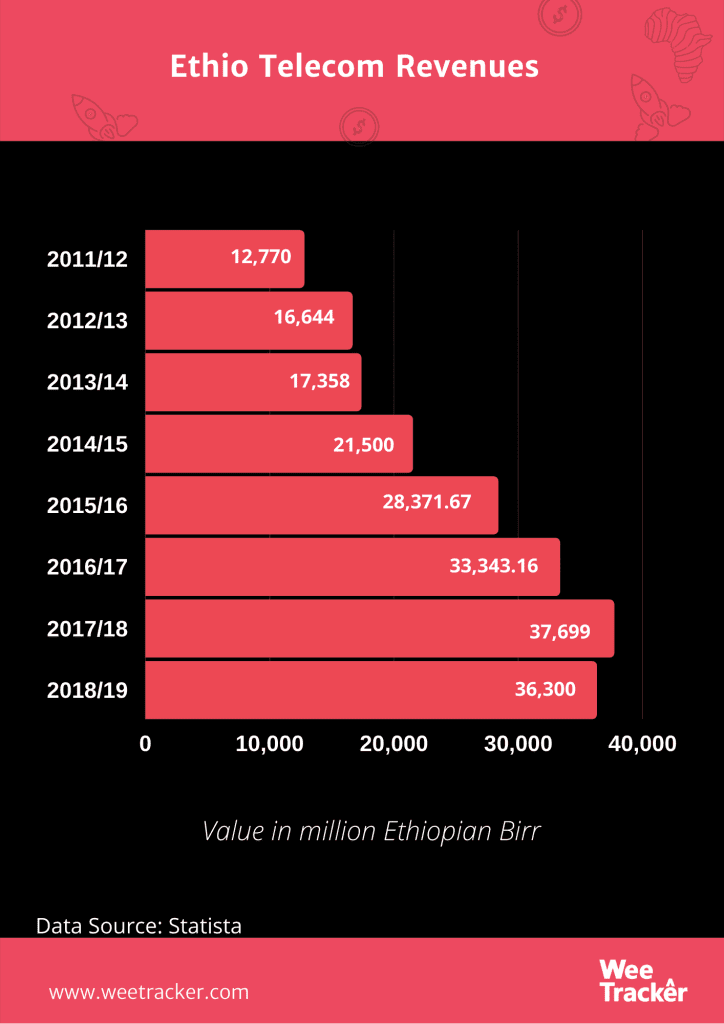

Ethio Telecom Witnessed A Jump In Revenue Ahead Of Privatization

Ethio Telecom, the one and only mobile operator in Ethiopia as of now, has been receiving financial positives for the last year.

The latest in the telco’s mailbox is a revenue jump which happens at a time when many eyes are on the East African country’s telecommunications space.

The state monopoly service provider which is expected to be partly sold off in Ethiopia’s so-called push to liberalize its economy, reported a 31.4 percent rise in revenues in the 12 months that ended June 2020, in comparison to a year earlier.

According to Ethio’s chief executive, Frehiwot Tamirua, the jump in revenues to USD 1.37 Bn, for the financial year is attributable to an expansion of the network and a influx of more customers.

Factually, the telco’s revenues have been on a rather steady increase for some time now, at least in the last financial year. In January 2020, the company reported that it has witnessed a rise of 32 percent in its first-half revenue to USD 693 Mn.

At the time, mobile voice accounted for 50.4 percent of the total revenue, data and Internet 27.3 percent, revenue from international business comprises 9.8 percent, value added service had 8.5 percent and the leftover 3 percent was generated from other sources

Going further back to October 2019, Ethio Telecom reported a 21 percent rise in the first quarter of its fiscal year to USD 343 Mn.

There is no gainsaying in the reality that the upwards trajectory of this Ethiopian telecoms business is already a sign that the mobile service provision ecosystem of Ethiopia brims with potential.

Well, no wonder, a handful of telecommunications bigwigs from around the world are in a hot race to win the country’s supposedly one chance in a lifetime to grant licenses to interested telcos.

The government is trying to sell 45 percent of its stake in Ethio Telecom to bidders. So far it has received 12 bids for the two telecoms licenses, as interest indications come from many—France’s Orange, MTN Group of South Africa, UAE’s Etisalat, and a consortium made up of Vodafone, Vodacom and others.

Nevertheless, there isn’t much doubt about the lucrativity of the Ethiopian telecoms sector. In spite of the fact that the country’s mobile penetration remains one of the lowest in the world, growth is strong and enormous growth potential remains.

Albeit from a low base, mobile penetration is rising and the sector continues to benefit from the poor fixed-line infrastructure which has promoted mobile alternatives as the only viable, or robust, telecoms option in many areas.

Meanwhile, economic liberalization is making Ethiopia an attractive market.

Featured Image: Reuters